Happy Birthday to the Canada Mortgage Bond Program

June 20, 2011Low Interest Rates a Ray of Sunshine On An Otherwise Cloudy Economic Day

June 27, 2011If you want to sell your current home and use the proceeds as a down payment  on a different property, what do you do if the closing dates don’t fall on the same day?

on a different property, what do you do if the closing dates don’t fall on the same day?

More to the point, what do you do if you have to close the purchase of your new home before you complete the sale of your old one?

In these cases you need a short-term loan to access the money that will be coming to you from your sale. The solution, appropriately enough, is called bridge financing.

Today’s post will explain how bridge loans work for borrowers who are considering this option.

Let’s start by addressing the most common concern: If you need a bridge loan, it does not alter or limit your ability to qualify for a mortgage in any way. You don’t actually need to qualify for bridge financing using your income – the only requirement is that you have an unconditional offer to purchase the property you are selling. This type of loan is typically offered in addition to a traditional mortgage loan – your lender simply lends you the money that will be coming to you when your property sells as a way to help facilitate the overall transaction.

Here is a simple example of how a bridge loan works (and here also is a link to my Bridge Loan Calculator so that you can follow along using your own specific details):

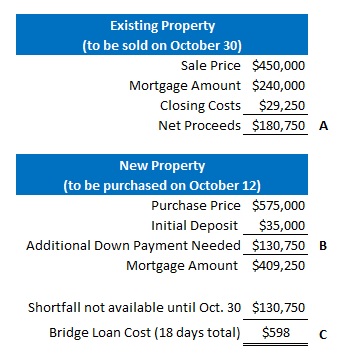

Assume you have just accepted an unconditional offer to purchase your current property on October 30. After paying off your mortgage and covering your disposition costs, you will be left with net proceeds of $180,750 (see item A).

You then buy a new property, but the sellers want you to take possession on October 12, which is 18 days before you will complete the sale of your existing home.

After making a $35,000 deposit, you decide to use an additional $130,750 (see item B) of the net proceeds from the sale and get approved for a $409,250 mortgage to cover the rest. (Note: in this example you decide to hold back $50,000 of the $180,750 coming to you from the sale for closing costs and minor renovations).

You need that $130,750 on October 12, but you won’t receive it from your buyer until October 30. As such, your mortgage broker helps you secure an 18-day bridge loan at prime +3% (6% in today’s terms) at a total cost of $598 (see item C). Problem solved.

Lenders typically expect a gap of no more than 30 days between your buy and sell dates, although bridge loans for longer periods may be offered by some lenders on an exception basis.

Bridge loan rates are always higher than traditional rates because they are unsecured, short term, and because the lender is basically lending you the entire purchase price of the house during the bridge-loan period. You should expect to pay somewhere in the range of prime + 2% to prime + 4%, which works out to 6% to 8% in today’s terms (some lenders will also charge an application fee of approximately $250).

Keep in mind that, on balance, your bridge loan rate will have far less impact on your overall financing costs than your mortgage rate because it only applies to the bridge-loan amount and during the bridge-loan period. (In the example above, the bridge loan of $130,750 with a rate of 6% only costs the borrower $598 over the 18-day period.) The key point is that bridge loans maximize your flexibility when selling.

If you have borrowing room on any existing lines of credit, most lenders will ask you to draw down these lines first, before then bridging the remaining gap.

On the day you complete the purchase of your new home, you will be required to sign a Letter of Direction and Irrevocable Assignment of Funds. This is a promise to use your net sale proceeds to pay off the lender’s bridge loan before taking any money for yourself. On larger bridge loans your lender may go a step further and require that a collateral charge be registered on the property you are selling (this adds some cost but achieves the same end result).

While not all lenders offer bridge financing, an experienced, independent mortgage broker will have access to several who do.

The Bottom Line: Instead of worrying about lining up your closing dates on the same day and trying for perfection in an imperfect world, consider bridge financing as an easy and cost-effective way to increase your flexibility when your buy and sell dates don’t overlap.

13 Comments

Hi,

Do you need to still come up with money to cover the closing costs namely the lawyer fee and land transfer tax on your purchase or, can the bridge loan cover this as well?

Thanks.

Hi Jessica,

Many lenders will allow you to add the closing costs to the bridge loan as long as you can confirm that you have enough equity in your existing property to repay the additional amount once that sale is completed.

Best,

Dave

What is the way to handle financing/mortgage if I want to buy, move and renovate before selling my existing home? I’d like close on a new property first, then take 6 months to renovate before moving, and once I’ve moved into the new home then put my existing home on the market. It means carrying two houses for about 6 months. Do I need to commit to a mortgage? Bank says my HELOC can only be for 65% of the value of my home so there’s not enough there for me to use to close on the new home. The rates for short term mortgages (as in 1 yr) are quite high. Are there alternate options?

Hi Mindy,

You need to have an unconditional offer to purchase your current home in order to secure bridge financing, so that option would not apply in the scenario you describe.

That said, if you can qualify to carry both properties (and their associated mortgages), then it would be possible to execute your desired plan. While it’s true that lines of credit only go to a maximum of 65%, there are other solutions available that allow you to borrow up to 80%.

If you have additional questions, please contact me directly at dave@morplan.ca.

Best regards,

Dave

Can we use our equity as deposit on NEW home before our house is sold?

We have 25% equity. The New property is $399,000 incl. GST.

Our current property is 425,000 less mortgage , approx. 25% equity.

Use bridge finance for 60 days…

Is this viable?

Hi Dan,

You have to have a firm sale on your existing home before you can secure bridge financing with the mortgage lender you will be working with on your purchase.

Best,

Dave

Hello,

How do you come about doing this? We want to put in an offer on a new home but haven’t sold ours. Do you have to waive the financing clause? Or do we still need to get a letter from our broker? My broker said they don’t se letters anymore because it’s so rare and don’t need them. I’m really confused and we want to submit the offer this week.

Hi Chantel,

You will need an unconditional offer to purchase your existing property in order to secure bridge financing as part of your buy/sell transaction.

Best regards,

Dave

We have sold our house and will be putting forth an offer on a new one. I understand the fee part but are we also paying the new mortgage along with the payment for the current home unitl we closed on ours? So 750 + 350 + fees for bridging?

Hi Ann,

That is correct. You need to make your mortgage payments on each loan for as long as it is outstanding.

Best,

Dave

Great post.

We want to get a bridging loan as we are selling our home and closing on Nov 30, but need down payment on Nov 27 for the new home- however we plan to switch from our exisiting mortgage provider and go with a new provider from Nov 27th.

In this case, will the bridging loan be provided by my current bank or the new one with which I’ll take the new mortgage?

Thanks

Hi Yesha,

Your bridge loan should be provided by the new lender (since they have a mortgage waiting for them when your purchase closes).

Best,

Dave