EU Leaders Agree to New Terms But Markets Aren’t Impressed

December 12, 2011Update On the Bank of Canada’s Latest Commentary with Implications for Canadian Mortgage Rates

December 19, 2011 It’s been three months since we last ran scenarios that compare the potential costs of fixed vs. variable-rate five-year mortgages using today’s market rates. Over that period, five-year variable-rate discounts have shrunk from prime minus .70% to prime minus .20% (which is 2.80% using today’s prime rate), and five-year fixed rates have dropped from 3.49% to 3.39% (or better if you know where to look).

It’s been three months since we last ran scenarios that compare the potential costs of fixed vs. variable-rate five-year mortgages using today’s market rates. Over that period, five-year variable-rate discounts have shrunk from prime minus .70% to prime minus .20% (which is 2.80% using today’s prime rate), and five-year fixed rates have dropped from 3.49% to 3.39% (or better if you know where to look).

The narrowing gap between today’s fixed and variable rates (3.39% vs. 2.80%) makes it harder to decide between them. Do you take the fixed rate because it gives you payment certainty for a premium of only .59%? Or do you bet that the same subdued economic forecasts that are driving fixed rates down will lead to a drop in the variable rate?

To help you ponder those two questions, we’ll run three variable-rate scenarios to show you: 1) when a variable rate will save you money, 2) when you’ll just about break even, and 3) when choosing a fixed rate will leave you better off. You can then decide for yourself which of these interest-rate scenarios seems most likely.

Here are the basic guidelines for this exercise, with a couple of tweaks since our last simulation:

- First and foremost, the decision to go with a fixed or variable-rate mortgage depends on each borrower’s particular circumstances. Although it may be an interesting exercise to speculate about where rates may be headed in the future, the final call should only be made after you speak with an experienced mortgage planner about your specific profile.

- While we did not include any variable-rate cuts in the last two rate simulations, times change. It is now at least possible that the Bank of Canada (BoC) will lower its overnight rate (causing variable-mortgage rates to drop). To allow for that possibility, one of the three simulations in this post will incorporate variable-rate cuts.

- Previous rate simulations have included examples whereby variable-rate borrowers set their mortgage payment at the fixed rate to pay off their debt more quickly. Given that the gap between fixed and variable rates has narrowed considerably, we will skip that example this time around. But make no mistake – we are still big believers in making prepayments on both types of mortgages and this post explains why.

Now let’s get started. We’ll take a $250,000 mortgage amortized over 25 years and compare the cost of a fixed-rate mortgage at 3.39% to the cost of a variable-rate mortgage that starts at 2.80% and adjusts from there.

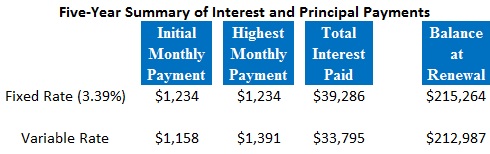

Variable-Rate Simulation #1

In the first simulation we assume that the BoC cuts the overnight rate by .25% in June and September of 2012, lowering the variable rate to 2.30%, where it stays until 2014. At that point, we get increases in March and September of 2014, and then as the economy starts rolling again, we see .25% increases every quarter from March 2015, through to November 2016. By the end of the five-year term, this variable rate has risen to 4.55%.

In this scenario, variable-rate borrowers come out ahead. They pay $5,491 less interest and they are left with a closing balance that is $2,277 lower, for an overall savings of $7,768.

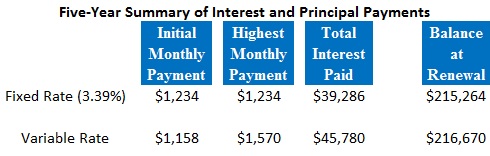

Variable-Rate Simulation #2

In our second simulation we assume that variable rates stay flat until rising by .25% in March 2014, and by another 25% in each subsequent quarter of that year. We then assume further .25% increases in June and September of both 2015 and 2016, with the variable rate finishing its five-year term at 4.8%.

The second scenario is a wash. The variable-rate borrower pays $212 in extra interest, but finishes the five-year term with a principal balance that is $368 lower than the fixed-rate borrower. The cost difference between the two rates is only $156.

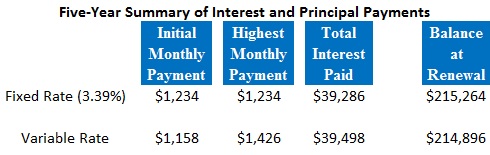

Variable-Rate Simulation #3

In the third simulation we assume that the BoC starts to raise rates by .25% every March, June, and September from 2013 through to 2016, pushing the variable rate that started at 2.80% to 5.80% at the end of five years.

If the third scenario occurs, variable-rate borrowers will wish they had gone with a fixed rate. They pay an extra $6,494 in interest over five years and owe an extra $1,406 in principal at the end of their term. On a net basis, they are $7,900 worse off than borrowers who chose a fixed rate.

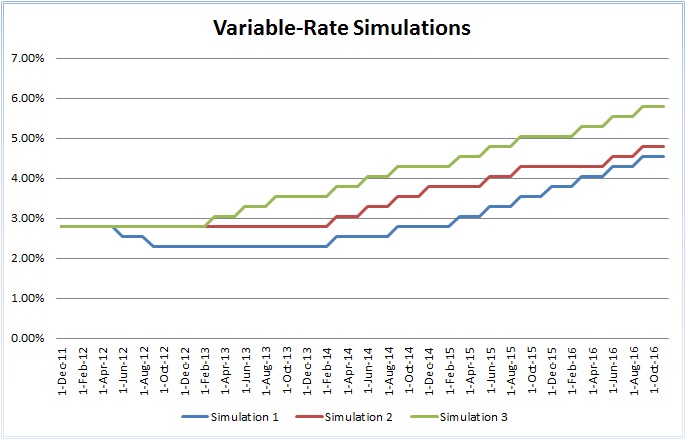

Here is a summary chart to give you a visual sense of how these rate simulations compare over five years:

Keep in mind that while five-year fixed and variable-rate mortgages are the most popular two choices among Canadian borrowers, there are myriad other terms and types available. For example, hybrid mortgages, which allow you to combine fixed and variable rates, are increasingly popular with borrowers who want to save money and hedge their exposure at the same time; and there are other fixed-rate terms that are attractively priced.

The purpose of this exercise is to test fixed versus variable rates under a variety of interest-rate scenarios, not to offer an opinion on where rates may actually be headed. If you want my ongoing opinion on that fundamental question, check out my Monday Morning Interest Rate Updates.

While narrower interest-rate spreads have made it more difficult to choose between fixed and variable rates, the good news is that, with both rates near all-time lows, you have far less chance of making a bad decision either way.