How Would the Risk of Higher Mortgage Rates at Renewal Affect You?

October 3, 2016What Canada’s Fifth Round of Mortgage Rule Changes Mean For You – Part Two

October 11, 2016** Update on the Mortgage Qualifying Rate stress-test that was to be implemented on Oct 17th – The Department of Finance just announced that while the MQR stress-test will be implemented for all high-ratio borrowers, effective October 17, the test will now not be implemented for low-ratio borrowers until the next round of mortgage-rule changes takes effect on November 30.**

Yesterday Canada’s Fi nance Minister Bill Morneau announced a series of changes to the rules used to underwrite insured mortgages. There is a lot to unpack so I’ll do it in three installments: Part One will focus on the change that will take place on October 17, Part Two will cover the changes that will take place on November 30, and Part Three will offer my take on the longer-term impacts that these changes will have on Canadian borrowers and our housing markets across Canada.

nance Minister Bill Morneau announced a series of changes to the rules used to underwrite insured mortgages. There is a lot to unpack so I’ll do it in three installments: Part One will focus on the change that will take place on October 17, Part Two will cover the changes that will take place on November 30, and Part Three will offer my take on the longer-term impacts that these changes will have on Canadian borrowers and our housing markets across Canada.

Let’s start with the first change, which will be implemented less than two weeks from today.

Effective Oct 17, all insured mortgage applications will be underwritten using the Bank of Canada’s Mortgage Qualifying Rate (MQR).

The MQR was first implemented on April 19, 2010 as an intelligent response to the lessons learned from the U.S. housing crisis (here is a post I wrote that explains how it works in detail). In short, the MQR requires high-ratio borrowers who want to take out either variable-rate loans or fixed-rate loans with terms of less than five years to qualify using a rate that is higher than the actual rate on their mortgage.

Today, the MQR is set at 4.64%, which is about double what you would actually pay for a market five-year variable-rate mortgage, and that gap helps ensure that the borrowers most vulnerable to rate rises can afford higher payments when the time comes.

Two Mondays from now, the MQR “stress test” will be applied to all insured loans, including fixed-rate terms of five years or longer. This will have a much greater impact than you might at first think because, these days, “insured” doesn’t just refer to the usual high-ratios borrowers who have down payments of less than 20%. A significant percentage of low-ratio mortgages (where down payments are 20% or more) are also now insured, but because the lender typically bears this cost, most affected borrowers never even know it. (Lenders buy low-ratio mortgage insurance, called “portfolio insurance”, because once these mortgages are insured against default they can be securitized more cheaply.)

Here is where the rubber meets that road. I get an email every morning with mortgage rates from twenty-two lenders. Half of them will now have to use the MQR to underwrite every loan they make, regardless of the size, mortgage type or down payment. The other half have funding alternatives that don’t require mortgage insurance, but they cost more to use and their increased usage will push mortgage rates higher. (Also, if our policy makers have real conviction, these balance-sheet lenders should be getting an MQR update from OSFI in the near future as well.)

Let’s look at the impact of the MQR change from a borrower’s perspective using three different examples:

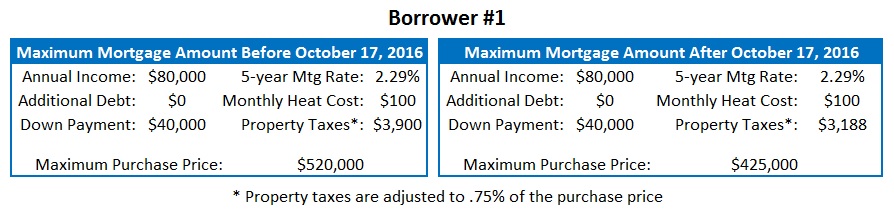

Borrower #1 is a fairly typical first-time buyer. He is putting down less than 10% of the purchase price and the MQR change will lower his maximum purchase price by 18%, from $520,000 to $425,000.

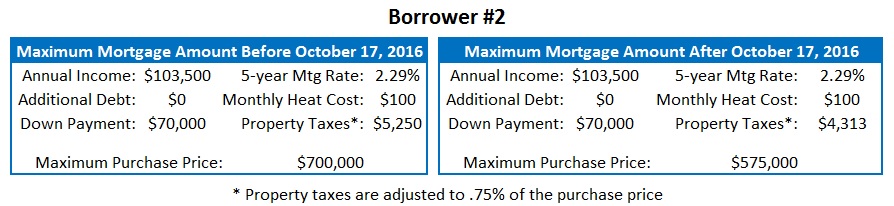

Borrower #2 could either be a first-time buyer at the higher end, or perhaps someone who is moving from a condo to a house. She is putting down about 15% of the purchase price and the MQR change will once again lower her maximum purchase price by 18%, from $700,000 to $575,000.

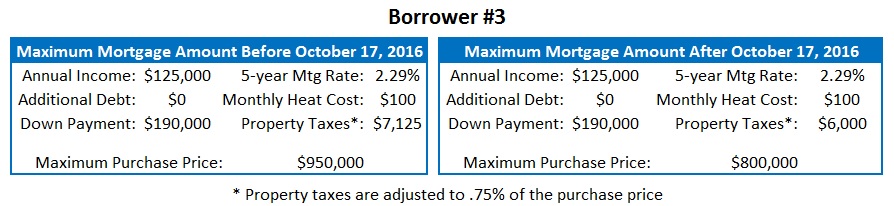

Borrower #3 would probably be selling his first home and using the equity to make a substantial down payment on a larger home. This low-ratio borrower is putting down more than 20% of the purchase price, and the MQR change will lower his maximum purchase price by roughly 16%, from $950,000 to $800,000. For the purposes of consistency, I used a 25-year amortization for this borrower, even though he/she would be eligible for 30-year amortization … at least until November 30 … but I’ll cover that in Part 2 …