Do Higher Interest Rates Cause Lower House Prices?

September 7, 2010Budgeting for a Mortgage

September 22, 2010In today’s interest-rate environment, using a rental property’s Free Cash Flow to determine its value will significantly understate its potential return as an investment. For those who don’t know, Free Cash Flow is basically the money you are left with once mortgage payments, property taxes and maintenance/upkeep expenses are paid. Some rental investors take the amount they are left with (the Free Cash Flow) each year and divide it by the amount of their investment to calculate their return. For example, if you make a down payment of $150,000 on a rental property and at the end of the first year you have $1,500 of rental income left over after paying all expenses including your mortgage payments, your investment return using Free Cash Flow would be 1% ($1,500/$150,000). It should come as no surprise then that investors who value income properties this way are not lining up to buy right now. But there is a big piece of the investment return missing, and it is a by-product of our current low interest rate environment.

maintenance/upkeep expenses are paid. Some rental investors take the amount they are left with (the Free Cash Flow) each year and divide it by the amount of their investment to calculate their return. For example, if you make a down payment of $150,000 on a rental property and at the end of the first year you have $1,500 of rental income left over after paying all expenses including your mortgage payments, your investment return using Free Cash Flow would be 1% ($1,500/$150,000). It should come as no surprise then that investors who value income properties this way are not lining up to buy right now. But there is a big piece of the investment return missing, and it is a by-product of our current low interest rate environment.

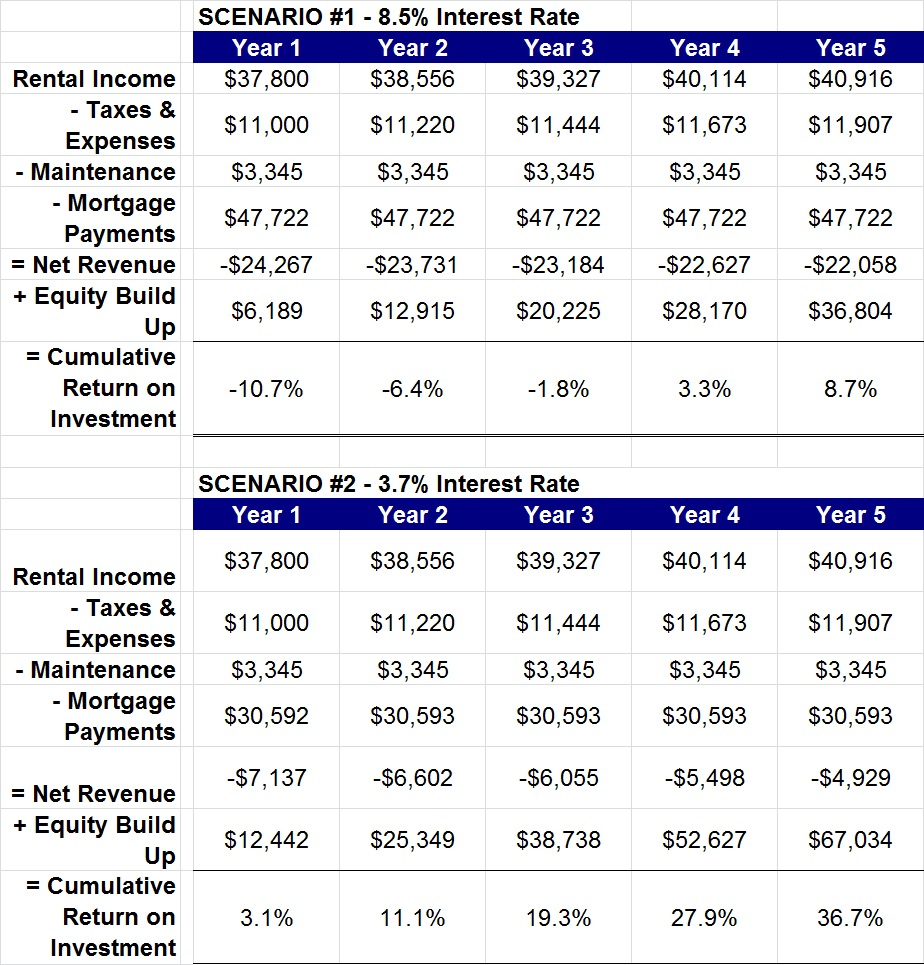

One of the golden rules of successful real-estate investing is that the rent cheques must go straight to the bank to pay off the mortgage. Every time this happens, the mortgage shrinks and equity increases. The hidden value in today’s low interest-rate environment is found in the percentage of each mortgage payment that goes to principal. To illustrate, let’s compare two scenarios. In scenario #1 we’ll use an i nterest rate of 8.5%, which is Canada’s average five-year mortgage rate over the last 25 years. If you borrowed $500,000 amortized over 25 years, your total payments made in the first year would be $47,722. Of that amount, $41,533 would be eaten up by interest and only $6,189 would be used to reduce mortgage principal (13% of the total). In scenario #2, if we change the five-year interest rate to the currently available 3.7% and you borrow $500,000 under the same terms, your total payments in year one would be $30,592. Of that amount, $18,151 would be allocated to interest and a whopping $12,442 would be used to reduce mortgage principal (41% of the total paid).

nterest rate of 8.5%, which is Canada’s average five-year mortgage rate over the last 25 years. If you borrowed $500,000 amortized over 25 years, your total payments made in the first year would be $47,722. Of that amount, $41,533 would be eaten up by interest and only $6,189 would be used to reduce mortgage principal (13% of the total). In scenario #2, if we change the five-year interest rate to the currently available 3.7% and you borrow $500,000 under the same terms, your total payments in year one would be $30,592. Of that amount, $18,151 would be allocated to interest and a whopping $12,442 would be used to reduce mortgage principal (41% of the total paid).

So in today’s interest-rate environment, not only are the payments lower, but even more importantly, the proportion of each payment that goes toward principal is more than three times greater. In scenario #2 you’re not just paying less interest, you’re paying off your mortgage twice as fast. This hidden benefit is well understood by seasoned investors but is often overlooked by less experienced buyers who focus solely on Free Cash Flow when evaluating investment opportunities. Here is a summary of what the two scenarios would look like over a five-year period, using the details from a rental property currently listed for sale by one of my realtor partners at $669,000. (Note: I have assumed a 10% annual vacancy rate and a 2% annual increase in rents and expenses, which is at the lower end of the central bank’s target band for inflation.)

Note that in the examples above, we are assuming no appreciation in property value. The returns shown are based solely on the Free Cash Flow generated, combined with the amount of equity built up as the mortgage principal is reduced. If we assume annual house-price appreciation of 3%, the cumulative five-year return on investment at a 3.7% interest rate jumps from 36.7% to 99.8%.

There are other hidden advantages when owning a rental property. Most people know that you can write off the cost of your mortgage interest ag ainst your rental income, but you can also depreciate all of the major appliances as well. This gives you additional non-cash write-offs to further reduce your tax hit. Of course, the flip side is that there is no capital gains exemption when selling an income property, but I don’t think that’s a bad trade-off if you can write off your mortgage interest instead. On balance, mortgage interest is a certainty while a capital gain is not, and what’s more, since you only incur a capital gain as a result of having just made a profit, it’s not the worst time to have to make a tax payment.

ainst your rental income, but you can also depreciate all of the major appliances as well. This gives you additional non-cash write-offs to further reduce your tax hit. Of course, the flip side is that there is no capital gains exemption when selling an income property, but I don’t think that’s a bad trade-off if you can write off your mortgage interest instead. On balance, mortgage interest is a certainty while a capital gain is not, and what’s more, since you only incur a capital gain as a result of having just made a profit, it’s not the worst time to have to make a tax payment.

If you’ve been evaluating rental property investments using the Free Cash Flow method, take a second look including mortgage principal payments in the calculation of your returns. You’ll be surprised at the difference it makes.

18 Comments

While I agree that the contribution to equity needs to be taken into account, in addition to free cash flow, there is a serious fallacy in this model. A property that cost $500K to generate $42K in rental revenue when the interest rates were 8.5% would cost a lot more in the present low-interest rate environment. Scenario 2 should consider mortgage payments based not on a $500K property value but a $900K or something similar. Then the difference in cumulative return on investments between scenarios 1 and 2 will not be as wide as this model portrays.

Hi Sashi,

The point of the post was to show that using Free Cash Flow to evaluate a rental property’s investment potential when rates are low does not give one a complete picture of its value. To illustrate, I showed that with rates at 8.5%, very little of each mortgage payment goes to principal, while at 3.7% the proportion more than doubles. While it’s reasonable to assume that when rates are higher a property will cost more, it doesn’t change the fundamental point (and keep in mind that rents would be higher as well).

Thanks for your email.

Dave

Hello Dave,

Thanks for your post! I have a rental property and was wondering if it is more financially beneficial to pay down my mortgage earlier by making one lump sum payment per year (up to 10% is not charged extra for my mortgage) or holding on to the mortgage longer and dong tax write-offs for the mortgage interest?

Thanks!

Alisa

Hi Alisa,

The answer to that question depends on a number of factors.

You need to compare the return you would otherwise earn on that lump-sum money if you didn’t pay down your mortgage plus the tax write-off you get by having a higher interest expense to the interest savings you would acheive by paying down your mortgage instead. My answer would also depend on how much equity you have already built up in your property as well.

Best regards,

Dave

Dave,

Thanks for the insight. I am looking to keep my existing condo and rent it out. However, when I run the numbers I will be in a negative monthly cash flow of give or take $100. What is appealing to me is the building of the equity as interest rates are low right now at 2.15%. Do you think this is still a worthy investment? I have 30% equity in the condo based on current market value. And would refinance at 80% of current market value taking leaving 20% equity.

Thanks

Hi Jason,

If you are currently in a slightly negative cash flow position and you refinance from 30% equity down to 20% equity then how much will you need to contribute every month? Taking on a small amount of negative cash flow can be justified in some circumstances but if I am reading your question right, once you refinance your current mortgage you would be in a significant cash-flow deficit each month. If that is the case then I would advise against the approach you are contemplating.

Best,

Dave

Hi Dave – We are about to refinance one of our rental properties. Is it advisable to put the term back to 30 years, since we will not be selling it any time soon? It’s renewing at a 25 year term. If we do this it would obviously lower the monthly payment a bit.

Also, we are thinking we should take a 5 year fixed even though the rate is about 0.5% more than for a 5 year variable – we never know how much we should gamble on interest rates. Do you have any thoughts on this?

Hi Valerie,

I like the idea of going with the longest amortization period that the lender will give you because that lowers your minimum contractual payment, and you can always use your prepayment allowance to pay off your mortgage more quickly.

The catch in your case is whether you are switching lenders, because you can move your mortgage at basically no cost if you don’t change your amortization period, whereas if you do, you would normally incur legal costs of about $1000. If that is the case then I would think long and hard before spending that extra money to be sure that you really value that extra five years of amortization.

In terms of the fixed/variable question, investors often like to have cost certainty when matching rental income with expenses, so there is a case to be made for going fixed, but without knowing more about your specific circumstances I can’t definitively say which option I would recommend.

Best,

Dave

Dave

Thanks for the cash flow models showing the impact of a lower interest rate and its impact on your initial investments roi. In both cases, however, the rental income does not cover the costs of the mortgage, maintenance etc. Are these cases really economically interesting when the owner will need to inject between 5 and 25k per year to cover the shortfall in rental revenue? How should this be taken into consideration when evaluating the real roi of your overall initial investment plus annual costs? Is there a better metric that should be used?

Hi Colin,

To clarify, in the examples given the borrower would have to inject about $23k/yr if rates were 8.5%, as compared to about $6k/yr if rates were 3.7%.

That’s quite a difference, and in my opinion, while having to kick in about $23k would normally not make sense from an investment standpoint, kicking in $6k, especially if you adjust the ROI to include the paid in equity, would appear to me to be more “economically interesting”.

Best,

Dave

Hi Dave.

Where all things are almost equal, is the cash flow advantage with a longer amortization term better than going with a shorter amortization over the entire term?

Longer term = higher cash flow but greater interest that has to be paid

Shorter term = lower cash flow but less interest and quicker ownership.

Does this become a question of who pays the interest on the principal?

Thanks.

Hi Ray,

I would always recommend taking the longest amortization a lender will give you because you can use your discretionary prepayment allowance to achieve a significantly shorter amortization once your deal closes.

Also, if you want to buy additional rental properties in future, you must use your contractual payment for existing mortgages when applying for that next loan, so keeping your contractual payments as low as possible will preserve maximum flexibility in that scenario as well.

Best regards,

Dave

Hi Dave,

Thanks for this post. It describes, almost to a tee, the situation I have with one of my rental properties. I have been in a slight negative cash flow position and have been relying on the build up of equity through the payment of principal to justify it. I am now using the chart you’ve shown above to analyze my situation more clearly.

I have a question about the ROI numbers you’ve shown. I guess the ROI numbers are based on the down payment of $169,000. So for Year 1, the “net” equity build up is $5,305 ($12,442-$7,137) which is a 3.1% “equity” return on the $169,000 down payment. So I guess rather than a traditional “cash-on-cash” ROI, you’re looking at an “equity-on-cash” ROI.

As for the following years, I believe the ROI’s may not be fully accurate. Should the ROI for years 2 through 5 be based on the cumulative “net” equity build-up, i.e. year 2 “net” equity build up is $11,610 ($25,349 – $6,602 – $7,137) and so a 6.9% ROI?

Thanks.

Hi Dave,

Great post for a great many ‘math challenged’ folks; and a great way to sell mortgages (lol).

Building equity in real estate is excellent advice and the difference between a 25 mortgage and a 15 year mortgage, is the necessary starting point ….

Thanks for sharing such an informative post. I like your idea of explaining free cash with the help of examples. Keep up the good work Dave.

Thanks Cédric.

Best,

Dave

Hi Dave, what I believe is not taken into account is if rates do rise then property values will decrease! So in essence your equity position can be compromised if you over pay for a property in this low rate environment. Thoughts?

Hi John,

There is always that risk when you buy a property, but it is beyond the scope of this topic.

Best,

Dave