More Near-Term Rate Hikes Are off the Table (But So Are Rate Cuts)

March 27, 2023Three Recent Posts to Get You Ready for the next Bank of Canada Meeting

April 10, 2023 In today’s upside-down world, good news for our economy is bad news for our mortgage rates because it increases the likelihood that the Bank of Canada (BoC) will either hike its policy rate or wait longer before cutting it.

In today’s upside-down world, good news for our economy is bad news for our mortgage rates because it increases the likelihood that the Bank of Canada (BoC) will either hike its policy rate or wait longer before cutting it.

Canadian mortgage borrowers got more “bad news” last week.

Statistics Canada confirmed that our GDP increased by 0.5% month-over-month (MoM) in January, and it estimated that our GDP will rise by another 0.3% MoM in February.

A detailed look at the results shows strength across the board. Both our goods-producing (+0.4%) and services-producing (+0.6%) industries grew last month, and 17 out of our economy’s 20 different sectors experienced gains.

The latest GDP data confirm that our economic momentum is still stronger than the Bank of Canada (BoC) expected.

In its most recent Monetary Policy Report, the Bank forecast annualized GDP growth of 0.5% in Q1, but Stats Can’s latest estimates have it coming in at around 3% instead.

The BoC hiked its policy rate all the way from 0.25% in March 2022 to 4.5% in January 2023, and that sharp series of rate hikes is supposed to be slowing our economy down. So far it hasn’t happened.

I have argued of late that our economic momentum won’t slow until we burn through the residual excess cash that is still sitting on household balance sheets (and as per the chart in last week’s post, there is still plenty of that on hand).

In the meantime, the economic measure that has slowed is inflation.

Our headline Consumer Price Index (CPI) came in at 5.2% year-over-year in February, dropping from 5.9% in January and marking our CPI’s sharpest deceleration in nearly three years. The result also took our CPI below the BoC’s forecast of 5.4% for Q1.

Stronger-than-expected growth and lower-than-expected inflation have inspired an increasing number of soft-landing forecasts, predicting that our inflation will be brought to heel without causing a recession. But I’m still not buying it.

Most of our recent drop in CPI was credited to base effects, which occur because prices were rising particularly fast a year ago. But that only means that the white-hot inflation we were experiencing a year ago has been replaced by red-hot inflation now.

Just because inflation is receding on a relative basis, it doesn’t mean that we’ll be returning to the BoC’s 2% target any time soon. And for anyone who needs reminding, the BoC is adamant that it won’t be considering rate cuts until that occurs.

Stronger-than-expected GDP growth also increases the likelihood that the demand for labour will remain elevated.

Our average wages have been rising by 5%+ for the past 10 months but are only now outpacing inflation. The average worker’s purchasing power is finally increasing, and that isn’t going to change as long as labour-supply shortages provide them with increased leverage.

BoC Deputy Governor Carolyn Rogers recently conceded that “unless a surprisingly strong pickup in productivity growth occurs, sustained 4 per cent to 5 per cent wage growth is not consistent with achieving the 2 per cent inflation target.”

We have had a longstanding problem with productivity growth and there is no reason to believe that that will change under our current conditions. Our most recent data confirm that our productivity levels are falling.

Regardless, the US and European bank failures that upset financial markets have led to speculation that rate hikes are off the table and have buoyed hopes that rate cuts may arrive sooner than previously expected.

I think that is unlikely.

The best remedies for a crisis of confidence in banking stability are increased liquidity and deposit guarantees, not rate cuts.

The banking crisis is still a foreign story at this point. Confidence in the Canadian banking system doesn’t appear to have been impacted in the slightest. As near as I can tell, the only real impact has been a dramatic lowering in the Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, because they follow US Treasury yield movements.

Those lower fixed mortgage rates are now bolstering housing-market demand at a time when the BoC’s rate hikes were specifically trying to reduce it. Our real-estate sector was the main sector of our economy that was slowing in response to the BoC’s rate hikes. Now the US banking crisis has given it new life.

If lower bond yields are sustained and real-estate markets rebound, that will compel the BoC to keep its monetary policy torniquet tighter for longer. In other words, the interest-rate saving that is benefiting fixed-rate mortgage borrowers will now almost certainly increase the cost of borrowing for variable-rate borrowers going forward.

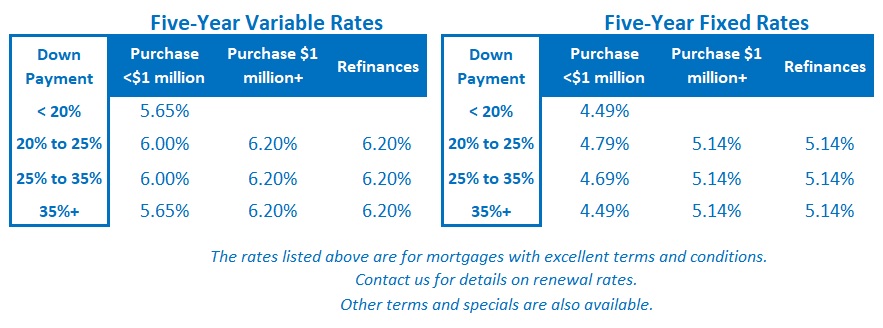

If you’re in the market for a mortgage today, I continue to believe that variable rates are an aggressive bet. They require you to pay an initial premium on the bet that you will save that extra cost farther down the road. In an economy still rife with upside surprises, and at a time when our central bank remains determined to err on the side of overtightening, I think today’s odds favour locking in for at least some period of time. (I used the term “bet” because unfortunately that is what today’s borrowers are forced to do.)

Short-term fixed-rate mortgages of one or two years come with big premiums today, along with the risk that you will be renewing before inflation cools sufficiently. Five-year fixed rates increase the risk that you will be locked in past the point when that happens.

For now, I believe that the three-year fixed rate looks like the safe middle-of-the-road pick. While opting for variable rates or shorter-term fixed rates may end up being cheaper, they come with more downside risk. Today’s three-year fixed-rate options should at least keep you out of the ditch. The Bottom Line: GoC bond yields rebounded from their recent plunge last week and have recovered nearly half of the ground lost during the US and European banking crises. If that trend continues, our fixed rates will be more likely to continue to move higher than to decrease over the near term.

The Bottom Line: GoC bond yields rebounded from their recent plunge last week and have recovered nearly half of the ground lost during the US and European banking crises. If that trend continues, our fixed rates will be more likely to continue to move higher than to decrease over the near term.

Variable-rate discounts were unchanged last week.

I think the BoC will be more influenced by our stronger-than-expected GDP growth than the quickly fading negative impacts of the foreign banking turmoil. It will maintain a tightening bias for the time being. If I’m right, rate cuts for variable-rate borrowers won’t materialize until some time in 2024.

2 Comments

Really enjoy your articles David!

Thanks Julie. Glad you find them useful.