Monday Morning Interest Rate Update

July 31, 2023US Inflation Rises, and Canadian Inflation Is About to Follow

August 14, 2023 Last week Statistics Canada confirmed that our economy shed approximately 6,000 jobs in July, a far cry from the 20,000 increase that the consensus was anticipating.

Last week Statistics Canada confirmed that our economy shed approximately 6,000 jobs in July, a far cry from the 20,000 increase that the consensus was anticipating.

After eight months of robust job growth from September 2022 to April 2023, we are now in a phase where gains in one month have been followed by losses the next month.

This slowing of our employment momentum is helping to close the gap between our economy’s demand for labour and its ability to supply it, but that evolution will take time to play out. Our labour market remains tight overall, as evidenced by average hourly wages increasing by 5.0% on an annualized basis in July (up from 4.2% in June).

Some market watchers concluded that last month’s weaker-than-expected employment data would ensure that the Bank of Canada (BoC) would hold off on additional near-term rate hikes. I think that outcome is far from certain.

As per my recent blog post, I believe that inflation will likely move higher over the remainder of this year. The BoC’s mandate is to maintain price stability above all else.

Many market watchers also make the mistake of assuming that slowing economic momentum will lead to less inflation, but that isn’t guaranteed. We could instead be entering a period of stagflation, where slow growth coexists with both rising unemployment and higher inflation.

The bulk of our recent economic momentum has been fuelled by a sharp drawdown in pandemic savings, which allowed consumers to absorb higher costs without reducing their spending. But those savings are shrinking, and increasing credit-card utilization rates are evidence that a growing number of Canadians have now burned through their buffers.

When the short-term economic boost from pandemic savings has run its course, we will be left with an economy that has experienced chronic under-investment and steadily declining productivity rates for some time. If those inefficiencies continue to worsen, so too will inflation.

Some of our most significant costs are also back on the rise.

In addition to wage costs swinging higher, oil prices have risen sharply of late, and food prices are likely to continue soaring now that Russia is no longer agreeing to the safe passage of Ukrainian grain exports through the Black Sea. Global weather conditions aren’t helping food production either.

Our borrowing costs, which have risen by about 30% year-over-year, are now also increasing for non-BoC reasons.

US bond yields have moved higher of late, and they always take their GoC equivalents along for the ride. The Bank of Japan also recently indicated that it would now allow longer-term Japanese bond yields to rise by more than it has previously. That is putting upward pressure on bond yields everywhere.

Slowing growth and a cooling job market are necessary but not sufficient conditions for returning inflation to its 2% target. Commodity prices, which are beyond the purview of BoC monetary policy, will also determine if and when inflation falls back to 2%, and a lot of them are still running hot at the moment. The Bottom Line: GoC bond yields continued their upward march last week until Friday’s disappointing US and Canadian employment reports caused sharp moves lower.

The Bottom Line: GoC bond yields continued their upward march last week until Friday’s disappointing US and Canadian employment reports caused sharp moves lower.

While that drop will likely provide a near-term reprieve for our fixed mortgage rates, the bond market likely over-reacted to the latest jobs data.

Food, fuel and borrowing costs continue to rise and the strong disinflationary tailwind from base effects has now dissipated (as per my prior post). Taking all of this into account, the BoC could readily conclude that rates need to rise further from here, especially if our next round of inflation data confirms that we are again moving farther away from the Bank’s 2% target, which I expect will be the case.

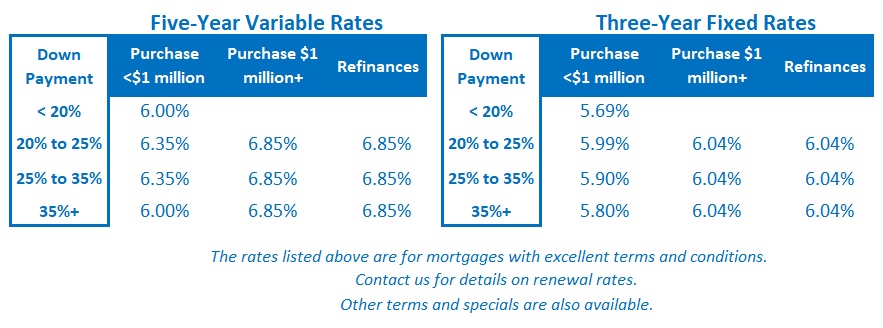

Variable-rate mortgage discounts were unchanged last week, but variable-rate borrowers should be prepared for another 0.25% increase this year.

From the BoC’s point of view, last week’s employment data were a sign of progress, but the battle is far from won.