Five Mortgage-Rate Related News Highlights from Last Week

August 7, 2018Five Key Canadian Mortgage Rate Questions for the Remainder of 2018

August 27, 2018 Last Friday we learned that the Canadian economy added an estimated 54,100 new jobs in July.

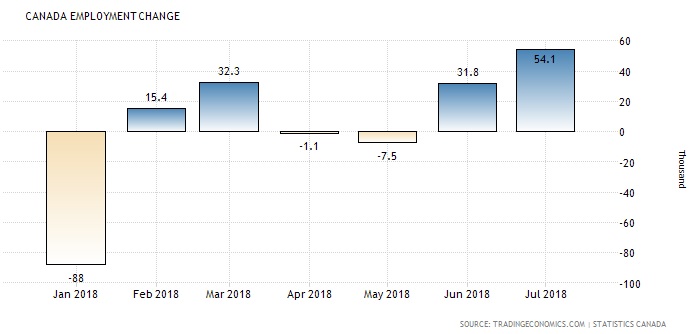

Last Friday we learned that the Canadian economy added an estimated 54,100 new jobs in July.

To put that number in perspective, consider that our economy needs to create about 20,000 new jobs each month in order to keep up with the natural growth rate of its labour force. When our economy creates additional jobs above that threshold, it reduces the supply of unutilized labour and narrows our output gap.

(As a reminder, the output gap measures the gap between our economy’s current output and its maximum potential output. When the output gap closes, costs rise as resources, like labour, become scarcer. As that happens, the Bank of Canada (BoC) typically raises its policy rate to combat rising inflationary pressures.)

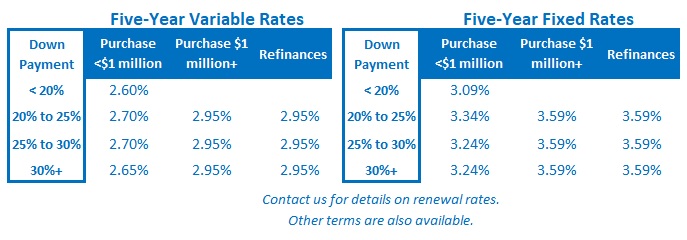

On first pass, last week’s banner jobs-number headline should have sent Government of Canada (GoC) bond yields soaring as investors priced in accelerating job growth and raised their bets that the BoC’s next rate hike would come sooner rather than later. But the details in the report were not nearly as encouraging, and the five-year GoC bond yield, which our five-year fixed mortgage rates are priced on, actually finished slightly lower on Friday.

Here is a look at the details in our July employment data that tempered the bond market’s enthusiasm:

- While we added 54,100 net new jobs last month, all of that gain came from a sharp rise in part-time employment. We lost 28,000 full-time jobs and replaced them with 82,000 new part-time jobs. Full-time jobs are more stable and higher paying, so this isn’t a trade-off that any policy maker would willingly make.

- Our economy has now added a total of 246,000 new jobs over the last twelve months, which is barely above the 240,000 new jobs that we needed just to match the natural growth of our labour force. On a related note, it took until July for our economy to add its first net new job in 2018 (see chart below).

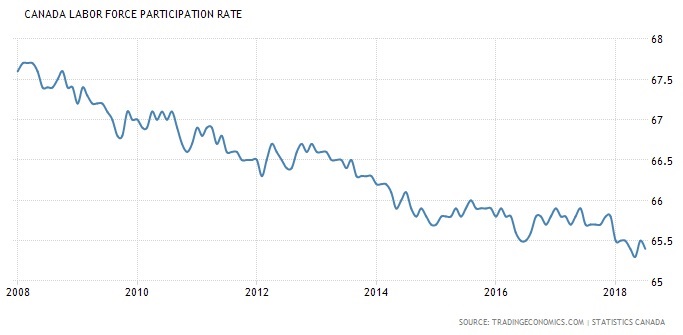

- Our overall unemployment rate fell from 6.0% in June to 5.8% in July, and our participation rate, which measures the percentage of working-age Canadians who are either working or are actively looking for work, fell marginally from 65.5% to 65.4%. Our participation rate has fallen steadily since the Great Recession in 2008 (see chart below), and while one might assume that this decline is a result of aging demographics, the data don’t bear that out. Consider that Canadian workers aged 55 and above have added 148,000 new jobs over the past twelve months, out of the total gain of 246,000 for all age groups, and that over that period, workers aged 55 and over had the same employment growth rate as workers aged 25 to 54.

- While the headline of 54,100 net new jobs is impressive at first glance, it is important to remember that number is just an estimate. Statistics Canada always massages its raw data to smooth out fluctuations that are caused by seasonality, such as schools shutting down every June and re-opening every September. On that note, last Friday, in his Weekly Market Insight report, CIBC Chief Economist Avery Shenfeld explained that Stats Can added 37,000 new jobs in the education sector out of thin air last month, solely due to a statistical anomaly that was caused by “seasonal swings that are large and not completely consistent from year to year”. So don’t expect to see chalk sales going through the roof in August.

- Average hourly year-over-year wage growth came in at 3.2% in July, and while that is still a solid result, our average wage growth has now fallen for three straight months (from 3.9% in May to 3.6% in June). In addition, much of our growth in average wages over the past year has been fuelled by one-time legislated minimum wage increases in Ontario, British Columbia and Alberta.

- Our manufacturing sector lost 18,000 jobs last month, and while it is too early for them to say so definitively, our policy makers have to be concerned that ongoing trade uncertainty is taking its toll and will possibly take a much greater toll going forward. As a reminder, manufacturing jobs are critical to our labour market’s overall health because they fuel job creation across our broader economy.

I have noted in several past posts that bond-market investors tend to shoot first and ask questions later, but this time that group was apparently willing to look beyond the headline before reacting to our latest employment data. When they did, they saw a reduction in job quality as full-time jobs were replaced by part-time jobs, as wage growth slowed, and as our manufacturing sector lost momentum.

The Bottom Line: Bond-market investors weren’t fooled when Statistics Canada released our latest employment data last Friday. They looked beyond the banner headline and found the details wanting. Bluntly put, GoC bond yields and the fixed mortgage rates that are priced on them were unaffected by the latest employment report, and I don’t think this report will have any material impact on the BoC’s plans to move its overnight rate, on which our variable mortgage rates are priced.