Will the Recent Bond Yield Run-up Push Canadian Mortgage Rates Higher?

September 16, 2019Five Changes to Help Canada’s Housing Affordability Crisis

September 30, 2019

Last Wednesday the U.S. Federal Reserve cut its policy rate by another 0.25%, dropping it down to a range between 2.00% and 1.75%. In its accompanying statement, the Fed conveyed both optimism and caution.

Before we examine the Fed’s latest statement, let’s recap why the Fed’s actions matter to anyone keeping an eye on Canadian mortgage rates.

The Canadian economy is tightly linked to the U.S. economy through trade.

While we are both each other’s largest trading partner, the relationship is far from equal. The U.S. economy is more than ten times the size of ours, and it buys about 70% of our total exports. Conversely, we only purchase about 14% of total U.S. exports.

Our dependent trade relationship with the giant on our southern border means that over time, our economic momentum tends to follow theirs. Bond market investors understand this, and that’s why Government of Canada (GoC) bond yields, which our fixed-rate mortgages are priced on, move in tight correlation with their U.S. equivalents.

The Bank of Canada must also be cognizant of Fed policy changes.

If the gap between our policy rates grows too wide, it impacts our exchange rate, which in turn impacts U.S. demand for our exports (and exports account for about 30% of our economy’s total output). The Bank doesn’t have to match every Fed move, but each successive Fed rate cut ratchets up the pressure for the BoC to lower its overnight rate, which our variable-rate mortgages are priced on, in response.

Now to recent history.

The Fed started its most recent rate hike cycle at the end of 2016 when its policy rate range was 0.25% – 0%. It then raised nine times through the end of 2018 to a peak range of 2.5% – 2.25%, before reversing course with a 0.25% cut in July of this year and another one last week.

Meanwhile, the BoC waited until July of 2017 before it began raising its policy rate up from 0.50%. It then hiked a total of five times through the end of 2018, topping out at 1.75%, and it has held steady since then.

The Bank recently argued that it hasn’t needed to match the Fed’s most recent moves because our economic trajectories are converging, with U.S. momentum falling and Canadian momentum rising. The Fed’s policy rate was also higher than the BoC’s overnight rate at the start of its latest rate-cut cycle, but that is no longer the case.

Now that our policy rates are essentially equal, it will be harder for the BoC not to match additional Fed cuts going forward. Consider also that the Fed’s policy rate is based on a median GDP growth forecast of 2.2% for the U.S. economy in 2019, while the BoC is forecasting only 1.3% GDP growth for our economy over the same period. That will make it increasingly difficult for the Bank to argue that its monetary policy should be tighter than the Fed’s, especially given that our overall inflation rates both hover at a little below 2%.

With the stage now set, let’s look at the highlights from the Fed’s latest commentary:

- The Fed observed that overall economic activity has been “rising at a moderate rate” and that the labour market “remains strong”.

- Household spending has been “rising at a strong pace” but “business fixed investment and exports have weakened.” Over time, factors like business investment, manufacturing activity (which is down 0.4% over the most recent twelve months), and exports feed into job and wage growth and ultimately into spending. So, weakness in these areas does not portend continued strength in consumer spending over the medium term.

- Overall inflation continues to run “below 2 percent” when volatile factors like food and energy are excluded, and “market based measures of inflation compensation remain low.” In other words, inflation isn’t concerning the Fed today, and the broader market isn’t expecting U.S. inflation to rise much over the short and medium term.

- The Fed conceded that “uncertainties” to its outlook abound. In his accompanying commentary, Fed Chair Powell used the term uncertainty a total of twenty times. The Fed’s main concerns are trade-policy developments, geopolitical risks, and slower global growth, and it positioned its latest rate cut as an “insurance cut” against these still gathering headwinds.

- The Fed reiterated that it will “act as appropriate to sustain the expansion.” The question now is what additional actions will be required to achieve that end. The bond futures market is currently assigning a 70% probability that the Fed will cut by another 0.25% at its next meeting on December 11, and Fed Chair Powell also conceded that the Fed may resume “the organic growth of the balance sheet [a.k.a. quantitative easing] sooner than we thought.”

The U.S. five-year treasury yield initially surged higher last Wednesday in immediate reaction to the Fed’s latest announcement, but that move was short lived. It subsequently closed lower for the week.

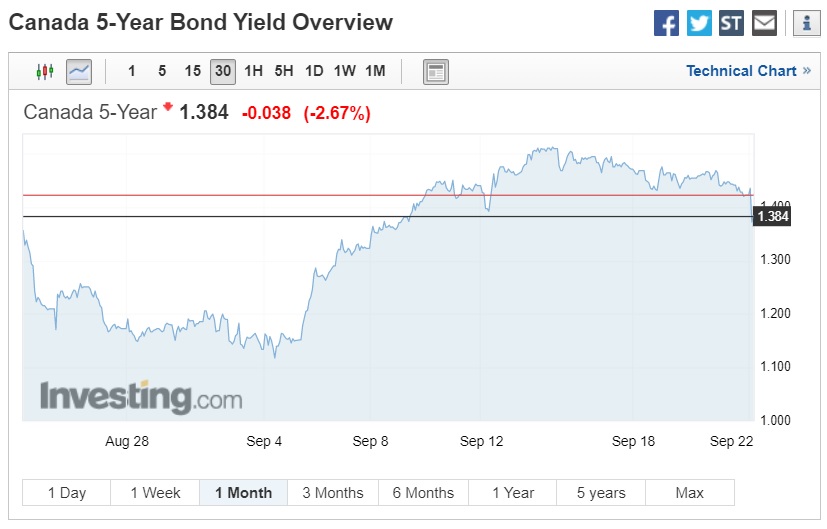

True to form, the GoC five-year bond yield followed suit, but even still, most Canadian lenders bumped their five-year fixed rates up by about 0.10% in a delayed response to the previous run up. (See chart.)

I expect the Fed to continue lowering its policy rate in the near term, barring a surprise resolution to the U.S./China trade conflict, which seems increasingly unlikely to occur before the next U.S. presidential election in 2020.

If I’m right, now that the U.S. and Canadian policy rates are essentially equal, the relative cost of continued inaction by the BoC will increase going forward, and as such, the rate cut that Canadian variable-rate borrowers have long been waiting for may materialize.

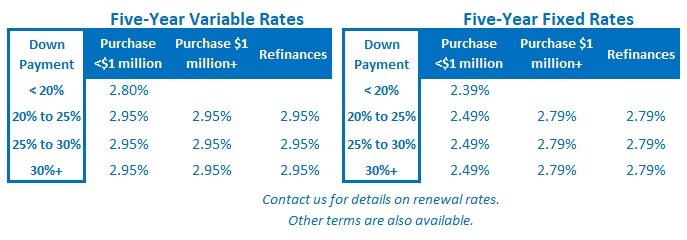

The Bottom Line: Five-year fixed mortgage rates moved a little higher last week in a delayed reaction to the recent run up in the GoC five-year bond yield. But as I predicted in last week’s post, this run up is likely to be short lived. The Fed’s policy-rate cut last Wednesday led to a drop in 5-year U.S. treasuries and our 5-year GoC bond yield quickly followed suit, so momentum has already turned the other way.

Meanwhile, now that the Fed and BoC policy rates are essentially equal, and especially considering that the U.S. economy is growing faster than ours, the BoC will be increasingly compelled to match additional Fed rate cuts going forward. If I’m right, December may finally bring variable-rate borrowers the rate cut they have long awaited.