Implications for Last Week’s Mortgage-Rate Related News

January 20, 2025The BoC’s Latest Rate Cut Is Overshadowed By Trump’s Trade War

February 3, 2025

Last week, Statistics Canada released our latest inflation data, for December, and the results came in basically as expected.

Our Consumer Price Index (CPI) decreased from 1.9% in November to 1.8% in December year-over-year (YoY). The Bank of Canada’s (BoC) most closely watched measures of core inflation, CPI-trim and CPI-median, also decreased slightly to 2.5% and 2.4% YoY respectively.

The continued declines in our key inflation gauges came with some caveats. They were largely driven by the temporary GST/HST break, which took effect mid-month, and core inflation, which strips out food and energy prices, increased for the third consecutive month on a month-over-month basis.

Last week the BoC also shared the results from its latest Business Outlook and Consumer Sentiment surveys for Q4 2024. Encouragingly, both confirmed that inflation expectations had mostly returned to historically normal levels during that period.

The Bank wants to see our inflation data cool further, but now that its key measures are back within its target range of 1% to 3%, it has leeway to let broader economic conditions weigh more heavily on its policy-rate decisions.

The BoC’s policy rate currently stands at 3.25%. That is considered the upper end of its neutral-rate range (with 2.25% being its low end).

The BoC broadly defines its neutral-rate range as the level where its policy rate is neither restricting nor stimulating economic growth. It considers this range appropriate when “the output gap is closed, inflation is at target, and there are no shocks pushing the economy around.”

(Reminder that the output gap measures the gap between our economy’s actual output and its maximum potential output. It is an important indicator of inflation pressure.)

By that definition, a policy rate of 3.25% is still too high for our current economic conditions.

Right now our output gap is wide and getting wider; inflation is near target; and tariff threats have created a shock that is pushing our economy around even before they have been officially announced.

At the same time, the gravitational pull from rising US Treasury yields has pushed Government of Canada (GoC) bond yields higher, and, by association, the fixed mortgage rates that are priced on them. Higher fixed rates restrict demand in many of the same ways that BoC rate hikes do, and that adds another economic headwind, which the Bank must account for and potentially counteract.

The Bank’s near-term policy path seems clear.

It needs to continue to reduce its policy rate to at least the low-end of its neutral-rate range, which is 2.25%. If our economy weakens, because of Trump tariffs or otherwise, the rate can then be reduced further to a stimulative level.

I don’t think we’ll see a 0.50% cut this week. The Bank made that clear when it said that it would reduce the pace of further reductions at its last policy-rate meeting. But I think there is still urgency for a further 0.25% reduction now, with more cuts to come thereafter.

Some will argue the BoC can’t overlook the fact that its core inflation gauges have not yet returned to their 2% targets. Yet I see much more downside risk if the Bank keeps its policy rate too high for too long. I am reminded of the Bank’s acknowledgement that its monetary-policy tools are better suited for fighting inflation than for fighting deflation.

Finally, there is a well-established precedent for more BoC rate cuts. The Bank has reduced its policy rate to 2%, or lower, over each of its past five rate-cut cycles (hat tip to David Rosenberg for that detail).

Put me down for 0.25% cut this Wednesday, with more to follow. The Bottom Line: GoC bond yields were range bound last week, and there was no significant pressure on our fixed mortgage rates in either direction.

The Bottom Line: GoC bond yields were range bound last week, and there was no significant pressure on our fixed mortgage rates in either direction.

The BoC and the US Federal Reserve both have their policy-rate meetings this week.

I expect the BoC to cut its policy rate by another 0.25%. If that happens, our variable mortgage rates will decrease by the same amount in short order.

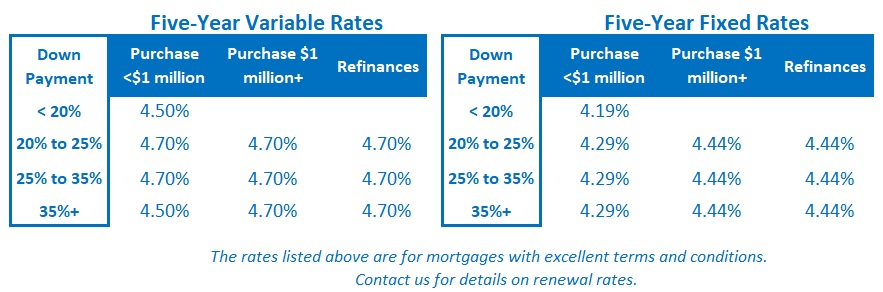

Five-year variable rates will then be roughly equivalent to five-year fixed rates for the first time since November 2022.

There is much less chance that the US Fed will cut this week. US CPI has increased for four consecutive months. Bond market investors expect inflation pressures to remain elevated under President Trump.

If the Fed adopts a more hawkish policy-rate stance, as expected, US Treasuries will likely rise. They typically take GoC bond yields along for the ride.

I have warned in recent posts that our fixed and variable mortgage rates may be headed in opposite directions in 2025.I expect that divergence to become increasingly apparent this week.