How Trump’s Tariff Tirade Is Impacting Canadian Mortgage Rates

April 7, 2025 Bond-market investors do not expect the Bank of Canada (BoC) to cut its policy rate when it meets this Wednesday. They are pricing in 60% odds that the Bank stands pat.

Bond-market investors do not expect the Bank of Canada (BoC) to cut its policy rate when it meets this Wednesday. They are pricing in 60% odds that the Bank stands pat.

The BoC has reduced its policy rate at its last seven consecutive meetings, but the most recent decreases have been close calls.

The Bank has become increasingly concerned about the uptick in our inflation data, the heightened inflation expectations of both consumers and businesses, and the inflationary impact of potential tariffs on US imports.

Despite those quite legitimate concerns, I still expect the Bank to cut by another 0.25% this week.

The BoC’s policy rate currently stands at 2.75%, which it considers a neutral level that is neither stimulating nor restricting demand. By its own estimate, the Bank’s won’t be stimulating demand until it lowers its policy rate to 2%.

The need for monetary-policy stimulus is becoming increasingly apparent as the impacts from Trump’s trade war take hold.

Our latest employment report confirmed that our economy shed 33,000 jobs in March, and the BoC’s latest Business Outlook Survey revealed that fully one-third of businesses now expect our economy to fall into recession with the next year.

A growing number of consumers are worried about their job stability and are pessimistic about their overall financial health. Not surprisingly, discretionary spending has declined.

The BoC is understandably concerned about the recent uptick in our inflation data.

Our Consumer Price Index (CPI) came in at 2.6% in March, higher than its inflation target of 2%. But the Bank’s mandate includes a broader target range for inflation that allows it to fluctuate between 1% and 3%. That range is designed to provide the Bank with flexibility when it needs to respond to unexpected economic events.

In a speech explaining when the Bank might allow inflation to deviate from its 2% target, Deputy Governor Timothy Lane explained: “We have some flexibility within our inflation-targeting framework: we might accept a slower return of inflation to target, if necessary, to avoid adverse effects on financial stability. But the expectation has been that we would only rarely, if ever, use the framework’s flexibility in this way.”

Clearly the BoC will use a high bar when allowing a slower return to the Bank’s 2% target. Fair enough. But the president of our largest trading partner has declared an economic war against our country for the express purpose of annexing it. If that doesn’t clear the Bank’s bar, I’m not sure what would.

Several emerging disinflationary tailwinds should also reassure the BoC that inflation is set to cool:

- Overall inflation is highly correlated with oil prices, which recently plunged to their lowest levels in more than four years. Our federal government has also just announced the cancellation of its carbon tax, effective April 1, and that will help to reduce fuel prices.

- The Loonie has been strengthening against the Greenback of late, and that will help reduce the cost of everything we import from US markets.

- Mortgage interest costs had been the main driver of inflation pressure for more than a year, but that impact is waning because mortgage rates have fallen steadily.

- Wage growth has slowed, and softening labour market conditions portend more easing of wage-pressures ahead.

Put me down for another 0.25% cut this Wednesday. The Bottom Line: US bond yields surged higher last week.

The Bottom Line: US bond yields surged higher last week.

President Trump’s erratic tariff announcements undermined both the willingness of global bond-market investors to hold US debt, and more broadly, the long-standing perception of US Treasuries as the ultimate safe-haven asset.

To wit, the benchmark US 10-yr treasury yield spiked 0.66% higher, marking its largest weekly surge since November 2021.

As is typical, Government of Canada (GoC) bond yields were taken along for that ride.

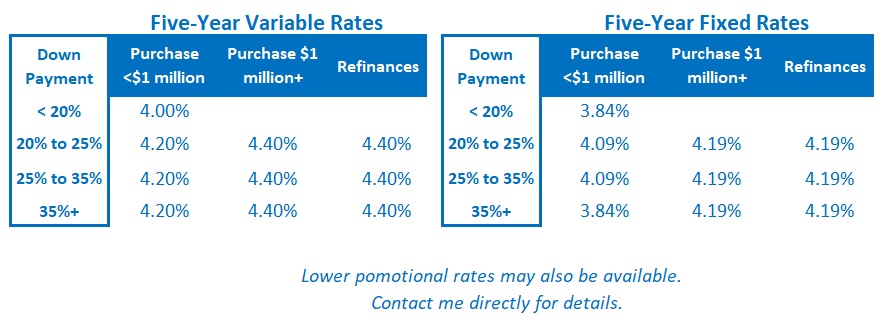

The five-year GoC bond yield increased by 0.40% last week, and lenders have begun to raise their fixed mortgage rates in response. I expect upward pressures to remain until we hear from the BoC.

Variable-rate discounts have shrunk of late because credit spreads are widening in response to increased financial market volatility.

I continue to expect more rate cuts by the BoC this year, with the next 0.25% reduction to be confirmed this Wednesday.