The Bank of Canada Holds Rates Steady and Dampens Rate-Hike Expectations

October 30, 2017A Detailed Look At Canada’s Mortgage Stress-Test Rate

November 13, 2017 Last week we received the Canadian employment data for October, which was better than expected.

Last week we received the Canadian employment data for October, which was better than expected.

Our economy added 35,300 new jobs last month and that was more than double the consensus forecast of 15,000 new jobs. The Loonie surged higher on the news and so did Government of Canada (GoC) bond yields as investors upped their bets that the Bank of Canada (BoC) would raise its policy rate once again in early 2018.

While this upside beat was a welcome surprise, our strong employment data in October stand in contrast to other recent data. For example, last week we also learned that our GDP growth fell by 0.1% in August on a month-over-month basis, after coming in at 0% in July, and our export sales revenue fell by 0.3% month-over-month in September. Our export sales have now dropped for four straight months by a total of 1.1% since hitting a record high in May as the headwind from the lofty Loonie continues to buffet our hard-won momentum in that sector.

Therein lies the challenge for the BoC.

When the Loonie hovered in the 75-cent range versus the Greenback in the second half of 2016 and into the early part of 2017, it gave our exports a boost that culminated in eye-watering second-quarter 2017 GDP growth of 4.5%. (Nowadays developed economies consider anything north of 2% GDP growth to be exciting.)

Around that time, the BoC became concerned about the risk of rising inflationary pressures and decided to raise its policy rate by a total of 0.50% this past summer. The Loonie soared, our export volumes tanked, and our GDP growth stalled out before shifting to outright decline in August.

When the Bank met two weeks ago, it adopted a more dovish stance and said that it was now much more “preoccupied with the downside risks to inflation”. The Loonie sold off and one assumes that this currency depreciation will help boost our exports over time … but only over time. And there’s the rub.

The BoC plays the long game much more so than the currency traders, bond-market investors and market pundits who react to every new data point. While strong employment growth is a good sign for our economy, BoC Governor Poloz recently said that he believes that our economy is in a “sweet spot”, where expanding output capacity gives it room for non-inflationary growth over the next six to twelve months.

U.S Federal Chair Janet Yellen recently estimated that average wage rises would need to be in the 3% to 4% range over a sustained period before wage costs would meaningfully impact overall inflation, so in that context, while our rate of average wage growth is accelerating, it should still have plenty of room to run before it causes meaningful inflation.

Here are the specific highlights from our latest employment data:

- Our economy added 35,300 new jobs last month. All of that growth came from full-time jobs, which increased by 88,000 (offset by a loss of 53,000 part-time jobs), and that’s on top of the 112,000 new full-time jobs that were created in September.

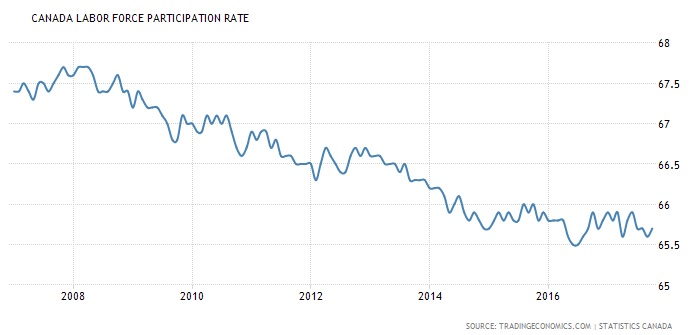

- Our unemployment rate rose from 6.2% to 6.3% last month but only because more Canadians came off the sidelines and re-entered the labour market. As a result, our participation rate, which measures the percentage of working-age Canadians who are either employed or actively looking for work, increased from 65.6% to 65.7%. Interestingly, our participation rate still hovers well below its longer-term average level (see chart below). When BoC Governor Poloz talks about our economy having room for non-inflationary growth, that is in large part because there are plenty of working-age Canadians still sitting on the sidelines. As our economic prospects improve, it is expected that many of those people will rejoin the work force, adding to our output capacity and delaying the onset of wage-cost inflation.

- Average wages in Canada rose by another 0.3% in September and have now increased by 2.4% on a year-over-year basis, marking a sharp turnaround from earlier this year. By comparison, our average wages were only growing by 0.5% year-over-year in April. While this pick-up in average wages is encouraging, it coincided with a rise in the demand for our exports which recently dissipated, so one wonders how sustainable our current momentum in average wages will be going forward. Also, minimum-wage increases in three of our four most populated provinces are also putting some upward pressure on average wages over the short term, but the BoC would be expected to “look through” this because its impact on inflation will only be temporary.

We also received the latest U.S. employment data last week, which showed the job growth came in lower than expected in October. The U.S. economy added 261,000 new jobs versus the consensus forecast of 310,000.

Most of those new U.S. jobs were of the lower-paying variety (with 106,000 of them coming from the leisure and hospitality sector) and not surprisingly, average U.S. wages fell by 0.1% last month. In addition, U.S unemployment dropped from 4.2% to 4.1%, but only because the U.S. participation rate fell from 63.1% to 62.7%.

This weaker-than-expected data was blamed on hurricane-related disruptions, and the consensus is still convinced that the Fed will raise its policy rate by another 0.25% when it meets in December (the futures market is current assigning a 96.7% probability that this will occur).

If the Fed raises as expected, the Loonie should weaken against the Greenback and give a boost to our export sector. While another Fed hike will also give the BoC more room to raise its policy rate if its becomes more concerned about rising inflationary pressures in the months ahead, at this point uncertainty is still the BoC’s watchword, especially with all of the negative talk around the NAFTA negotiations, so that seems unlikely over the near term.

The Bottom Line: Our latest employment report was encouraging but other recent data, such as our GDP and export sales, indicate that our overall economic momentum is now slowing. The BoC should remain cautious against that backdrop, and as such, I don’t expect that our October employment data will have a material impact on our mortgage rates.