Governor Poloz’s Big Reveal and Fed Chair Yellen’s Test Balloon

March 24, 2014What the Latest Canadian and U.S. Employment Data Mean for Our Mortgage Rates

April 7, 2014 I usually refrain from dealing with specific product offerings in the market but I have had so many questions from my clients and potential clients about the Bank of Montreal’s (BMO’s) newly announced Low-Rate Mortgage at 2.99% that I have decided to make an exception.

I usually refrain from dealing with specific product offerings in the market but I have had so many questions from my clients and potential clients about the Bank of Montreal’s (BMO’s) newly announced Low-Rate Mortgage at 2.99% that I have decided to make an exception.

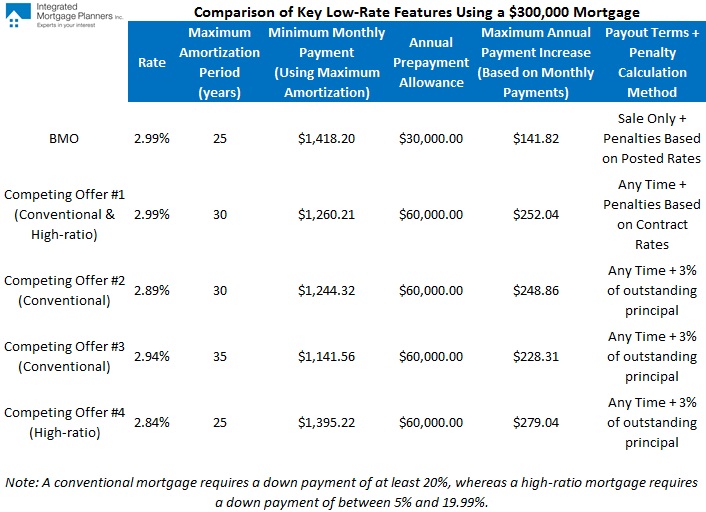

In today’s post, I will evaluate the BMO offer in detail and compare it to several other options that are currently available in the market. We’ll start off with the interest rate itself before shining a light on the terms and conditions that accompany BMO’s headline grabbing Low-Rate Mortgage product. Then you can decide for yourself whether the trade-offs are worth it.

That Sexy 2.99% Rate

Nothing sets a mortgage borrower’s heart aflutter these days like seeing a five-year fixed rate that starts with a 2 handle. While not every lender has the advertising and PR muscle of a Big Five bank, you can find other sub-3% rates without having to give up the flexibility that BMO has removed as part of its glitzy offer. In fact, I currently offer fully featured five-year fixed-rate mortgages at 2.99% with two different lenders that are much more flexible, and if you’re willing to accept the kind of terms and conditions that are included in the BMO offer, my best no-frills five-year fixed rates range from 2.84% to 2.89%, depending on the size of your down payment.

Payout Privileges and Penalties

BMO’s no-frills offer only allows you to break your mortgage if you sell your property or if you refinance your mortgage into another BMO product. This effectively eliminates any negotiating leverage you have with the bank for the next five years, and that’s a long time to be bolting shut the mortgage-market door and throwing away the key.

While it’s true that you can technically refinance your mortgage if you stay with BMO, don’t expect the bank to sharpen its pencil on your revised rate when it knows that you have no other choice, short of selling your house. After all, those billion-dollar quarterly profits have to come from somewhere.

Speaking of which, if you do sell your house before your term is up, a five-year fixed rate from BMO comes with an Interest Rate Differential (IRD) penalty that is calculated using posted rates. This can, and usually does, increase the size of your penalty by more than four times the amount charged by a host of other lenders. For a detailed explanation of the differences in how fixed-rate mortgage penalties are calculated, check out my post on the topic. (BMO uses the Discounted Rate IRD Penalty method and my two lenders who are currently offer fully featured 2.99% mortgages use the far more reasonable Standard IRD Penalty method.)

That said, if you’re one of those borrowers who is convinced that you will be happy in your home for the full term of your mortgage, and if you are also willing to accept the kind of mortgage terms that BMO demands, there are still lower rates available.

I have a lender that is offering five-year fixed rates between 2.84% and 2.89% if you agree to pay a mortgage penalty of 3% of your outstanding principal at the time of discharge, and you are not required to sell your house to get out of your contract. If you’re looking for the lowest rate and are willing to trade off a higher prepayment penalty to get it, you will save more on interest cost with either of these options.

Maximum Amortization Period

BMO is limiting the maximum amortization period on its Low-Rate Mortgage to 25 years. Here again, conventional borrowers (who can make a down payment of at least 20% when purchasing a property) would be unnecessarily limiting their flexibility. My fully featured 2.99% conventional mortgages come with maximum amortizations of 30 years, and my conventional 2.94% offer that comes with more limited terms and conditions includes the option to increase your amortization by up to 35 years.

To be clear, I am not highlighting the appeal of a longer amortization period because I think you should take longer to pay off your mortgage. Far from it. Ideally, the maximum amortization period is merely used to set the minimum mortgage payment that you must make regardless of any changes in your personal circumstances. As such, there is value in keeping this payment amount as low as possible, especially when combined with a mortgage that is set in stone for five years. Taking a longer amortization period in no way inhibits your ability to pay off your mortgage more quickly because you can use your annual prepayment allowances to dramatically reduce your minimum amortization period. It just maximizes your flexibility, which could come in handy when you are locking in a five-year financial obligation with a big penalty clause.

Annual Prepayment Allowances

BMO’s Low-Rate Mortgage allows you to make additional payments of up to 10% of your original mortgage balance each year and to increase your contractual mortgage payment by up to 10% as well.

The other offers I have been highlighting allow you to pay up to 20% of your original balance each year and to increase your contractual payment by up to 20% as well.

If you like prepayment flexibility, why not enjoy more of it, especially when you can pay the same interest rate or better?

We’ve covered a fair amount of detail in this post. To make it easier to understand, here is a summary chart that compares the key mortgage features side by side:

Five-year Government of Canada (GoC) bond yields fell by three basis points last week, closing at 1.71% on Friday. As discussed above, market five-year fixed rates are still available in the 2.99% to 2.84% range, and five-year fixed-rate pre-approvals can be had for rates as low as 3.09%.

Five-year variable-rate mortgages are offered at rates as low as prime minus 0.65%, which works out to 2.35% using today’s prime rate of 3.00%.

The Bottom Line: For the reasons outlined above, if you’re looking for the best combination of five-year fixed mortgage rates and features, it pays to look beyond BMO’s heavily advertised offering.