Why Higher Fixed Mortgage Rates Make Additional Policy-Rate Hikes Less Likely

October 10, 2023Mortgage-Rate Update: What to Make of the Bank of Canada’s Hawkish Hold

October 30, 2023 Last week was a busy one for mortgage-related news and rates.

Last week was a busy one for mortgage-related news and rates.

Our banking regulator provided its latest review of its residential mortgage underwriting guidelines; we received updated Consumer Price Index (CPI) data for September; and the Bank of Canada (BoC) released both its Q3 Business Outlook Survey (BOS) and Canadian Survey of Consumer Expectations results.

I’ll offer my take on each and then close with a look ahead at the Bank of Canada’s (BoC) meeting this Wednesday.

- Update from the Office of the Superintendent of Financial Institutions (OSFI)

Last week our banking regulator, OSFI, provided the much-anticipated review of its mortgage underwriting guidelines.

There was concern that OSFI would follow through on its previously outlined plans to tighten lending standards and heap further suffering on our already cooling real-estate markets. But it held off on making material changes.

For now, OSFI will allow market forces to play out, satisfied that demand for mortgages has cooled while mortgage default rates remain at the low end of their historical range.

There was hope that OSFI would finally end an anti-competitive practice. That didn’t happen either.

OSFI has been under steadily increasing pressure to allow renewing borrowers to switch lenders at renewal without having to requalify at the mortgage qualifying rate (MQR), which is in the 8% range today. (Borrowers who paid for high-ratio default insurance can be qualified using their actual rate at renewal if they decide to switch lenders, but they are a small subset of the total.)

OSFI’s requalification requirement for most renewing borrowers is trapping an increasing number of them with their current lenders, forcing many of them to accept uncompetitive rates. (OSFI says it doesn’t see evidence of this, but any experienced mortgage professional can be forgiven for spitting out their coffee when reading those words.)

OSFI’s rationale was that the existing lender did extensive due diligence when providing the initial loan (typically five years ago), and that a new lender should apply the same standards at renewal to avoid “compet[ing] for loans that do not meet OSFI’s expectations.”

Practically speaking, this means OSFI prefers to have lenders renew their existing borrowers with no re-underwriting (or stress-testing) at comparatively higher rates, rather than to allow competing lenders to fully re-underwrite applications using their most competitive contract rates.

If it were your money on the line, dear reader, which group of borrowers would you rather lend it to?

Bluntly put, our banking regulator’s decision to maintain this anti-competitive restriction (and its failure to provide sufficient justification for doing so) is hurting an increasingly large number of Canadians. This is, in a word, inexcusable.

(Paging their political masters at the federal Ministry of Finance…)

- September Consumer Price Index (CPI)

Last Tuesday, Statistics Canada confirmed that our headline CPI decreased from 4.0% in August to 3.8% in September, lower than the consensus forecast of no change. Core CPI, which strips out volatile food and energy costs, also fell from 3.6% in August to 3.2% in September.

Stats Can noted that the deceleration in prices was “broad based”, with notable declines in durable goods, groceries, and travel-related services. Gas prices rose by 7.5% (year-over-year) last month but have cooled since.

Financial markets responded by reducing the odds of a BoC rate hike this week to about 15%. That said, the bond futures market is still pricing in a 50% chance that the Bank will hike one more time before the end of this tightening cycle.

Last week, in his presentation at the national Mortgage Professionals Canada conference, CIBC Deputy Chief economist Benjamin Tal explained that our overall CPI would already be back to 2% if interest-rate payments were excluded. He believes that fact should compel the BoC not to hike again and to start cutting its policy rate sooner than is generally expected.

I don’t think the Bank shares that view.

Interest-rate increases and price rises are fighting for the same dollars. Without today’s higher interest rates, other prices would not have cooled to the same extent.

From an overall inflation perspective, it’s one or the other, and as such, the fact that overall inflation remains elevated matters much more to the BoC than where specific current price pressure is coming from.

Higher rates also needed to be fully accounted for because they feed into consumer and business inflation expectations. The growing belief that inflation will remain higher for longer is fueling behaviour changes that are inflationary and can become self-reinforcing (such as when workers demand more pay to compensate for higher perceived future inflation).

Speaking of which …

- The Latest Canadian Survey of Consumer Expectations

If the BoC were concerned that inflation expectations were becoming unmoored from its 2% target, the latest Survey of Consumer Expectations results should make them more so.

The Bank noted that consumer inflation expectations remain “stubbornly high” and that the gap between perceptions of inflation and actual inflation is “unusually wide”.

Consumers expect inflation to cool over the next twelve months, but their expectations for inflation two years hence increased in Q3. On average, they don’t believe that inflation will return to the Bank’s 2% target over the next five years.

Signs of continued confidence in the labour market were also evident.

Workers expressed “a higher-than-normal likelihood of voluntarily leaving their job”, which is a sign of confidence in the demand for their services. Wage growth expectations are now the highest they have been since the BoC started sending out this survey in 2014.

Workers also expect that higher prices will cause their spending to increase faster than their incomes.

If they believe that inflation will outpace their current earnings and if they are confident in their job prospects should they decide to change employers, it is reasonable to infer that workers will continue to push for compensation increases, which will then feed into future prices.

- The Latest Business Outlook Survey (BOS)

The Q3 BOS survey revealed that businesses are becoming more cautious in their outlooks.

On average, they reported that “economic activity has slowed across a broad range of indicators”. Most businesses are anticipating that sales will slow, and as such, they are planning less investment in capacity expansion.

More than half of the businesses surveyed expect to continue increasing their prices by “more than normal” over the next 12 months. About half of them believe that the impacts from the Bank’s tighter monetary policy “are just beginning”. an Many expect “growth in demand to continue to be subdued”.

Interestingly, while businesses expect to slow their pace of hiring, few are planning layoffs. Most expect “higher-than-normal wage increases over the next year”. Many businesses also remain “uncertain about when their wage growth will return to normal”.

Wages are expected to increase by an average of about 4% over the next 12 months (compared with an average of 5% year-over-year in August). When it comes to labour costs, most businesses sounded more like price takers than price makers.

Continued price hikes seem likely to be defensive (to account for higher input costs) rather than offensive (to increase profit margins).

Overall, inflation expectations edged down somewhat. About half of the businesses surveyed still expect that inflation will average more than 3% over the next 2 years. But “roughly one-third of firms still believe it could take longer than three years before inflation returns to the Bank’s 2% target.”

The BoC will be encouraged that this BOS survey shows businesses’ expectations for growth have cooled and that firms are adjusting their plans accordingly. But it will also be concerned that expectations around labour costs remain elevated.

- The BoC’s Next Move (When It Meets This Wednesday)

I expect the BoC to hold steady when it meets this week and to reiterate its commitment to continue raising its policy rate if circumstances warrant.

There is clear evidence that the ten rate hikes the Bank has already made this cycle are still increasing their bite. Our GDP growth has slowed to stall speed; an increasing number of consumers have now depleted the pandemic savings they were using to maintain spending in the face of higher prices; and higher bond yields have slowed housing-market activity to a crawl.

But all that said, consumer inflation expectations remain stubbornly high; wage growth is still robust; and falling productivity rates are less likely to reverse while businesses are planning to reduce investment over the near term.

The Bank will also want to ensure that its guidance is hawkish enough to prevent overly enthusiastic reactions that would undermine its goal of reducing near-term demand.

Put me down for a hawkish hold.

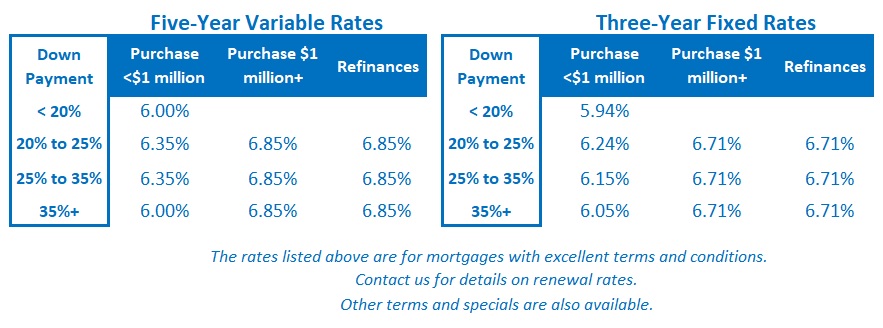

If you’re in the market for a mortgage today, I continue to believe that the two most compelling choices are between a three-year fixed rate and a five-year variable rate.

A three-year fixed-rate term offers the best risk/reward balance among today’s fixed-rate options. The premium you pay over five-year fixed rates is now down to about 0.35%. I would be reluctant to lock in for longer than three years when rates are at their highest levels in more than a decade and appear to be near their peak.

The premiums for shorter-term fixed rates are much higher. The shorter the term, the greater the risk that you’ll be renewing before rates have fallen enough to leave you better off.

If you can tolerate the risk that your variable mortgage rates may go still higher from here before they drop, and if you’re prepared for elevated levels for another year or more, choosing a five-year variable rate today has the greatest potential for saving over the full term of your mortgage.

In fact, at this point, given we are at or near the peak in rates and that three-year fixed rates and five-year variable rates are about the same, the case for variable-rate options is becoming more compelling all the time.

The Bottom Line: In isolation, last week’s lower-than-expected CPI data should have pulled down Government of Canada (GoC) bond yields. That didn’t happen. Instead, they were pulled higher by their US Treasury equivalents, which were buoyed by the release of stronger-than-expected US retail sales data.

This is a manifestation of my recent warning that the concomitant relationship between GoC bond yields and US Treasuries means that our bond yields, and, by association, our fixed mortgage rates, will likely remain above the levels that would be appropriate if they were solely a reflection of our weakening domestic economy.

Our variable mortgage rates, on the other hand, won’t be similarly tethered. They move up and down with the BoC’s policy rate, which will more closely reflect our domestic conditions.

Put more simply, variable mortgage rates will fall when Canadian inflation cools sufficiently, whereas our fixed mortgage rates may have to wait until US inflation does the same.

Given the current divergence in our economic trajectories, I think the former is likely to happen sooner than the latter.