To Review

May 19, 2020The Length of Our Recovery Could Have a Surprising Impact on Your Mortgage

June 1, 2020Last week, Evan Siddall, CEO of the Canada Mortgage and Housing Corporation (CMHC), made a speech to our federal government’s Standing Committee on Finance, and in it he floated the idea of increasing the minimum down payment required to purchase a residential property from 5% to 10%.

His recommendation to restrict lending seems out of sync at a time when our policy makers have put their monetary and fiscal stimulus firehoses on full blast in their attempts to counteract the massive negative economic impacts of COVID-19 and the oil-price crash.

Before I offer my take on Siddall’s surprising proposal, let’s look at the highlights from his speech, which provided an update to the committee on “how CMHC is helping to stabilize Canada’s financial system and support the economic well-being of households and small businesses during the COVID-19 pandemic.”

- CMHC relaunched the Insurance Mortgage Purchase Program to help “ensure that banks have access to reliable term funding so they can continue their lending activities and housing markets remain functional.” This program was also expanded to include uninsured mortgages, and all told, it will offload up to $150 billion from bank balance sheets.

- CMHC is also allowing borrowers to defer their mortgage payments for up to six months. It estimates that 12% of mortgage holders have taken advantage of this program thus far, and it forecasts that figure “could reach nearly 20% by September.”

- Siddall highlighted the oft-repeated concern that “Canadians are among world leaders in household debt” and noted that our country far exceeds the 80% debt-to-GDP threshold “which the Bank for International Settlements has shown … intensifies the drag on GDP growth.”

- CMHC is now forecasting a decline in average house prices over the next year, in a range between 9% and 18%. “The resulting combination of higher mortgage debt, declining house prices and increased unemployment is cause for concern for Canada’s longer-term financial stability.”

- Siddall dramatically warned of a “debt deferral cliff that looms in the fall, when some unemployed people will start paying their mortgages again.” He estimates that “one fifth of all mortgages could be in arrears if our economy has not recovered sufficiently.”

- Against that backdrop, said Siddall, “we feel we need to avoid exposing young people (and through CMHC, Canadian taxpayers) to the amplified losses that result from falling house prices.” To help do this, he proposed that we increase the minimum down payment requirement from 5% to 10%. He further rationalized his recommendation by saying “if housing affordability is our aim, as surely it must be, then there must be a limit to the demand we help to create, especially when supply isn’t keeping up.”

Bluntly put, I think now would be a particularly bad time to make the change that Siddal is recommending.

The time to tighten lending guidelines is when the economy and our real estate markets are strong, not when they are at their most vulnerable. That’s why our policy makers have responded with aggressive stimuli during the current crisis.

Siddall’s “debt deferral cliff”, which included a forecast of up to $9 billion in defaults, has been widely panned. But some rise in defaults is likely, and if that happens, we will see an increase in listings, which would help alleviate Siddall’s concern that “supply isn’t keeping up.”

Why, at that pivotal moment, would we want to reduce demand by restricting lending?

The best way to deal with disruptions is to let the market clear as efficiently as possible. Restricting borrowing and reducing demand at the same time that listings are increasing would make it harder for the market to adjust and would likely exacerbate the price declines that Siddall is also concerned about.

Interestingly, I think borrowers with down payments of less than 10% of the purchase price of a property will be a key source of market support if we do see a surge in listings, because they are the ideal buyers for the very properties that I think are most likely to hit the market.

Here’s why I say that:

- As this recent article in the Globe and Mail noted, hourly workers have borne the brunt of our recent job losses, while salaried workers have been “largely insulated from the employment downturn.”

- Hourly workers are less likely to have reserves to draw on to cover expenses when income is lost, the largest of which will almost always be rent. If impacted workers can’t pay their rent, landlords will have to cover the shortfall, and their employment incomes may also have been impacted by the current crisis.

- Property investors with tenants who can’t pay their rent have a serious problem, but at least there are rent relief programs available to help cushion the blow for those affected.

- Property investors who opted instead to list their properties in the short-term rental market, using websites such as Airbnb, have no prospect for any rental income for as long as our quarantine lasts, and likely for even longer if changing consumer habits significantly reduce the demand for short-term rentals, as is widely expected.

- This Global News article cites a study estimating that the Canadian Airbnb market comprised approximately 31,000 units in 2018. That number likely continued to grow until the current crisis hit.

All of the points listed above increase the odds that rental-property investors, as a group, will be under increased pressure to sell their properties (and that’s without counting those who simply want to sell because they think there are now other, more attractive investing options available).

In expensive cities like Toronto and Vancouver, rental properties are often small, affordable condos – exactly the kind of entry-level housing that young Canadians might be able to afford, especially if their prices started to drop.

A flood of new listings from rental-property investors and a decline in prices would open the door to home ownership for more first-time-buyers and help alleviate the affordability issues that have plagued our largest real-estate markets for decades. Increasing the down-payment requirements for the specific borrowers who might benefit from this window of opportunity would deny many of them that chance.

If listings are going to increase and house prices do end up falling, wouldn’t a redistribution of our housing stock from rental-property investors to owner-occupied buyers be a silver lining?

As Siddall says, if prices continue to fall, there is a risk that some of those owner-occupied buyers might see their properties drop in value shortly after they buy. But housing is a long-term investment, and even CMHC’s own bearish forecasts predict that house prices will return to pre-COVID levels by 2022. Siddal also readily concedes that “Canadians do a very good job of paying their mortgages even when they’re underwater”, so why do young Canadians need to be saved from themselves, and how much increased risk is CMHC actually facing?

Regular readers of this blog know that I have given my full-throated support to the many rounds of mortgage-rule changes that we have seen since the start of the Great Recession (which you can review in detail here). But I just don’t see the wisdom of reducing minimum down payment requirements from 5% to 10% in the current environment. The Bottom Line: Our excessive debt levels are a legitimate concern and something that our policy makers should continue to address once the current crisis subsides. But raising down payments in the current market conditions would be much more likely to do harm than good, particularly for potential first-time buyers who live in our largest cities and have long been priced out of their housing markets. Furthermore, such a change would directly contradict our federal government’s oft-stated goal of making housing more accessible to first-time buyers.

The Bottom Line: Our excessive debt levels are a legitimate concern and something that our policy makers should continue to address once the current crisis subsides. But raising down payments in the current market conditions would be much more likely to do harm than good, particularly for potential first-time buyers who live in our largest cities and have long been priced out of their housing markets. Furthermore, such a change would directly contradict our federal government’s oft-stated goal of making housing more accessible to first-time buyers.

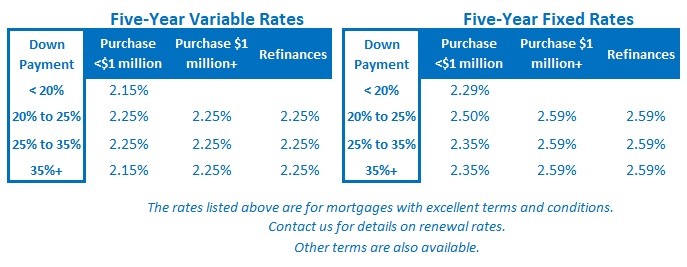

Five-year fixed rates continued to edge down last week as risk premiums relating to the current crisis continue to shrink, slowly but surely. The best available five-year variable rates were unchanged.

Last week the Bank of Canada dropped its benchmark qualifying rate from 5.04% to 4.94%. That change will increase maximum borrowing capacities very slightly.

1 Comment

Nice Article…Very interesting to read this article. I have learned some new information. Thanks for sharing.