Canadian Mortgage Rate Updates – Top Five Recent Posts

February 20, 2024The Bank of Canada’s First Rate Cut Should Not Be Far Off

March 4, 2024 Last Tuesday Statistics Canada confirmed that our Consumer Price Index (CPI) declined from 3.4% in December to 2.9% in January (year-over-year). That result was well below both the consensus forecast of 3.3% and the Bank of Canada’s (BoC) most recent projection for Q1 (3.2%).

Last Tuesday Statistics Canada confirmed that our Consumer Price Index (CPI) declined from 3.4% in December to 2.9% in January (year-over-year). That result was well below both the consensus forecast of 3.3% and the Bank of Canada’s (BoC) most recent projection for Q1 (3.2%).

Interestingly, that downside surprise in our CPI followed an upside surprise in the US CPI just the week before. That US number came in at 3.1% for January versus the consensus forecast of 2.9%.

Because of the different ways that our mortgage rates are determined, this divergence between the Canadian and US CPI numbers should be taken as a warning that Canadian fixed and variable mortgage rates may soon be moving in different directions.

To explain why I write that, let’s first recap the latest Canadian CPI data:

- Our headline CPI dropped to 2.9% primarily because gasoline prices are lower now than they were last year, but a deceleration in food price inflation also helped.

- Core inflation, which strips out volatile food and energy prices, declined from 3.4% in December to 3.1% in January (year-over-year). Decelerating airfare and cell phone prices were mainly responsible for that drop.

- The BoC’s most closely watched sub-measures of core inflation also declined. CPI-median fell from 3.5% in December to 3.3% in January (year-over-year), and CPI-trim dropped from 3.7% to 3.4% over the same period.

- Most of our continuing inflation pressure is still coming from shelter costs, which account for 30% of our total CPI. They rose again in January, driven higher by increased mortgage interest costs, which rose by a whopping 27.4% (year-over-year), and by rental costs, which increased by 7.8%. (Note that rental costs are also affected by higher mortgage costs.)

- A recent TD Bank report noted that our CPI clocked in at just 1.5% in January when shelter costs are excluded.

This latest inflation data bolstered the bond market’s expectations that we’ll see the BoC’s first 0.25% policy-rate cut by June. Once that happens, the price pressure on our mortgage rates, which also feed into rent costs, will start to abate.

That said, both the timing and magnitude of the coming rate cuts are still somewhat uncertain.

If the BoC cuts too soon, or by too much, it could over-stimulate our real-estate markets and buoy demand for the wide array of consumer products that are tied to real-estate purchases. The risk of that happening is further magnified by our housing shortage, which is keeping a constant additional pressure on prices.

All considered, it is still reasonable to expect that variable mortgage rates will start to decline, to some extent, in the near future as the BoC begins cutting its rates. But the same may not be true for today’s fixed rates. They are priced on Government of Canada (GoC) bond yields, which follow their US Treasury equivalents in lockstep because of the close linkages between our two economies.

The US economy has followed a very different trajectory of late:

- US GDP increased by 4.9% in Q3, 2023, whereas Canadian GDP decreased by 1.1%. That’s an unusually high divergence.

- The US federal government has been running much larger deficits relative to GDP than the Canadian federal government. Deficits are inflationary.

- The US unemployment rate is currently 3.7%, whereas the Canadian unemployment rate is 5.7%. (There are differences in the ways that each country calculates its unemployment rate, but even when these are accounted for, the Canadian unemployment rate comes in higher.)

- US CPI now stands at 3.1% versus the Canadian CPI at 2.9%, but the meaningful gap is wider because our CPI baskets use different inputs. For example, the Canadian CPI assigns a much higher weighting to shelter costs. As per the TD Bank report referenced above, when the US CPI weightings are applied to our data, our CPI drops all the way to 2.1% for January.

This is where things get weird.

The US economy is running hotter than the Canadian economy by just about every measure, but despite that, bond-market investors consistently priced in more cuts by the Fed than the BoC in 2023. (Right now, the consensus is calling for four cuts of 0.25% by the Fed compared to only two by the BoC.)

GoC bond yields, and, by extension, our fixed mortgage rates, follow US Treasury yields, and that fact means that our current fixed rates are lower than they might otherwise be because they are a reflection of looser monetary-policy expectations south of the border.

Lower for now.

While Canadian economic data are weakening and the BoC’s first rate cut is coming more clearly into to view, the Fed’s messaging is growing increasingly hawkish. Its members are re-asserting higher-for-longer views that are getting the bond market’s attention.

The US bond-yield tailwind, which carried our fixed mortgage rates lower, is now morphing into a headwind that may soon pull them higher –at a time when our domestic data should be pulling them lower.

Higher fixed mortgage rates won’t just increase the appeal of variable-rate options. They will also further tighten financial conditions at a time when the BoC will be trying to loosen them. That countervailing force may also compel the BoC to respond by dropping its policy rate by more than it otherwise would.

Current Mortgage Selection Advice

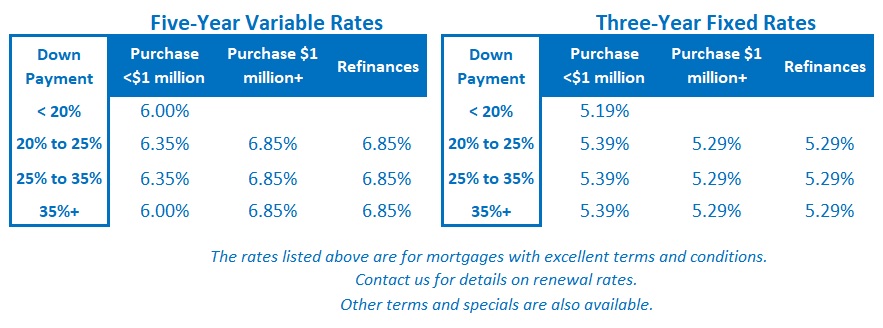

If you’re willing to pay an upfront rate premium and can tolerate a higher-risk option, I think variable rates are well worth considering today. While we can never be fully certain how things will play out, I think the BoC will start cutting fairly soon and to an extent that may well produce the lowest average interest cost over the full term of a typical five-year loan.

On the other hand, if you’re a more conservative borrower who is still concerned that inflation and high rates may end up proving stickier than expected, I think a three-year term is the best bet among today’s fixed-rate options. Fair warning though. Today’s fixed rates may soon be pulled higher by rising US bond yields as they respond to the evolving higher-for-longer rate view in the US. The Bottom Line: The Canadian inflation data for January came in lower than expected last Tuesday, and GoC bond yields initially plunged in response. But then the gravitational pull of US Treasury yields, which moved higher last week, re-asserted itself. By close of business on Friday, the five-year GoC bond yield finished the week a little higher than where it started.

The Bottom Line: The Canadian inflation data for January came in lower than expected last Tuesday, and GoC bond yields initially plunged in response. But then the gravitational pull of US Treasury yields, which moved higher last week, re-asserted itself. By close of business on Friday, the five-year GoC bond yield finished the week a little higher than where it started.

If US bond-market investors continue to pile back on to the higher-for-longer bandwagon, GoC bond yields, and therefore our fixed mortgage rates, are likely to be pulled higher over the near term, even as the Canadian data imply that they should be moving lower.

In contrast, our variable mortgage rates will mirror much more closely our own domestic economic trajectory. As such, they seem much more likely to start moving lower in the coming months.