Five Mortgage Highlights from the Bank of Canada’s Latest Update

April 15, 2024Canadian Variable Mortgage Rates Should Fall Soon, But Fixed Mortgage Rates Are Headed the Other Way

April 29, 2024

Last week Statistics Canada confirmed that our overall Consumer Price Index (CPI) increased from 2.8% in February to 2.9% in March on a year-over-year (YoY) basis, broadly in line with the consensus forecast.

The average of the Bank’s key measures of core inflation, CPI-median and CPI-trim, decreased from 3.1% in February to 3.0% in March (YoY). This was encouraging news because at its policy-rate meeting earlier this month, the Bank of Canada (BoC) said that it required further confirmation that the recent decrease in its core inflation measures was “not just a temporary dip”.

Gasoline prices contributed the most to last month’s overall CPI increase, driven 4.5% (YoY) higher in March by a combination of heightened geopolitical uncertainty and strategic production cuts by OPEC.

Shelter costs also continued to contribute significantly to our current inflation pressure. Within that component:

- Shelter prices rose by another 6.5% in March (YoY), the same as in February.

- Mortgage interest costs rose by 25.4% (YoY) in March, following a 26.3% increase in February.

- Rent prices increased by 8.5% in March (YoY), a further acceleration from an 8.2% increase in February.

If we back out shelter costs, our overall CPI increased by only 1.5% in March (YoY). While citing that stat might be criticized as cherry picking, it is an important clarification because shelter costs will soon start falling.

Our mortgage rates have now stabilized at higher levels. That means the huge increases that drove the mortgage-interest cost component of our CPI higher will soon begin to age-out of the CPI data set (because it only counts price changes over the most recent twelve months).

The BoC also knows that mortgage interest costs will drop further when it starts to cut its policy rate.

Our federal government’s recently announced immigration caps will also kick in next year. That will help reduce demand for shelter and alleviate some of the pressure on rent prices.

Bond-market investors were encouraged by last week’s CPI data, and they responded by increasing the odds of a BoC rate cut in June to approximately 67%.

That said, the contrarian in me must add that our CPI still increased by 0.6% in March on a month-over-month basis, and Stats Can also noted that price growth was “broad-based”. The BoC is closely monitoring the CPI components that are increasing by more than 3%. Any broadening out of that category will be a significant concern.

Our federal government’s recently announced budget also had inflationary fingerprints all over it:

- The 2024 federal budget projects that tax increases will help to offset various spending increases, but higher tax rates don’t always result in higher tax revenues. History has shown that businesses and individuals tend to alter their plans to minimize their additional tax bill. If tax revenues increase by less than expected, our federal deficit will increase by more than the current $40 billion projection.

- BoC Deputy Governor Carolyn Rogers recently referred to our lagging productivity as “an emergency” and said that “it’s time to break the glass” to deal with it. Our low productivity rate reduces the speed at which our economy can grow before further inflation sets in, and it has been caused, in large part, by very weak business investment. Far from helping to address this emergency, our federal government’s decision to increase the capital gains tax for investors, entrepreneurs, and businesses will make that productivity glass even harder to break.

- Many of the federal government’s newly announced housing initiatives will help to increase supply in the long run and will eventually be deflationary. But, unavoidably, in the near term they will increase demand for resources and divert more capital into non-productive investment (houses).

- New demand-fueling housing measures, such as allowing extended amortizations on the insured mortgages available to first-time buyers who purchase new construction homes, will also lead to higher prices. They will enable some buyers to pay more, and the highest take-up rates will be in our hottest markets (Alberta, Quebec, and Atlantic Canada) where insured mortgages are more prevalent.

I’m no fan of the federal budget, but it may end up being an (unintentional) blessing in disguise.

Here’s why.

The US federal government is also spending at an unprecedented rate at this point in its economic and political cycles. It is running recession-level deficits at a time when the US economy is growing at a robust rate and the US labour market is still strong.

One could argue that our federal government is better off following the lead of their US counterparts. If the US federal government is willing to tolerate hotter inflation and to accept higher concomitant bond yields and mortgage rates as a result, following in their powerful wake may lead to less turbulence in the Great White North.

It’s true that a more austere approach by our federal government would help to slow our economic momentum and reduce inflation pressure. But if the BoC cuts its policy rate while the Fed stands pat, the Loonie will weaken against the Greenback and increase the price of everything we import from US markets, causing further inflation. At the same time, slower growth may not bring relief in the form of lower fixed mortgage rates because the Government of Canada (GoC) bond yields they are priced on move in lockstep with their US equivalents.

This could engender a scenario called stagflation, which occurs when flagging economic growth combines with high inflation and unemployment. (It is a central banker’s worst nightmare.)

The BoC is quick to remind Canadians that it conducts its monetary policy independently of what other countries do. That is technically true, but there is no denying the US economy’s gravitational pull. If their federal government is going to leave the punch bowl out, that limits our options and means we might actually be better off to keep our own spending party going as well.

Mortgage Selection Advice

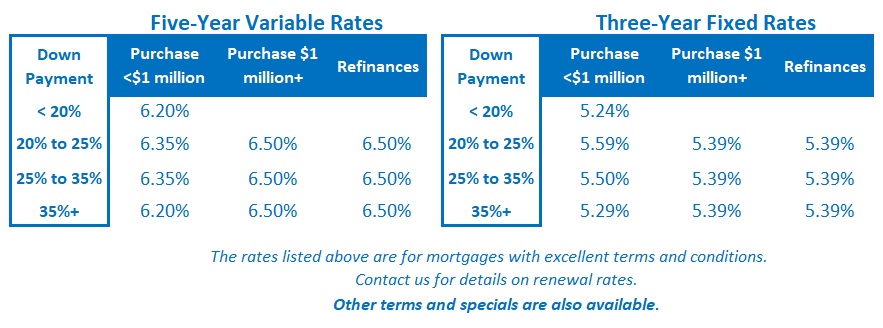

If you’re a conservative borrower concerned that stickier-than-expected inflation will continue to keep rates elevated, I think terms in the three-year range are still the best choice among today’s available fixed-rate options. The premiums required for one- and two-year fixed rates remain substantial. While five-year fixed-rate terms come with today’s lowest rates, I worry that five years is too long to be locking in when rates are still near their highest levels in more than three decades.

Alternatively, if you’re willing to pay an upfront rate premium and can tolerate a higher-risk option, variable rates are also worth considering. While we can never be certain how things will play out, and there is a risk that the BoC’s first rate cut may take longer than expected to materialize, I think the Bank will cut its policy rate substantially during the next phase of its policy-rate cycle. The Bottom Line: GoC bond yields dropped early last week after the release of our softer-then-expected inflation data. But true to form, they then retraced their steps and were pulled higher by their US equivalents.

The Bottom Line: GoC bond yields dropped early last week after the release of our softer-then-expected inflation data. But true to form, they then retraced their steps and were pulled higher by their US equivalents.

Lenders continued to raise their fixed rates last week. That process is likely to continue in the days ahead as fixed rates settle into a new, higher range.

Variable-rate discounts were unchanged.

The consensus now expects the first BoC rate cut in June, but the broadening out of price pressures will concern the Bank. The federal government’s just-released budget isn’t going help on the inflation front either (even if it ends up reducing near-term economic turbulence because it follows the US federal government down its profligate path).