As Canadian GDP Growth Slows, Will U.S. Economic Momentum Save the Day?

April 2, 2018Five Key Questions For This Week’s Bank of Canada Meeting

April 16, 2018 Last Friday Statistics Canada released our latest employment report, for March. It estimated that our economy added 32,300 new jobs last month, which was well above the consensus estimate of 20,000.

Last Friday Statistics Canada released our latest employment report, for March. It estimated that our economy added 32,300 new jobs last month, which was well above the consensus estimate of 20,000.

While the headline result came as a surprise, the much bigger surprise, at least to me, was the bond market’s reaction.

Over the past year, bond-market investors have become increasingly confident that our job market’s momentum will compel the Bank of Canada (BoC) to raise its overnight rate. This view was maintained even after our economy lost 88,000 jobs in January, reversing much of the late surge that we saw at the end of 2017. Only two weeks ago our bond futures market was assigning an 80% probability that the BoC would raise its policy rate in May, despite cautious recent commentary from the Bank itself.

Against that backdrop, when I read that our economy added 32,300 new jobs last month, I expected to see the five-year Government of Canada (GoC) bond yield surging higher in response. But when I clicked over to check, it wasn’t following suit.

To my surprise, the five-year GoC bond yield closed lower for the day on Friday, and at the same time the bond-futures market had dropped the probability of a BoC rate rise in May to 40%.

What had caused bond-market investors, who are known to shoot first and ask questions later, to react bearishly to such a bullish headline?

To answer that question, let’s start with a look at the good news that they essentially overlooked in the latest employment data:

- Our economy added an estimated 32,300 new jobs last month, while the unemployment rate held steady at 5.8%.

- All of the gains were in full-time employment, which added 68,300 new jobs in March, while part-time employment shed 35,900 jobs.

- Average wage growth held steady at 3.1%, maintaining the impressive income gains that we have seen over the past eight months.

Now let’s look at the details that appear to have tempered the bond market’s usual knee-jerk reaction:

- The private sector lost 7,000 jobs in March, and it has now shed almost 70,000 jobs since the start of the year. The public sector added 19,600 new jobs last month while self-employment grew by 19,800. Surges in self-employment are treated with caution because growth in this sector can mask a rise in workers who are actually unemployed.

- Manufacturing employment, which leads to job creation across the broader economy and correlates with overall business investment, fell by 8,300 jobs in March after declining in February as well.

- The biggest surge in job growth came from the construction sector, and that momentum is now in question against a backdrop of slowing real-estate momentum in our largest regional markets.

- Average hours worked were flat in March and that correlates with other recent data that show our overall economic momentum slowing of late.

- While wage growth of 3.1% last month compares favourably to our average over the past twelve months, that number is being temporarily inflated by recent minimum wage hikes in Ontario and British Columbia, and in light of that, the consensus had actually predicted that we would see 3.4% wage growth in March.

- Our participation rate, which measures the percentage of working-age Canadians who are either employed or actively looking for work, held steady at 65.5% last month. If we can add 32,300 new jobs in a month with no change in our participation rate, this supports BoC Governor Poloz’s recently stated belief that our economy “is carrying untapped potential that could prolong the expansion without causing inflation pressures”.

Putting the less-than-rosy details of the latest employment report aside, I was still surprised by the bond market’s reaction to our latest headline employment data.

Could it be that the consensus view that bond rates, and, by association, mortgage rates, are going to rip higher in 2018 is changing? Is the BoC’s clearly communicated uncertainty around the impacts of its already enacted rate hikes, the recent mortgage rule changes, and our ongoing trade negotiations with the U.S. finally tempering the prevailing bullish view of the BoC’s future rake hike plans?

In the words of the famous Magic Eight ball: “All signs point to yes”.

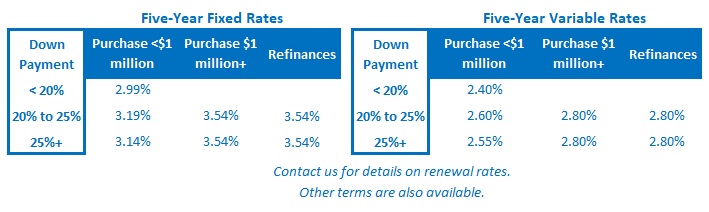

The Bottom Line: The bond market’s reaction to our latest employment report suggests that the consensus is becoming more cautious in its forecasts for Canadian interest rates in 2018. If that shift proves prescient, then by association, both our fixed and variable mortgage rates will remain at or near their current levels for longer than many, until very recently, had feared.