What the Bank of Canada’s Latest Economic Assessment Means for Our Mortgage Rates

December 7, 2015Why the U.S. Federal Reserve’s Rate Hike Might Push Canadian Fixed Mortgage Rates Higher

December 21, 2015 Last Friday our federal department of finance announced a change to the minimum down payment requirements for residential mortgages which will take effect on February 15, 2016.

Last Friday our federal department of finance announced a change to the minimum down payment requirements for residential mortgages which will take effect on February 15, 2016.

While it received far less media attention, the feds also announced an increase in the cost of funding mortgages through its National Housing Act Mortgage-Backed Securities (NHA MBS) program. This change could have a much greater impact on the broader mortgage market over time because it has the potential to raise costs for all lenders, and these costs are likely to be passed on to mortgage borrowers.

In fact, this may have happened already. I think the NHA MBS cost-increase announcement helps explain why lenders have raised their mortgage rates several times of late, despite the fact that bond yields have mostly been falling. Interestingly, while researching this post I learned that all federal regulated lending institutions recently received a letter from OSFI (our lending regulator) warning them that their funding costs were about to go up. This would appear to solve the mystery of what was driving those persistent rate hikes.

In today’s post I will explain last week’s changes in detail and offer my take on the implications for Canadian mortgage borrowers.

Changes to Minimum Down-Payment Requirements (starting on February 15, 2016)

First, a quick reminder. When a borrower is buying a property with a down payment of less than 20% of the purchase price, they are classified as “high-ratio” and are required to pay for insurance that protects the lender against loss if the borrower defaults on their loan. This insurance coverage comes with a one-time premium that can be added to the mortgage balance, and while this adds to the cost of the loan, this government-backed guarantee enhances the quality of these mortgages by greatly reducing their risk. This allows high-ratio borrowers access to the very best mortgage rates, rates that would not otherwise be available to those who make small down payments.

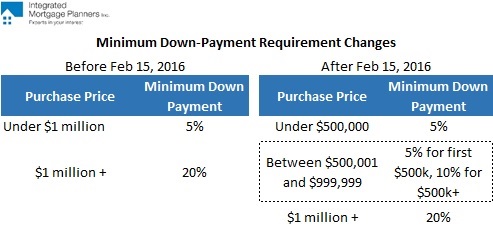

On February 15, 2016, minimum down-payment requirements will now be adjusted according to the price of the property you are buying:

- If you are paying $500,000 or less for a property, your minimum required down payment requirement will still be 5% of the purchase price.

- If you are paying between $500,001 and $999,999 for a property, your minimum required down payment will be calculated by taking 5% of the first $500,000 of the purchase price and adding 10% for any amount above that threshold.

- If you are paying $1,000,000 or more for a property, your minimum required down payment will be unchanged at 20% (or more, if your lender applies a sliding-scale policy for high-value properties).

Here is a table that summarizes this change:

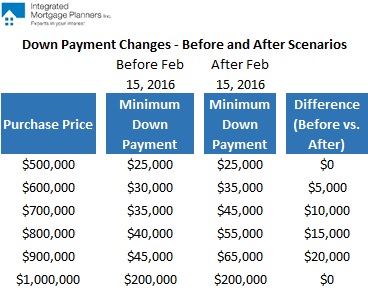

Here is another table that shows you some specific examples of how this change will be applied:

From my point of view, I think this change is a well-targeted modification to the minimum down-payment requirements for borrowers who require high-ratio mortgage insurance. Our regulators continue to try to identify the areas of greatest risk in our housing markets. Since high-ratio mortgages are no longer offered on properties with purchase prices of more than $1 million, focusing on down payments for properties with purchase prices between $500,001 and $999,9999 seems like the most logical and prudent area to focus on next.

This change is meant to target buyers in major urban centres like Toronto and Vancouver. While it is true that more vulnerable markets like Calgary will also be affected, this is a small, incremental change, which increases the equity requirement for a subset of borrowers who are among the riskiest group of those still eligible for high-ratio mortgage insurance.

Once again, our regulators have adapted their requirements to evolving market conditions using a scalpel instead of a sledgehammer, and as a real-estate market stakeholder, I applaud this change.

Changes to the Funding Cost of the NHA MBS and CMB Programs

The NHA MBS program was created to give lenders a very cost-effective way to securitize their mortgages, with the ultimate goal of lowering borrowing costs for Canadians.

This program has proven very effective, largely because it includes a bulk form of government-guaranteed default insurance, which gives NHA MBS investments a risk weighting that is almost the same as those assigned to Government of Canada (GOC) bonds. This guarantee has kept the yields on NHA MBS investments at ultra-low levels, and has minimized the amount of balance-sheet capital that lenders are required to set aside for them (at least for now).

Over time, this program grew increasingly popular, to the point where it began to crowd out alternative forms of mortgage securitization. Our regulators realized that if the NHA MBS program were allowed to grow unchecked, it would expose our government to enormous risk as the sole backer of residential mortgages in Canada. This would leave Canadian taxpayers vulnerable to significant real-estate losses (since taxpayers ultimately pay when government guarantees are called upon).

In addition to the existing caps on the maximum volume that individual lenders can securitize through the NHA MBS program, our regulators have now raised the cost of using this program by an additional twenty basis points when a lender’s annual NHA MBS fundings exceed $7.5 billion, as a way to discourage its “excessive use” and to make the cost of other, non-government guaranteed securitization vehicles more competitive (although the goal of the former seems far more realistic than the latter).

There is a companion program to the NHA MBS called the Canada Mortgage Bond (CMB) program, which converts the monthly cash flows of the NHA MBS into more typical bond-like payments, making them more appealing to a broader investor base. The costs of securitizing into the CMB program were lowered from forty basis points to thirty basis points last week, so this saving will partially offset the cost increases to the NHA MBS program.

Five-year GoC bond yields fell by eighteen basis points last week, closing at 0.74% on Friday. Five-year fixed-rate mortgages are available in the 2.54% to 2.69% range. Scotiabank did, however, raise to raise to 2.99% late last week, so if the market follows we could see another round of rate increases, despite plunging bond yields (strange as that may seem). Five-year pre-approval rates are being offered at 2.79%.

Five-year variable-rate mortgages are available in the prime minus 0.50% to prime minus 0.40% range, which translates into rates of 2.20% to 2.30% using today’s prime rate of 2.70%.

The Bottom Line: Our regulators continue to be cautious when making changes to the regulations and policies that govern our mortgage market. I think that the decision to increase the down-payment requirements for properties valued between $500,001 and $999,999 will prove to be a prudent one over time, as will the decision to increase the cost of providing a government guarantee for securitized residential mortgages. These are the sacrifices we must make if we are going to preserve the stability and underlying value of our real-estate markets.

On a separate note, now that the dust of the recent mortgage-rate increases has settled somewhat, I am offering a new Deal of the Week on a three-year fixed-rate mortgage at 2.24%, which you can learn more about by clicking on the link.

2 Comments

Does the gov’t really think these changes are going to effect the market in Vancouver and to a lesser extent Toronto,ie the foreign buyer.

I don’t think so. Time will tell but maybe when more changes are required they will look at countries like New Zealand and take a page from there book as to how to slow the market down.

That means higher taxes for their purchase.

Hi Ralph,

That is certainly their hope.

For my part, I think their gradual approach thus far has been appropriate.

Best,

Dave