Inflation on the Brain

May 24, 2022How Much Higher Will the Bank of Canada Go?

June 6, 2022I was away this weekend so there won’t be a new post this week, but I’ll be back next Monday as usual.

In the meantime, here are links to five recent posts to get you caught up on all the mortgage news that has been fit to print lately:

- Inflation on the Brain – Canadian inflation surged higher in April, and in this post I offer my take on what the Bank of Canada is (and isn’t) likely to do about it.

- US Inflation Falls In April (Sort of) – In this post I explain why the April drop in US headline inflation came with some important caveats that caused the market to temper its reaction.

- Fixed vs Variable: Which One Is Now the Better Bet? – This post offers my latest take on the question every borrower loves to ask.

- Five Thoughts on Last Week’s Mortgage-Related News – This post covers the latest Canadian and US employment data, current recession odds, and the Fed’s most recent rate hike, and it offers my take on what all these factors may mean for Canadian mortgage rates going forward.

- How the 2022 Federal Budget Will Impact Our Real-Estate Markets – Our federal government touted a lot of key initiatives to address our housing affordability crisis. In this post I offer my take (and explain why most of them were all hat and no cattle).

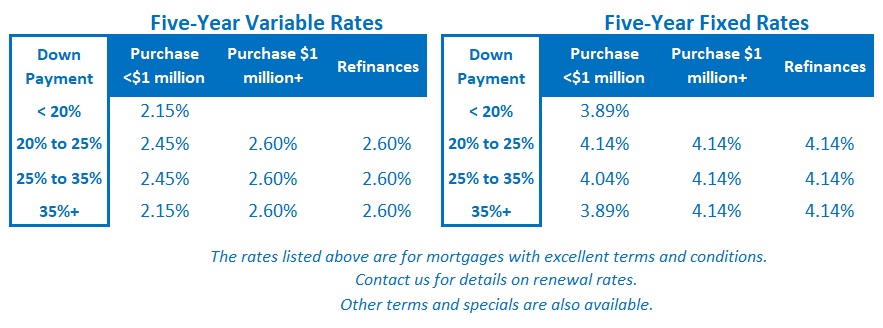

The Bottom Line: Five-year year fixed and variable rates held steady last week. The heightened risk premiums that have pushed both higher of late now appear to be fully priced in.

The Bank of Canada is almost universally expected to raise its policy rate by 0.50% when it meets this week, and that means variable mortgage rates will rise by the same amount shortly thereafter.

The Government of Canada bond yields that our fixed mortgage rates are priced on may also move in response to surprises in the Bank’s accompanying policy statement, but I don’t expect that will be the case.