Why Our Inflation Uptick Is Unlikely to Deter the Bank of Canada’s Rate Cut Plans

November 25, 2024Last Week’s Surprising Bond-Market Moves Are Good News for Canadian Mortgage Rates

December 9, 2024 Last Friday Statistics Canada confirmed that our GDP increased by only 1% quarter-over-quarter (QoQ) in Q3, down from 2.2% in Q2.

Last Friday Statistics Canada confirmed that our GDP increased by only 1% quarter-over-quarter (QoQ) in Q3, down from 2.2% in Q2.

That unspectacular result was in line with the consensus estimate. But it fell well short of the Bank of Canada’s (BoC) forecast of 1.5% growth in its October Monetary Policy Report (MPR), which it had already reduced from 2.8% in its July MPR.

The Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, fell sharply in response The bond-futures market raised its bet on the probability of a 0.50% rate cut by the BoC at its next meeting on December 11 to about 50%.

A closer look at the GDP data explains the bond market’s reaction:

- Our headline GDP increased only because of immigration. On a per capita basis, our GDP declined by 0.4% in Q3, its sixth consecutive quarterly decline. Economists haven’t officially labelled our current economic situation a recession, but if it looks and feels like a recession to the average Canadian, do we really care what label they use?

- Government spending increased by another 4.8% (QoQ) in Q3, and according to Stats Can “spending across all levels of government increased”. Increased government spending isn’t a sustainable way to grow an economy (and Lord knows we’ve tried).

- Business spending decreased by 3.6% QoQ. That’s concerning for a country in the middle of a productivity crisis. Is anyone surprised that businesses are less willing to increase investment in capacity expansion and productivity enhancements with so much uncertainty surrounding trade and our overall economic conditions?

- Our export sales fell by another 0.3% in Q3 after declining by 1.4% in Q2, despite the Loonie being the weakest it has been against the Greenback since May 2020.

- Stats Can also provided an initial estimate that our GDP increased by a paltry 0.1% month-over-month in October, which means there is little economic momentum being handed off to Q4. (GDP estimates occur with a lag because it takes time to compile the data.) If the BoC wants to skate where the puck is going, it might be time to start skating backwards.

While I think the latest GDP report was full of concerning trends that should have the BoC hustling to reduce its policy rate well below its current level of 3.75%, I should also highlight some positive aspects of our latest GDP data.

Consumer spending increased and residential investment showed signs of life in Q3, giving hope that the most interest-rate sensitive parts of our economy are responding to the rate cuts already made by the BoC.

That said, if our employment market softens, and I think that will be the next shoe to drop, those positive trends won’t last.

There were also some positive revisions made to our previous GDP data going all the way back to 2021, indicating that our economic momentum has been stronger than previously estimated. But our GDP per capita has still declined for six straight quarters, so “less bad” shouldn’t be mistaken for “good”.

Furthermore, if our past GDP growth rates were actually higher, that means the drop in our current GDP growth rate is even sharper – and our current momentum is most indicative of where our economy is headed next.

This Friday’s employment report will be the last key release before the BoC’s next policy-rate meeting. If we see signs that less confident businesses have curtailed their hiring, bond-market investors will continue to increase their bets on another 0.50% cut by the BoC next week.

Note: If you are in the market for a mortgage today and want my take on the best options currently available, check out the section in my blog post from last Monday labelled Mortgage Advice For Now.) The Bottom Line: GoC bond yields declined sharply last week, with much of that drop occurring on Friday after Stats Can’s release of our latest GDP data.

The Bottom Line: GoC bond yields declined sharply last week, with much of that drop occurring on Friday after Stats Can’s release of our latest GDP data.

Somewhat counter-intuitively, as that was happening, lenders were concluding a round of increases to their fixed mortgage rates in response to the previous bond-yield run-up.

If our bond yields hold at their current levels or decline further, lenders may quickly unwind their latest fixed rate increases. That outcome is far from certain.

While our American neighbours were enjoying their turkeys last week, US financial markets were quiet. The latest US employment data will be released this Friday. If that report becomes a catalyst for the next move in US Treasuries, our GOC bond yields are likely to be pulled in the same direction.

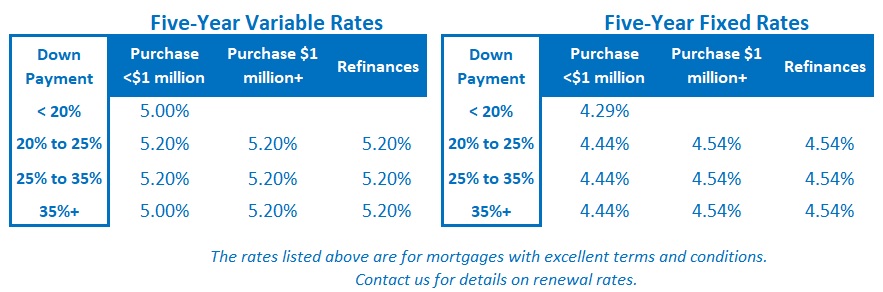

Variable-rate mortgage discounts decreased a little last week.

With the next BoC rate cut almost universally expected on December 11, variable mortgage rates should continue to move lower in the very near future.