Canadian Variable Mortgage Rates Should Fall Soon, But Fixed Mortgage Rates Are Headed the Other Way

April 29, 2024Was Our Latest Employment Data Just Sound and Fury?

May 13, 2024 Bond yields finally broke lower last week, and that has relieved some of the pressure on our fixed- mortgage rates.

Bond yields finally broke lower last week, and that has relieved some of the pressure on our fixed- mortgage rates.

The US Federal Reserve provided the catalyst.

It held its policy rate steady again last Wednesday. Much to the relief of bond-market investors, Fed Chair Jerome Powell’s comments also assuaged rate-hike concerns.

The US economy has defied expectations thus far in 2024.

The consensus narrative at the start of the year was that the US economy would slow to stall speed, that US inflation would continue to cool, and that the Fed would be compelled to substantially cut its policy rate in response.

But that didn’t happen. Not even close.

Thus far in 2024, each new piece of US economic data has shown surprising strength. Not surprisingly, US inflation has also swung higher.

At the start the year, the US bond-futures market was pricing in six cuts of 0.25% by the Fed in 2024, but those bets have been steadily pared back. US bond-market investors now expect only one Fed cut this year, although there had even been some speculation that the Fed might resume hiking to tamp down rising inflationary pressures.

Bond markets are forward looking so bond yields adjust when expectations shift. Last week US Treasury yields fell when the Fed’s communications were less hawkish than feared/expected. (As is typically the case, Government of Canada (GoC) bond yields were pulled lower by their US equivalents.)

Here are some of the key areas in the Fed’s latest policy statement and Fed Chair Powell’s accompanying press-conference commentary that bond-market investors keyed on:

- In its previous statement, the Fed observed that the risks to achieving its dual inflation and employment objectives were “moving into better balance”. This time around, it assessed that those risks have now “moved toward better balance”. That confirms progress at the margin.

- Powell said that “our policy rate is likely at its peak” and “it’s unlikely the next move will be a hike”. He further clarified that “we’d need to see persuasive evidence our policy stance is not sufficiently restrictive” and “we’re not seeing that at present.” Clearly, and reassuringly, rate hikes aren’t in the Fed’s current plans.

- Powell confirmed the Fed’s assessment that the policy rate was sufficiently restrictive at its current level, and that the key question was how long it would need to remain at its current level (not whether it should be increased further).

- He also confirmed that “unexpected weakness in the labor market” could cause the Fed to move up its rate-reduction timetable.

On Friday, we learned that the US economy added 175,000 new jobs in April, well below the consensus forecast of 240,000. The US unemployment rate also increased from 3.8% to 3.9%, and US average hourly earnings growth slowed from 4.1% in March to 3.9% in April.

The bond market liked the softer-than-expected employment data, and, just like that, the bad-news-is-good-news zeitgeist has returned.

If the bond market wants bad news, I think it may soon get more of it than it has bargained for.

As I have noted in recent posts, the current US economic momentum is being underpinned by factors that are unsustainable.

For example, the US federal government is spending like a drunken sailor. Its current budget deficit is at a level typical of past recessions, not ongoing expansions like its economy is currently experiencing. Further, US consumers have rapidly depleted their savings from the COVID period and are increasingly tapping into credit cards and lines of credit to make ends meet.

At least for the time being, a less hawkish Fed stance has provided welcome relief for bond yields and therefore our fixed mortgage rates. It has also provided more leeway for the Bank of Canada (BoC) to start cutting its policy rate soon, because it narrows the expected gap between our two monetary-policy trajectories.  The Bottom Line: GoC bond yields followed their US Treasury equivalents lower last week. (To wit, the five-year BoC yield dropped by 0.18%, marking its sharpest weekly decline in months.)

The Bottom Line: GoC bond yields followed their US Treasury equivalents lower last week. (To wit, the five-year BoC yield dropped by 0.18%, marking its sharpest weekly decline in months.)

Prior to last week, gross-lending spreads were tighter than normal, and a round of fixed-rate increases was expected. At the very least, lower GoC bond yields should staunch any additional rise in fixed-mortgage rates over the near term. This Friday’s employment report will probably determine what happens after that.

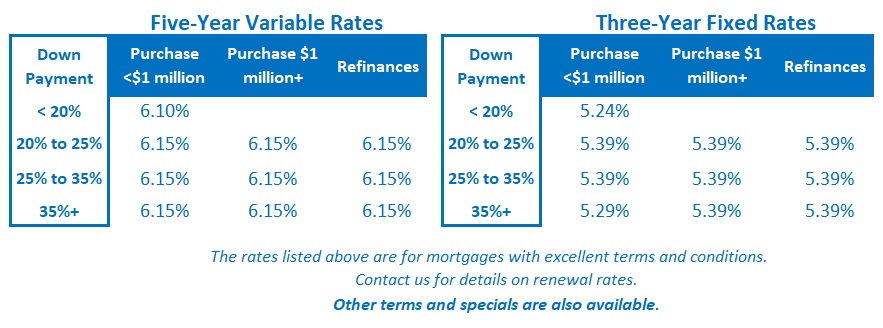

Variable-rate discounts have continued to widen. The gap between three-year fixed rates and five-year variable rates has narrowed from about 1% to about 0.65%. That reduced premium increases the appeal of variable-rate options.

Last week’s dovish Fed announcement also helped to bolster the bond market’s belief that the BoC’s first rate cut will occur at its next meeting on June 5.