Why We Shouldn’t Over-React to the Bank of Canada’s Rate-Hike Pause

January 30, 2023Canadian Hiring Surge Undermines Rate-Cut Bets

February 13, 2023 The US Federal Reserve raised its policy rate by another 0.25% up to a target range of 4.50% to 4.75%.

The US Federal Reserve raised its policy rate by another 0.25% up to a target range of 4.50% to 4.75%.

Anyone keeping an eye on Canadian mortgage rates should pay close attention to US rate news. Our Government of Canada (GoC) bond yields tend to move in lockstep with their US treasury equivalents. A divergence in our monetary-policy rates, which is occurring now, can impact our economy in myriad ways.

The Fed’s official statement didn’t provide many hints about its future policy-rate path, but US Fed Chair Jerome Powell offered plenty of insight in his accompanying press conference. Here are some of his most notable comments:

Restoring price stability will likely require maintaining a restrictive stance for some time.We believe ongoing rate hikes will be appropriate to attain a sufficiently restrictive stance of policy to bring inflation back down to 2 percent.Despite the slowdown in growth, the labor market remains extremely tight, with the unemployment rate at a 50-year low, job vacancies still very high, and wage growth elevated.

While recent [inflation] developments are encouraging, we will need substantially more evidence to be confident that inflation is on a sustained downward path.

We see ourselves as having a lot of work left to do … we have to complete the job, you know, that’s what we’re here for.

I’m not going to try to persuade people to have a different forecast, but our forecast is that it will take some time and some patience and that we’ll need to keep rates higher for longer.

While most of Powell’s comments espoused a higher-for-longer rate view, investors keyed in on two of his comments relating to inflation:

The inflation data received over the past three months show a welcome reduction in the monthly pace of increases. We can now say, I think, for the first time that the disinflationary process has started.

Those comments led many market watchers to interpret the Fed’s latest move as a dovish hike.

The bond futures market was already betting on two Fed rate cuts by the end of this year, and the market increased those odds after the Fed’s meeting. The futures market now expects the Fed to drop its policy rate by 2% by the end of 2024. (For comparison, thus far the futures market is pricing in at least one Bank of Canada rate cut later this year and additional cuts in 2024.)

Bond-market investors just aren’t buying the Fed’s current guidance (or the BoC’s for that matter). Instead, they think inflation will fall faster than expected and our central bankers will be cutting sooner.

That view took a hit on Friday when we learned that the US economy added an estimated 517,000 new jobs in January. That blockbuster headline was much higher than the consensus forecast of 188,000 and was more than double the December total. (The previous estimates for US employment changes in November and December were also revised upwards by another 71,000 jobs.)

The latest US employment data confirmed that unemployment fell, the participation rate rose, and average hours worked increased. Those signs of robust employment momentum were partially offset by news that average US wage growth declined from 4.8% in December to 4.4% in January on a year-over-year basis. But the US economy also had an estimated 11 million unfilled job openings in January. Against that backdrop, any further material softening in average US wages over the near term seems most unlikely.

The tug of war between the forecasts of the bond market and those of the Fed will play out in the months ahead. While the bond market has a history of predicting where rates are headed more accurately than the Fed (and the BoC), I think the current data increase the likelihood that central bankers will follow through on their higher-for-longer policy-rate plans.

The US and Canadian economies still have more momentum than expected, and many of the recent data continue to surprise to the high side. Also, as I wrote in last week’s post, I continue to believe that central bankers will err on the side of overtightening, given their recent mistake of waiting too long before starting to hike at the end of the pandemic. They remember that their predecessors started cutting too soon in the early 1980s, causing inflation to reignite and peak at an even higher level during a second surge.

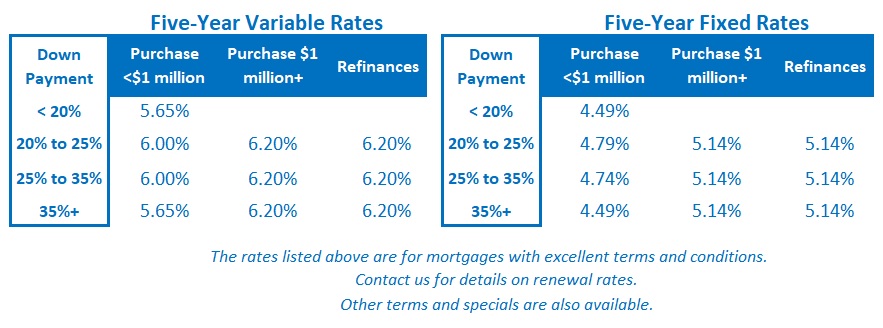

If you are in the market for a mortgage today, it is important to note that US bond yields and their Canadian equivalents, which our fixed mortgage rates are priced on, have fallen lately on the belief that the Fed and BoC will start cutting later this year. If the market starts to believe the central banker’s warnings that they expect to keep their policy rates higher for longer, bond yields will adjust upwards. Today’s fixed mortgage rates will rise as well.

That’s also an important point for any variable-rate borrowers who want to convert to a fixed rate but are holding out in the hope that fixed rates will keep falling. I think those fixed rates are more likely to rise in the near term as central bankers bring investors around to their higher-for-longer view.

If you choose a variable rate today, you’ll be paying an initial premium over the available fixed-rate equivalents hoping that the bond market’s expectations will prove more accurate. If you choose a fixed rate, you’re making a more conservative choice – one that I think is underpriced in the short term because today’s bond-yield pricing is getting ahead of itself.

I think today’s three-year fixed rates offer the best combination of near-term protection and competitive pricing. Three years should be plenty of time for our central bankers to wrestle inflation down to target, and three-year fixed rates don’t come with the significant premium that you would otherwise have to pay for one- or two-year fixed-rate alternatives.

Investors may be clinging to the belief that the Fed and the BoC have their back (as they used to). I don’t think that will be the case this time. The path of inflation will dictate our central banker’s next moves. Stronger-than-expected economic momentum on both sides of the 49th parallel leads me to believe that it will take longer to return to target than the consensus is currently pricing in. The Bottom Line: GoC bond yields finished flat last week, but that result was the culmination of a drop early in the week and a spike up on Friday after the US employment report for January was released. As such, the near-term indicator for our bond yields, and therefore our fixed mortgage rates, is pointing up.

The Bottom Line: GoC bond yields finished flat last week, but that result was the culmination of a drop early in the week and a spike up on Friday after the US employment report for January was released. As such, the near-term indicator for our bond yields, and therefore our fixed mortgage rates, is pointing up.

Variable-rate discounts were unchanged last week and all lenders have adjusted their prime rates to reflect the BoC’s recent 0.25% increase. The bond futures market expects the BoC to start cutting later this year. If you believe what the BoC and the Fed are currently telling us (and I do), it will take longer than the consensus expects for variable-rate reductions to materialize.