Not All Variable-Rate Mortgage Contracts Are Created Equal

May 28, 2018Will More Job Losses Delay the Bank of Canada’s Next Interest Rate-Hike?

June 11, 2018 The Bank of Canada (BoC) held its policy rate steady last week but warned in its accompanying statement that our next rate hike is not far off.

The Bank of Canada (BoC) held its policy rate steady last week but warned in its accompanying statement that our next rate hike is not far off.

The futures market is now pricing in about 80% odds that the BoC will increase its overnight rate by 0.25% at its next meeting on July 11. Variable-rate mortgages are priced off of the overnight rate, so if that happens, our variable rates will increase by the same amount.

In today’s post I’ll provide highlights from the BoC’s latest statement with my related comments in italics, and then offer my take on how this latest news impacts the appeal of the variable-rate mortgage option.

Highlights from the BoC’s Latest Statement

- The BoC assessed that global economic activity is “on track” with its latest forecasts and that “recent data point to some upside to the outlook for the U.S. economy.” Despite the recent data, I remain sceptical about the recent pickup in the U.S. economy. I see a short-term sugar high that has been fuelled by ill-advised tax cuts, stimulus spending that the U.S. federal government can’t afford, and by a sharp, short-term rise in U.S. consumer borrowing in late 2017.

- The Bank acknowledged that “uncertainty about trade policies is dampening global business investment.” And that was the BoC’s view before the U.S. announced last Friday that it was imposing tariffs on steel and aluminum imports from Canada, Mexico and the European Union, and before all three counterparties predictably said that they would respond in kind.

- Canadian inflation is “likely to be a bit higher in the near term” but it attributed most of this uptick to higher gas prices which it said it will “look through”. The BoC still doesn’t sound overly concerned about inflationary pressures when referencing them directly, but it clearly feels that it must continue to raise its overnight rate to stay out in front of them.

- The BoC reiterated its belief that our economy will grow by an average of 2% over the first half of 2018, and predicted that first quarter growth would prove “a little stronger than projected”. Surprisingly the BoC’s hopes for stronger-than-expected first-quarter growth were quickly dashed when our latest GDP report was released on Thursday (weren’t they privy to an advanced copy?). That report confirmed first-quarter growth of 1.3%, which was bang on the BoC’s previous forecast but well short of the 1.8% stronger-than-expected growth the consensus had predicted.

- The Bank noted that our recent export data were “more robust than forecast”. While that “robust” momentum is encouraging, it is also still vulnerable to continued NAFTA uncertainty and, most recently, to the tariff war that the U.S. started on Friday.

- The BoC noted that housing resale activity “remained soft into the second quarter”, but expressed confidence that “solid labour income growth” would ensure that housing activity and consumption “contribute importantly to growth in 2018”. Strangely, in a speech given on the same day that the BoC’s policy statement was released, Bank of Canada deputy governor Sylvain Leduc acknowledged that when our economy has reached a similar stage during past cycles, “wage growth did not increase substantially”. In addition, although recent minimum wage increases have boosted our recent income growth, that impact is only temporary. The optimistic outlook for housing and consumption is an important, and in my opinion, highly uncertain part of the Bank’s forecast, especially until the full impact of the recent mortgage rule changes becomes clearer.

- The BoC made several notable changes in its key closing statement. It had previously noted that higher rates would be needed “over time” and that it would “remain cautious” when making future adjustments. This time, the Bank said that it will take a “gradual approach” to rate rises that are now “warranted to keep inflation near target”. Those key changes in wording alter the timetable for the BoC’s next rate rise from ‘down the road’ to ‘around the corner’.

Now that the BoC is signaling that its next policy-rate increase is imminent, what does this mean for variable-rate borrowers, especially those who have just recently taken advantage of this spring’s offerings from the variable-rate mortgage wars?

For starters, it should serve as a reminder that they traded knowing what their mortgage payment would be for the next five years in exchange for a lower rate at the outset of their term. Bluntly put, rate movements are the nature of the variable-rate mortgage beast.

After the BoC’s warning that another 0.25% rate hike is likely around the corner, the most important question is whether variable rates are still likely to save money over their fixed-rate equivalents over the next five years. I continue to believe they will for the following reasons:

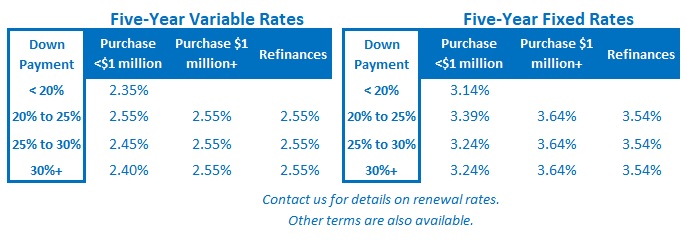

- Variable-rate borrowers who secured their financing over the last few weeks are starting with a rate of 2.45%, which gives them a buffer of about 1% over their fixed-rate alternatives. A 0.25% increase by the BoC erodes some of that margin, but still leaves them well ahead. The real risk lies in the likelihood of steady, additional increases.

- Importantly, the BoC has repeatedly observed that our current elevated household debt levels make our economy more sensitive to rate rises than it has been in past cycles. In its latest statement the Bank emphasized that its actions would be guided by our “economy’s sensitivity to interest rate movements“ and it has previously estimated that it can take up to two years for the full impact of each rate increase to be realized. The combination of those factors makes it likely that any additional variable-rate rises should happen gradually, and as such, today’s variable-rate saving can be maintained (and banked) for some time yet.

- Trade uncertainty remains a very significant unknown that keeps the sand shifting under our economy’s feet, and last Friday’s tariff announcement by U.S. President Trump is a cautionary reminder to the Bank that discretion is still the better part of valour. I don’t think escalating trade tensions make it impossible for the BoC to raise its policy rate, but I do think it greatly reduces the odds of the Bank doing so rapidly.

- The BoC has repeatedly cited concerns over our exporters’ “competitiveness challenges”, a reference to the Loonie’s increased exchange-rate value. When the BoC raises its policy rate, the Loonie will appreciate further. And while corresponding U.S. Federal Reserve rate hikes may offset that direct impact in the U.S. market, the Loonie will still appreciate against a basket of other currencies that we compete with when exporting in to U.S. (See How the Loonie’s Value Is Likely to Impact Canadian Mortgage Rates for a more detailed explanation). These currency movements will intensify an already troublesome headwind for our exporters and that will tend to limit the extent to which the Bank can raise its rate.

- In the current context, we continue to focus on BoC rate rises but it bears repeating that over the last twenty-eight years there hasn’t been a single five-year period when the Bank didn’t lower its policy rate at least once. Additional BoC rate increases will slow our economy and exacerbate its vulnerabilities. In my view, the faster they occur the more quickly they will lead to the BoC’s next rate cut(s).

The Bottom Line: The BoC made clear its intention to raise its policy rate as early as its next meeting in July. While that won’t be welcome news for variable-rate borrowers, for the reasons outlined above, I continue to believe that today’s variable rates are likely to be less costly than today’s fixed rates over the next five years.