Why Today’s Job Losses Won’t Change the Bank of Canada’s Mind

August 8, 2023Canadian Inflation Rises. Will Mortgage Rates Follow?

August 21, 2023 The US headline Consumer Price Index (CPI) ticked higher last month, rising from 3.0% in June to 3.2% in July on an annualized basis.

The US headline Consumer Price Index (CPI) ticked higher last month, rising from 3.0% in June to 3.2% in July on an annualized basis.

That result was a little below the consensus forecast of 3.3%, and the US bond-futures market responded by lowering the odds of a Fed rate hike at its next meeting in September to 10%.

US Core CPI, which strips highly volatile food and energy prices, rose by only 0.2% on a month-over-month basis. That matched the June result and marked the smallest two-month increase in US Core CPI in more than two years. On an annualized basis, US Core CPI came in at 4.7% for July, down from 4.8% in June.

While bets on additional Fed rate hikes have been scaled back, most market watchers still don’t expect the Fed to start cutting its policy rate until the middle of 2024. US inflation is still well above the Fed’s 2% target, and most of its voting members maintain that there is plenty of work left before it returns to that level.

Right now, the Fed is keeping a keen eye on a measure of inflation called supercore, which strips out volatile food and energy prices, as well as shelter costs, which are measured in a way that under-weights recent price changes.

Supercore focuses instead on labour-intensive service-sector costs, which are closely tied to consumer demand and therefore should be more sensitive to the Fed’s policy-rate movements.

Supercore is estimated to have increased from 4.0% in June to 4.1% in July (annualized). That correlates with US wage growth, which is currently running at 4.8%. The Fed knows that overall inflation won’t return to its 2% target until labour costs, and supercore, cool considerably.

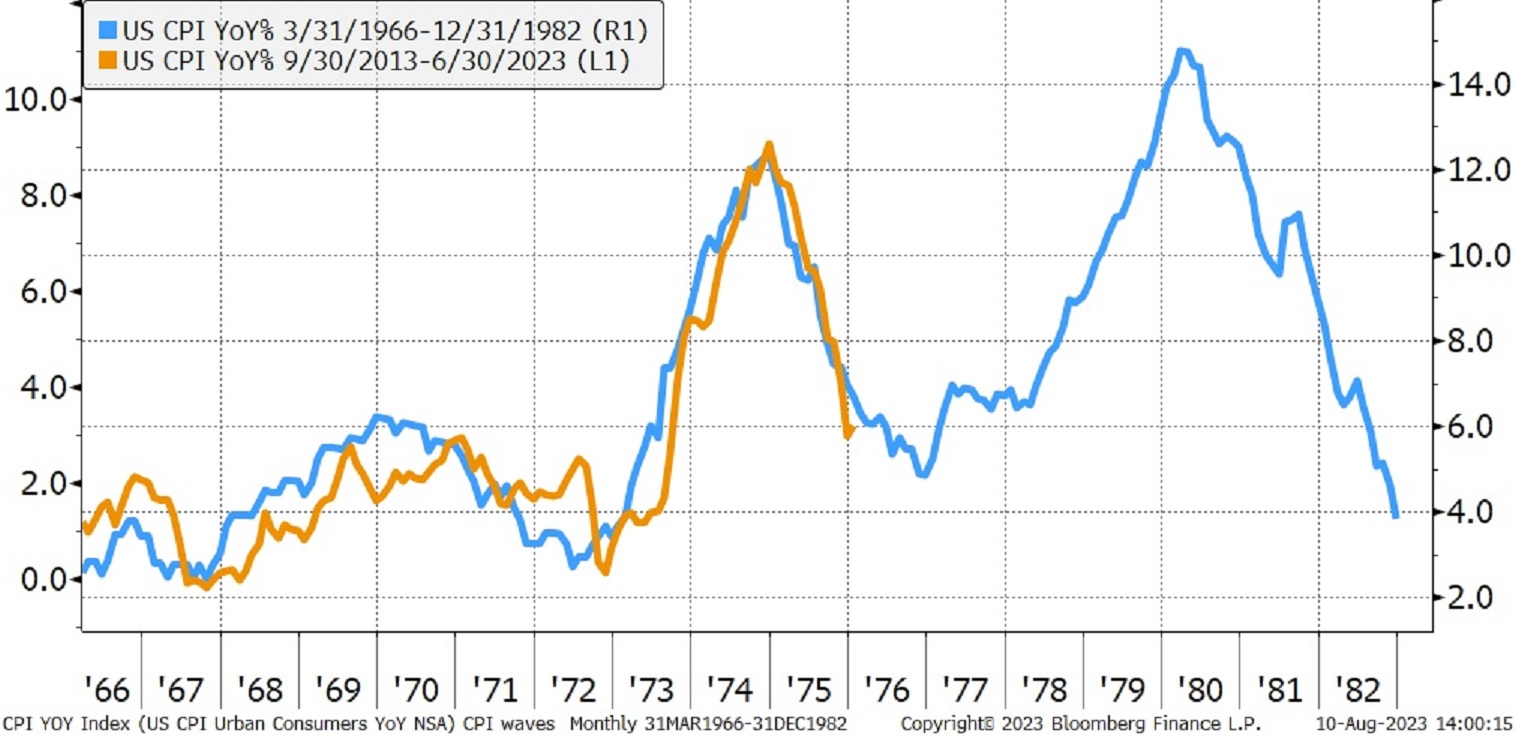

The upswing in last month’s US inflation data should also serve as a reminder that inflation tends to occur in waves. It will likely oscillate higher over the remainder of 2023 amid strong GDP growth, a tight labour market, and soaring US fiscal deficits. Against that backdrop, it is not unreasonable to believe that more Fed hikes may be required.

On a related note, here is a chart from Jeffery Kleintop, Chief Global Investment Strategist at Charles Schwab & Co, who last week tweeted out a reminder that while history doesn’t always repeat, it often rhymes. (The remarkedly similar two lines in the chart below represent the paths of US headline CPI during the 1970s and now.)

This Tuesday, Statistics Canada will release the Canadian inflation data for June. The consensus forecast is that it will increase from 2.8% in June to 3.1% in July (annualized).

That result will caution the Bank of Canada, Canadian bond-market investors, and anyone keeping an eye on Canadian mortgage rates that inflation may continue to be stickier than hoped.

The Bottom Line: The reprieve from rising bond-yields caused by the recent weaker-than-expected US and Canadian employment data didn’t last long.

Bond-market investors once again drove US yields higher last week and took their Canadian equivalents along for the ride.

This was likely a response to the US Treasury flooding the market with $103 billion worth of bonds just after the rating agency Fitch downgraded its US credit rating from AAA to AA+ due to “a steady deterioration in standards of governance”.

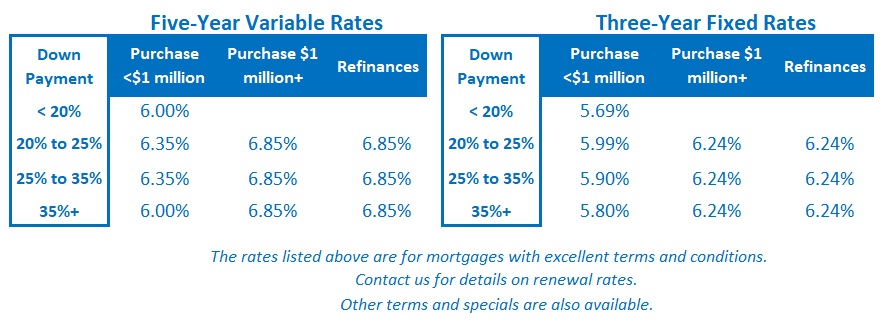

Lenders initiated another round of fixed-rate increases on Friday, and that will likely continue over the days ahead.

Variable-mortgage rate discounts were unchanged last week.

While many market watchers still expect that the Fed and the BoC will hold off on additional rate hikes for the remainder of this year, the recent resurgence of headline inflation on both sides of the border may confound those expectations.