Canadian Mortgage-Rate Advice: Trade War Edition

February 10, 2025Canadian Inflation Perks Up, But More Rate Cuts Should Still Be on the Way

February 24, 2025

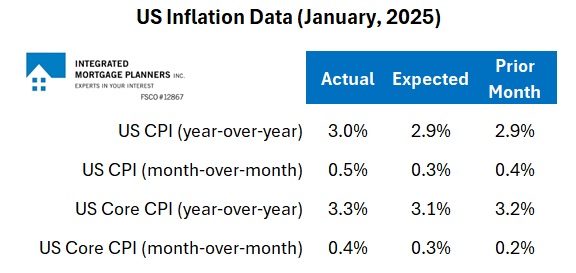

US inflation increased again in January, for the fourth consecutive month.

That continued rise in US prices occurred without any help from US President Trump’s recently announced tariffs, which won’t start to show up in the US inflation data until April.

Instead, the recent run of hotter-than-expected US inflation was caused by record deficit spending by the US federal government and by US consumer spending, which was propped up by the highest credit-card utilization rates in more than a decade.

Steadily rising inflation is an inconvenient truth for Trump because it will make it more difficult for him to sell the lie that his tariffs aren’t pushing up US prices. American consumers, who are already feeling the pinch, will be increasingly sensitive to each additional price uptick.

Here are the latest US Consumer Price Index (CPI) data with a few related observations:

- The US CPI month-over-month increase was the highest since August 2023.

- The US Core CPI month-over-month increase was the highest since March 2024.

- A recent University of Michigan survey confirmed that Americans now expect US inflation to average 4.3% in 2025, up from 3% expected at the end of 2024.

The US bond-futures market responded to the latest US inflation data by extending its bet on the US Federal Reserve’s next rate cut out to October.

It appears that the Fed is aligned with that expected timing. In his testimony to the US Senate Banking Committee last week, US Fed Chair Jerome Powell said that the Fed doesn’t “need to be in a hurry” to lower rates further.

The divergence between US and Canadian inflation rates continues to widen, and that has significant trade-war implications. Unlike the Fed, the Bank of Canada (BoC) won’t have to risk stoking inflationary pressures if it wants to cut its policy rate to help offset trade war headwinds.

Of course, that doesn’t change the reality that we rely on the US more than it relies on us. But it does mean that pain from this trade war will be felt on both sides of the 49th parallel.

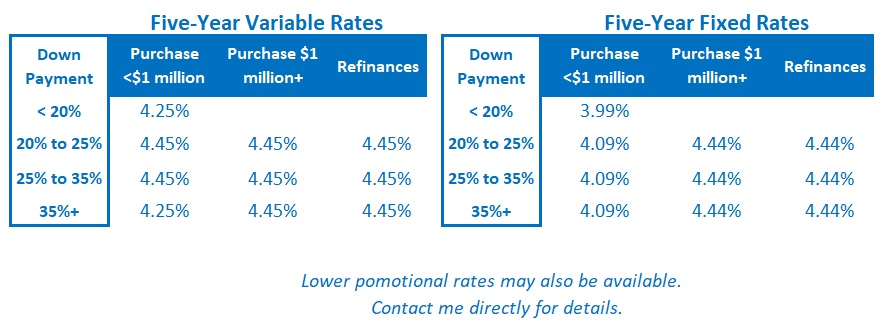

Note: If you are in the market for a mortgage today and want my take on the best options currently available, check out the section labelled Mortgage Selection Advice for Now in my blog post from last Monday. The Bottom Line: Government of Canada (GoC) bond yields were range bound last week. As expected, lenders have slowly begun to lower the fixed mortgage rates that are priced on those yields.

The Bottom Line: Government of Canada (GoC) bond yields were range bound last week. As expected, lenders have slowly begun to lower the fixed mortgage rates that are priced on those yields.

Variable mortgage-rate discounts were unchanged.

I continue to believe that there are more BoC rate cuts in store for variable-rate borrowers.

Unlike in the US, inflation in Canada has returned to its normal range. That gives the Bank flexibility to enact more rate cuts to offset trade war headwinds. I expect that it will continue to do just that over the near term.