Five Thoughts on Last Week’s Mortgage-Related News

May 9, 2022Inflation on the Brain

May 24, 2022Surging prices continue to dominate the headlines, but last week’s US inflation data offered the first glimmer of hope that inflation may finally have peaked.

The annual headline US Consumer Price Index (CPI) fell from 8.5% in March to 8.3% in April, and annual core US CPI, which strips out more volatile CPI inputs such as food and energy prices, dropped from 6.5% in March to 6.2% in April.

US inflation trends should provide some hint of what to expect when our own inflation data are released this Wednesday, but more importantly for readers of this blog, the US data will impact our bond yields and interest rates, which closely track their US equivalents.

Falling inflation is the kind of good news we’ve all been waiting for, but a closer look at the details should temper our enthusiasm. For example, the overall US Consumer Price Index (CPI) rose by only 0.3% in April on a month-over-month basis, after surging higher by 1.2% in March. That moderation is a welcome sign. But the less volatile core CPI rose by 0.6% month over month in April, which was a doubling from 0.3% in March.

Long story short, if core CPI is now rising faster than headline CPI, that means prices are now rising more quickly across a broader set of goods and services.

Here are some additional details worth noting from the latest US CPI data:

- Energy prices rose by 30.3% in April on an annualized basis, down from 32% in March. (Did you ever imagine that a 30% increase in energy prices would look good by comparison?)

- US food prices spiked by 9.4% in April, marking the biggest jump in more than 40 years. Those increases are popularly attributed to shortages caused by the war in Ukraine, but there is more to the story. The US is in the midst of an avian flu outbreak, which has spread to 32 states and has led to the culling of more than 28 million chickens and turkeys, causing egg and poultry prices to soar.

- US shelter costs, which make up about one-third of the US CPI index, continued to rise last month. US rents rose by 0.6% in April on a month-over-month basis, and the proxy used to estimate the cost to own a home also increased by 0.5%. On an annual basis, overall US shelter costs have now risen by 5.1%.

- Some of the sources of last month’s US price rises are expected to be temporary. Airfares surged higher by 18.6% in April, which marked the largest month-over-month increase since tracking began in 1963. That followed an increase of 10.7% in March, but some of this price spike has been attributed to a short-term surge in demand that is tied to pandemic re-openings.

- Real US wages fell by 2.6% in April on an annualized basis, and average inflation-adjusted wages decreased by 0.1%. Lower real wages will reduce spending (and demand) and, as such, will do some of the heavy lifting that would otherwise be left to Fed rate hikes.

If the points above aren’t filling you with confidence that inflation will continue to fall over the months ahead, consider that a technicality in the way the CPI is calculated will also help.

The CPI tracks price changes over the 12 prior months, and the price spikes, which really started to kick in at the start of last summer, will now form the baseline used for comparison.

Those higher starting points will mean that, going forward, prices will have to increase by even more to replicate the same percentage increases. Conversely, if prices continue to rise, but by less on a relative basis, the CPI will fall.

The consensus forecast assumes that these “base effects” will cause headline US CPI to drop into the 5% range over the second half of 2022. Beyond that, it will take heavy lifting by the Fed and other demand-reducing factors to further ease price pressures.

On that note, economist David Rosenberg recently estimated that fiscal stimulus from the US federal government added 5% to US GDP growth in 2021, whereas this year, fiscal contraction by the US federal government will be subtracting 2.8% by the fourth quarter of 2022. That big swing will have a substantial impact on consumer spending and overall demand.

The key question for readers of this blog is: How much higher will the Fed have to take its policy rate to bring inflation back to or near its 2% target?

The answer will come down to timing.

US GDP fell by 1.4% in Q1 2022. If the US economy continues to slow and if inflation and consumer expectations about future inflation moderate, the Fed will likely not have to tighten by as much as financial markets have currently priced in. But if US labour costs accelerate and inflation pressures continue to broaden, the Fed will likely have no choice but to crush demand with aggressive rate hikes (barring an end to Chinese lockdowns and/or peace in Ukraine).

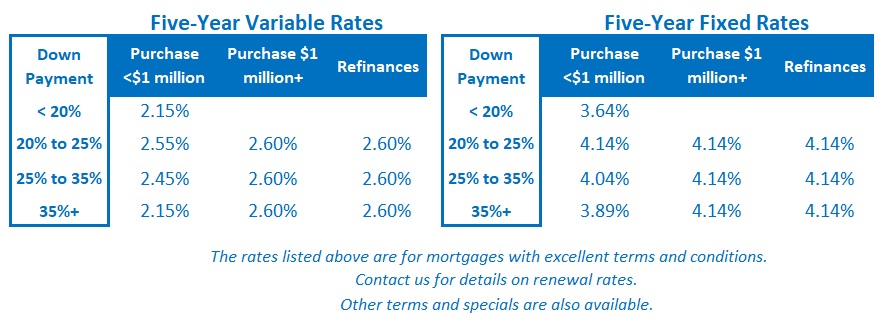

At this point the outcome remains uncertain, but it is worth remembering that financial markets tend to err on the aggressive side when forecasting Fed rate hikes and that those aggressive assumptions are already reflected in US bond yields (and the Canadian bond yields that move lockstep with their US equivalents). The Bottom Line: Five-year Government of Canada bond yields fell last week but the five-year fixed mortgage rates that are priced on them are still poised to move higher in response to increasing risk premiums. Expect hikes of another 0.10% to 0.15% early this week.

The Bottom Line: Five-year Government of Canada bond yields fell last week but the five-year fixed mortgage rates that are priced on them are still poised to move higher in response to increasing risk premiums. Expect hikes of another 0.10% to 0.15% early this week.

Five-year variable-rate discounts are also shrinking again for the same reason. Higher risk premiums increase lender funding costs, and lenders raise rates to pass those increases on to borrowers.

Over the near term, the momentum arrow for both fixed and variable rates is still pointing straight up.