Will Record Job Losses Lead to Negative Bond Yields?

May 11, 2020Why CMHC Shouldn’t Raise Its Minimum Down Payment from 5% to 10%

May 25, 2020I took the Victoria Day weekend off so there won’t be a new post this week. Instead, here are links to five of my most popular recent posts describing the unusual mortgage market we find ourselves in today and how best to navigate through it:

- Is now a good time to refinance your mortgage? This post shows you how to run the numbers.

- Debating between fixed and variable? This post explains why I think the five-year variable rate now looks like a slam dunk option for many borrowers.

- Wondering how mortgage lending will be change as a result of COVID-19? This post offers my take an includes tips for how to manage in the new lending environment.

- Thinking about applying for deferred mortgage payments? This post offers ten key points about deferred mortgage payment programs.

- Want to know more about the unprecedented steps our policy makers have taken to combat the negative impacts of COVID-19 and the oil-price crash on our credit markets? This post provides a detailed breakdown.

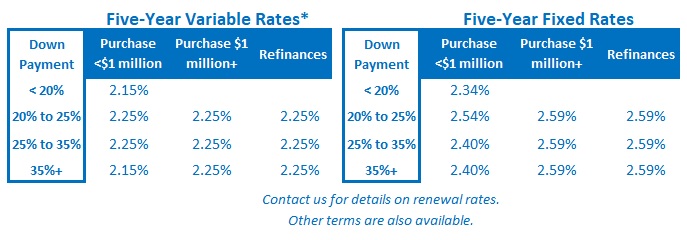

The Bottom Line: Five-year fixed rates dropped a little last week while five-year variable rates were unchanged. The drop in our five-year fixed rates was caused largely by a reduction in lender risk premiums this time, and not by a drop in the Government of Canada five-year bond yield that our fixed rates are priced on. This is a slow-moving trend that I expect will continue in the week ahead. See you next week.

I am an independent full-time mortgage broker and industry insider who helps Canadians from coast to coast. If you are purchasing, refinancing or renewing your mortgage, contact me or apply for a Mortgage Check-up to obtain the best available rates and terms.