Here Comes the Next Bank of Canada Rate Cut

March 10, 2025The US Federal Reserve Is as Uncertain as Everybody Else

March 24, 2025

The Bank of Canada (BoC) cut its policy rate by another 0.25% last week, as expected. Variable-rate mortgage borrowers will see their rates drop by the same amount in short order.

Its accompanying policy statement, and press-conference commentary offered a wistful look back at where we started the year and a sobering assessment of where our economy is likely headed if the US follows through on more of its trade-war threats.

Here are my five thoughts on the Bank’s latest communications:

- Our economic trajectory is changing rapidly.

The BoC noted that our economy ended 2024 “on a stronger footing than [they] expected” and started this year “with inflation close to the 2% target and robust GDP growth”.

The Bank’s substantial rate cuts helped to boost consumer spending and business investment, and our labour market was also showing encouraging progress. Job creation had finally started to outpace the expansion of our labour force. Despite that, there were also signs that wage growth was moderating from elevated levels.

But then US President Trump launched his trade war against Canada and declared his intent to weaken our country so he could annex it. That created an economic shock that is now reverberating.

The most immediate impact was a surge in demand as companies on both sides of the 49th parallel loaded up on materials that would become subject to tariffs, giving our economy a short-term boost. But now that tariffs are kicking in the negative impacts from the trade war are becoming increasingly apparent. The threat of a sharp slowdown looms.

- The BoC must now try to strike a difficult balance between two opposing forces.

The Bank expects the US trade conflict to both slow economic activity (via weaker demand) and to fuel higher prices (via the need for counter-tariffs and a weaker Loonie).

That is a central banker’s perfect storm.

Slower economic growth will call for looser monetary policy via more rate cuts. But increasing price pressures will call for tighter monetary policy, which would mean no further cuts in the short term, and possibility of rate hikes over the longer term.

The Bank must account for both countervailing forces when setting its policy-rate path.

BoC Governor Macklem has, quite rightly, called the current situation a crisis. For that reason, most market watchers (me included) expect the BoC to enact further near-term rate cuts to help buffer against the coming economic shock.

Having said that, last week the Bank also made sure to emphasize that it will do whatever is necessary to maintain price stability above all else, recognizing that fiscal policy can also play a major role in dampening the effects of a trade war.

- Inflation pressures are largely contained, for now, and the Bank will look through the coming CPI spike in March.

The BoC assessed that current inflation “remains close to the 2% target”.

The Bank observed that our January Consumer Price Index (CPI) was “slightly firmer than expected”, but it didn’t sound too concerned about the underlying causes.

It noted that although its preferred measures of core inflation remain above 2%, that was largely due to “the persistence of shelter price inflation”, which is a lagging indicator.

The main driver of shelter-price inflation has been mortgage-interest costs, which have been falling steadily. There is a lag in how those declining rates help to lower our CPI. In the meantime, our CPI ex-mortgage interest costs came in at just 1.5% in January.

The Bank is now forecasting that our Consumer Price Index (CPI) will rise to 2.5% in March. But it attributes that rise to the end of Prime Minister Trudeau’s brief GST/HST holiday, and as such, it will look through that coming spike.

- Consumers and businesses are both expecting more inflation ahead.

Last week, the BoC released the results from a special trade-conflict focused survey of business and consumer confidence that it recently conducted.

It concluded, not surprisingly, that “the pervasive uncertainty created by continuously changing US tariff threats has shaken business and consumer confidence”.

An increasing number of consumers are concerned about their job security. That is causing more of them to forgo or postpone major purchases to focus instead on increasing their savings. Businesses are also now more likely to scale back both their investment and hiring plans.

The survey also found that both consumers and businesses “expect prices to increase due to uncertainty about trade tensions”.

Thus far, only short-term inflation expectations have risen markedly. The Bank emphasised that “keeping medium- and longer-term inflation expectations well anchored” will remain its primary focus.

- Canadians shouldn’t assume that lower rates will boost house prices this time.

Canadians have come to expect that lower interest rates bring higher house prices. But if rates continue to fall from here, it will be against a weaker economic backdrop than we experienced during the last two periods when they dipped that low.

When our mortgage rates fell sharply in 2008, it was due primarily to the US financial crisis. Our economy largely avoided its negative effects.

When they dropped during COVID, it was in anticipation of a temporary but significant economic shock that never fully materialized. And most of the concomitant job losses were in lower paying jobs where home-ownership levels were low.

This time around, there likely will be a substantial economic shock. The bulk of the job losses will likely be in the higher-paying manufacturing jobs, where home-ownership levels are much higher.

To be clear, I’m not predicting that house prices will crash. That’s not my view. But I think anyone who is assuming that lower rates will cause prices to rise to the extent that they did in 2008 and 2020 is bound to be disappointed.

It’s different this time.

Mortgage Selection Advice for Now

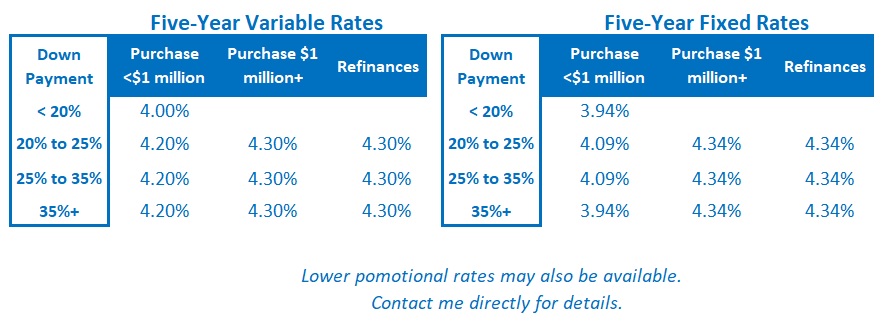

Today’s fixed and variable mortgage rates remain roughly equal.

If, as I expect, the BoC continues to cut its policy rate, variable rates will fall below any of the fixed-rate options that are now available.

That said, while I continue to expect variable rates to produce the lowest total borrowing cost over their typical five-year term, anyone considering a variable rate today must be willing and able to accept their inherent volatility risk.

For borrowers who prefer the certainty of a fixed rate, I think terms of between three and five years remain the best options.

The rates available within that range are below their long-term averages, and shorter one- and two-year fixed-rate terms are only available at much higher rates which I don’t think are worth paying. The Bottom Line: The GoC bond yields, which our fixed mortgage rates are priced on, moved a little higher last week (no doubt to the surprise of many mortgage borrowers).

The Bottom Line: The GoC bond yields, which our fixed mortgage rates are priced on, moved a little higher last week (no doubt to the surprise of many mortgage borrowers).

Bond-market investors had already priced in the BoC’s last rate cut. Their reaction post-meeting was based on the Bank’s hawkish warning in the closing paragraph of its policy statement that it “cannot offset the impacts of a trade war” and would focus instead on ensuring that “higher prices do not lead to ongoing inflation”.

For now, fixed rates remain range bound.

Variable-rate borrowers will see their rates drop by another 0.25% in short order, thanks to the BoC’s rate cut last week.

The BoC’s policy rate now stands at 2.75%, which is considered the mid-point of its neutral range. While the Bank isn’t making any promises about more cuts, I still expect it to lower its policy rate to a stimulative level (of 2.00%, or less) before all is said and done.