Thoughts on the Bank of Canada’s Latest Rate Cut

March 17, 2025Should Canadians Choose a Fixed or Variable Mortgage Rate During a Trade War?

March 31, 2025

Last week the US Federal Reserve left its policy rate unchanged, as expected.

The theme in the Fed’s accompanying communications was “uncertainty”.

Fed Chair Jerome Powell acknowledged that uncertainty around the Fed’s most recent forecasts is “remarkably high” as it tries to anticipate the impacts from President Trump’s radical policy changes in trade, immigration, regulation, and fiscal spending.

For now, the Fed is maintaining a wait-and-see approach.

It foresees less growth and more inflation over the near term. Its latest consensus forecast projects US GDP growth of 1.7% in 2025, down from 2.1% previously. It projects US core inflation at 2.8% this year, up from 2.5% previously.

The consensus forecast among Fed officials still anticipates two 0.25% cuts later in 2025, with two more in 2026 and one final cut in 2027. But there was a slightly more hawkish tilt at the margin. Four Fed officials now forecast no cuts in 2025. Only one Fed official had forecast no cuts previously.

At his accompanying press conference, Fed Chair Powell hedged his bets.

He said that the Fed could hold off on rate cuts “if the economy remains strong, and inflation does not continue to move sustainably toward 2%”, but that it would cut “if the labor market were to weaken unexpectedly, or inflation were to fall more quickly than anticipated”.

While there is nothing particularly revelatory in those statements, the fact that he feels the need to highlight two starkly different scenarios underscores the Fed’s uncertainty about where the US economy is headed.

When asked about the impact of tariffs, Fed Chair Powell predicted that they would be “transitory”.

Perhaps he should have checked his Thesaurus for a different word. The last time he described US inflation as “transitory” (during COVID) he then had to institute the Fed’s sharpest series of policy-rate hikes in more than 40 years to rein it in.

While it is possible that tariffs will have a transitory impact on inflation, their dampening effect on economic activity is much more likely to be sustained.

Consumers are already cutting back on spending. Businesses won’t be able to pass on tariff-related cost increases if their customers can’t afford higher prices.

When businesses raised prices during and after COVID, demand was sustained because consumers were able to tap into their accumulated savings, which they had plenty of at the time.

But the US saving rate is now only 4.6%, about half of its long-term average of 8.4%, which leaves US consumers with a much smaller buffer. And it doesn’t appear that any COVID-like fiscal stimulus from the US federal government will be forthcoming this time.

For those reasons, while the Fed was circumspect about where the US economy is headed, I think a downturn is now inevitable. Only its magnitude is yet to be determined. The Bottom Line: Last week, global bond yields continued their decline in the lead up to President Trump’s announcement of the next round of US tariffs on April 2, which he has been referring to as “the big one”.

The Bottom Line: Last week, global bond yields continued their decline in the lead up to President Trump’s announcement of the next round of US tariffs on April 2, which he has been referring to as “the big one”.

Bond-market investors increasingly expect the US economy to stall in the face of Trump’s chaotic tariff rollouts and associated negative economic shocks to reverberate around the globe.

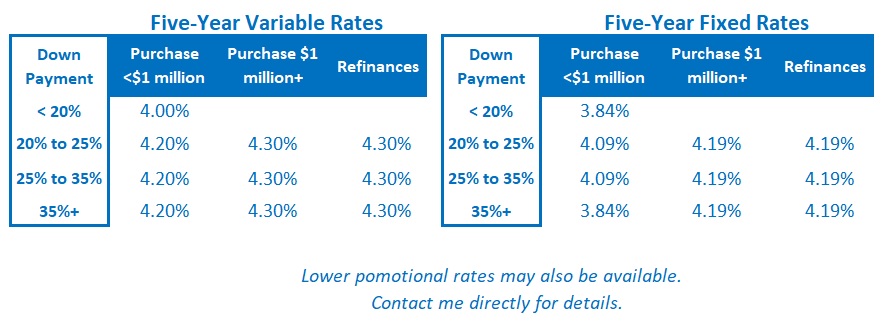

Canadian lenders continue to reduce their fixed mortgage rates in response.

In a speech last week, Bank of Canada (BoC) Governor Tiff Macklem said that the Bank is currently focused on minimizing risk, which means “being less forward-looking than normal” and “may mean acting quickly when things crystallize”.

The consensus no longer expects the BoC to cut its policy rate at its next meeting on April 16, believing that last month’s inflation spike to 2.5% will stay the Bank’s hand.

Regardless of whether that assessment proves correct, I continue to believe that more BoC cuts are in store and that today’s variable-rate mortgage options will outperform their fixed-rate equivalents over their full terms.