The Bank of Canada Offers Hope (For Later), Caution (For Now)

April 23, 2018Off This Week … Back Next Monday

May 7, 2018 Last week TD Canada Trust raised its five-year posted rate from 5.14% to 5.59%, and shortly thereafter, Royal Bank and National Bank increased their five-year posted rates from 5.14% to 5.34%. Other major banks are expected to follow shortly.

Last week TD Canada Trust raised its five-year posted rate from 5.14% to 5.59%, and shortly thereafter, Royal Bank and National Bank increased their five-year posted rates from 5.14% to 5.34%. Other major banks are expected to follow shortly.

At first glance these increases may seem innocuous to mortgage borrowers because bank posted rates are not typically used for lending. (For comparison, today’s actual market five-year fixed rates are offered in the low to mid-three percent range.) But the posted rates from the Big Six banks are now used by our regulators to determine how much we can borrow, and as their importance grows, their use should be subject to more scrutiny.

Although posted rates have been around for a long time, they are somewhat mysterious because borrowers don’t pay them and these rates don’t move consistently in response to market forces. With nothing to anchor them, they can be moved up or down arbitrarily at each bank’s whim.

Until recently, posted rates were used almost exclusively to inflate the Big Six Banks’ fixed-rate mortgage penalties, which are typically four or five times higher than those charged by their competition. To use a current example, let’s assume that TD lends you $300,000 today at a five-year fixed rate of 3.59% with a 25-year amortization. If you break that mortgage in three years’ time, and if rates have not changed, TD’s latest posted-rate hike increases the penalty they will charge you from $10,228 to $12,715 (using some slight rounding). For comparison, a host of other non-Big Six lenders would charge you a penalty of $2,480 under the exact same circumstances. (If you want more detail, this post outlines the important differences in the ways that lenders calculate their fixed-rate mortgage penalties.)

While the Big Six use their posted rates to make their fixed-rate mortgage penalties much more expensive, there is some justification for that because informed borrowers are free to choose another lender. What is patently unfair is that the Bank of Canada (BoC) now uses the mode from the Big Six’s posted rates to calculate its Mortgage Qualifying Rate (MQR). That is the rate used to determine how much most Canadians can borrow (and is also commonly referred to as the stress-test rate).

Here is an example of how the MQR is applied in practice.

If you’re a high-ratio borrower (meaning that you are putting down less than 20% on the purchase price of your property), lenders don’t use the actual rate on your mortgage when they determine how much you can afford. They must now use the MQR. (Borrowers who are putting down 20% or more of the purchase price are held to a similar but slightly modified standard.)

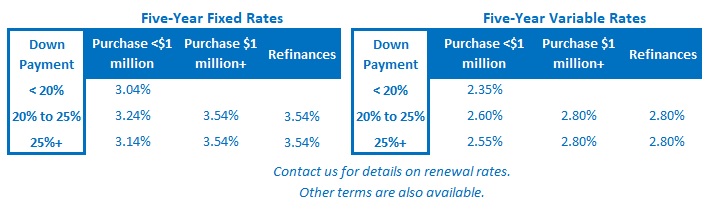

That means that today, when a high-ratio borrower applies for a five-year fixed mortgage, instead of using the actual contract rate of 3.04% that the borrower will pay on their mortgage, lenders must qualify the borrower using a mortgage payment that is based on the MQR, which currently stands at 5.14%. That difference reduces a borrower’s maximum mortgage amount by about 20%, and this Thursday, when the BoC next resets the MQR, the latest round of posted-rate hikes will increase it from 5.14% to around 5.29%, further magnifying that impact.

Given that the MQR now plays such an important role in lending, it seems unfair that just six market players have been given unfettered control over it. By comparison, when the BoC moves its overnight rate, it provides a detailed rationale for the change, and rightly so given the impact that policy-rate changes have across our economy. The MQR’s impact can be almost as far reaching, at least in the mortgage business, yet Big Six posted-rate changes come with about as much transparency as the smoke emanating from the Sistine chapel after a new pope is elected.

TD’s massive 0.45% posted-rate increase last week was not a response to changing bond yields (which have been relatively flat) or to increased funding costs (which haven’t risen by nearly that amount). So why might that bank have raised its posted rate so significantly?

I think the answer lies in a new policy that was implemented by the Office of the Superintendent of Financial Institutions (OSFI), our banking regulator, as part of the last round of mortgage rule changes that were made on January 1, 2018 (which I covered in detail here).

OSFI decided that borrowers who wanted to switch lenders at renewal would have to qualify using the MQR, but those who renewed with their current lender would not. (I was supportive of the mortgage rule changes overall but criticized this specific policy for reasons that are now obvious.)

Fast forward to today.

A recent widely published report by CIBC estimated that a record 47% of all Canadian residential mortgages outstanding will come up for renewal in 2018. At the same time, as rates have risen, borrowers have become more inclined to shop around and to switch lenders if they can do better elsewhere.

Bluntly put, I think TD is losing an increasing share of its renewal business because the rates it is offering aren’t competitive, and instead of sharpening its pencil and lowering them (which would negatively impact profitability), the bank is using its posted rate to spike the MQR and make it harder for their renewing borrowers to seek alternatives.

With almost half of Canadian residential borrowers renewing this year, and with slowing real-estate markets making new business harder to come by, is it so hard to imagine that the biggest market players would be tempted to use the lever handed to them by OSFI to protect their existing portfolios?

Those of you who read my posts regularly will know that I have supported all of the rounds of mortgage rule changes implemented thus far overall but have also pointed out flaws where I see them. To that end, OSFI should tell the BoC to base the MQR on real market rates and take the control of it away from the Big Six. Bluntly put, the economic incentives of these lenders are simply not aligned with those of the market at large – not borrowers, not other lenders, and not even OSFI itself. Furthermore, OSFI needs to stop making it harder for renewers to switch lenders at renewal, or alternatively, explain how forcing them to pay higher rates improves financial stability.

The Bottom Line: The five-year posted-rate increases that were initiated by TD’s massive hike last week will increase the stress-test rate (MQR ) from 5.14% to 5.29% with the next BoC reset this Thursday, and it will probably rise again shortly thereafter if the remaining three Big Six Banks respond in kind, as expected. That will further reduce the maximum mortgage amount for new borrowers and make it even harder for renewing borrowers to opt for more competitive alternatives – fairly or not.

2 Comments

Excellent article!

Informative article.