What Can Be Done About Rising House Prices?

April 5, 2021An Important Week Ahead for Canadian Mortgage Rates (and Real Estate)

April 19, 2021Canadian residential real-estate prices have risen rapidly and broadly during the pandemic, and as prices have surged, so too have calls for our policy makers to step in.

Last week, the Office of the Superintendent of Financial Institutions (OSFI), our banking regulator, made its first move. As is customary, OSFI put out a request for input to “interested stakeholders” on a proposal that is scheduled to take effect on June 1, 2021.

Bluntly put, this consultation phase is a mere formality. OSFI is proposing a change in the same way that parents suggest that their young children brush their teeth before bed – one way or the other, it’s going to happen.

Effective June 1, OSFI will increase the benchmark rate that is used to qualify uninsured mortgages from 4.79% to 5.25%. (This is also commonly referred to as the stress-test rate.)

Here is some additional background:

- Uninsured mortgages are currently qualified using a rate that is the greater of the contract rate on the mortgage plus 2% or a rate that is equal to the mode of the Big-Six Banks’ current five-year posted rates.

- Prime mortgage rates are now offered in the 2% range, and today the mode of the Big-Six Banks’ five-year posted rates is 4.79%. Therefore, 4.79% is the rate currently used to qualify all prime borrowers who apply at any federally regulated financial institution.

- On June 1, OSFI will stop using the mode of the Big-Six Banks’ five-year fixed rates (thank goodness for that) and replace it with a floor rate that will start out at 5.25%.

- This change will reduce an average borrower’s maximum mortgage borrowing capacity by about 5%. It will not impact insured mortgages, which come with government-backed default insurance, and as such, fall under the purview of our federal government.

While I agree with our policy makers’ decision to help cool our red-hot housing markets, I have concerns about this specific change (some of which I raised previously in this recent BNN interview immediately following the announcement).

For starters, its impact will be minor and limited to borrowers who don’t have access to a co-signer or additional Bank of Mom and Dad funds (which will further widen our wealth gap).

When changes like this are announced, they tend to trigger a short-term run-up in prices as impacted buyers scramble to get in ahead of the deadline. Given our current overheated conditions, a shorter grace period might have been more prudent.

I also find the explanation for how OSFI arrived at its new rate somewhat baffling.

In its announcement, OSFI acknowledged that its previous decision to base the stress-test rate on the mode of the Big Six Banks was flawed because it was “neither dynamic nor representative of the entire market”.

Strangely, after that frank admission, OSFI then explained that it will switch instead to an arbitrary floor rate which is based on an average of that same non-dynamic, non-representative benchmark rate over the 12 months leading up to the pandemic.

I have long argued for a market-based benchmark tied to real interest rates, but in its announcement, OSFI explained that it decided against this option because it had the potential to be volatile and could “create uncertainty among consumers”.

While their concern is valid, I think that on balance, changing to a market-based rate is still the best option.

The introduction of some uncertainty might be just the thing to give speculative buyers pause, and a market-based rate can be smoothed out with averaging. Also, as a market participant, I can tell you firsthand that I would prefer a transparent benchmark that has some volatility over an opaque one that has less.

Most glaringly, the stress test was originally designed to ensure that borrowers can afford higher rates at renewal. I don’t think there is a credible case to be made for a near tripling in today’s rates five years hence.

Now let’s focus on three key questions that follow from OSFI’s announcement:

- Will the stress-test rate for insured mortgages also be raised?

While I would normally expect a change to the uninsured stress-test rate to be quickly followed by a mirror change to the insured stress-test rate, that may not be the case this time around.

Previous rule changes capped the maximum amortization period allowed on insured mortgages at 25 years (as opposed to 30 years for uninsured mortgages) and capped the maximum eligible total purchase price at less than $1 million.

Those changes have helped reduce taxpayer exposure and risk during the recent run-up in prices – because stretched borrowers need extended amortizations to qualify and because as house prices rise, an increasing number of properties are falling into the $1 million+ exclusion range.

I think the effects of those changes, combined with the fact that first-time buyers tend to rely more on insured mortgages, increase the likelihood that our federal government may not match OSFI’s move.

- What other real-estate market changes are likely to (and should) come next?

If I’m going to criticize this move, it only seems fair that I should offer alternative solutions, especially since the federal government has signalled that more changes are coming.

Here is a summary of the changes, which I think would do a better job of cooling prices and which I also wrote about in last week’s post:

- Institute a capital gains tax for short-term house flippers

- Introduce federal non-resident and vacancy taxes

- Mandate an end to blind bidding

- Improve money-laundering enforcement

- Update zoning and building codes to help increase supply

- Is there anything that impacted borrowers can do to mitigate the effects of OSFI’s change?

OSFI confirmed that anyone who secures an approval or pre-approval prior to June 1 can be grandfathered back to the current qualifying rate for as long as those contracts remain valid. As such, if you secure a pre-approval prior to June 1 and subsequently convert it to a live deal that will close within the active window (typically 120 days), you can be qualified at 4.79% instead of 5.25%.

Impacted borrowers also have the option to borrow from provincially regulated credit unions that aren’t regulated by OSFI. These institutions allow borrowers to qualify at their contract rates, albeit with a premium of about 0.50% above the best market rates.  The Bottom Line: Government of Canada five-year bond yields fell a little last week and so did some of the five-year fixed mortgage rates that are priced on them. Variable rates held steady.

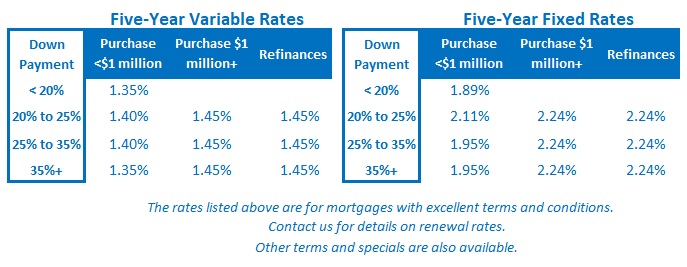

The Bottom Line: Government of Canada five-year bond yields fell a little last week and so did some of the five-year fixed mortgage rates that are priced on them. Variable rates held steady.

We received some encouraging employment numbers from Statistics Canada on Friday, but that upside surprise didn’t have much impact on our bond yields. I don’t expect that to change for at least as long as we are mired in the grip of COVID’s third wave.