The Coming Test for Canadian Bond Yields

November 28, 2016The Bank of Canada Bolsters Its Cautious Rate View

December 12, 2016 The latest round of mortgage rule changes kicked in last week and lenders wasted no time in adjusting their product offerings, in some cases by adding new rate premiums and in others by pulling products altogether.

The latest round of mortgage rule changes kicked in last week and lenders wasted no time in adjusting their product offerings, in some cases by adding new rate premiums and in others by pulling products altogether.

While these changes were not welcomed by borrowers, or by many people who work in mortgage-related fields, our policy makers got exactly the result they were looking for. They had become increasingly concerned that an extended period of ultra-low mortgage rates was fueling an unsustainable rise in house prices in hot regional markets and was exacerbating our average household debt levels, which today stand at record levels.

Ideally, our mortgage rates would have risen naturally, but aside from the short-term post-U.S. election spike that pushed them a little higher, that just hasn’t happened. And since market forces weren’t going to materially raise mortgage rates on their own, our policy makers decided to implement another round of mortgage rule changes to make them rise, this time by limiting the availability of government default-insurance on specific mortgage products. (Bluntly put, it was either that or close your eyes, cross your fingers and hope for the best – an approach that too many of my colleagues continue to espouse.)

Now that the latest changes have been implemented, here are the answers to five key questions to help borrowers understand how the residential Canadian mortgage landscape has now changed.

- Are there any mortgage products that are no longer available?

No. Mortgages are still available to affected borrowers like refinancers, rental property investors, purchasers of high-value properties and those looking for extended amortizations. That said, these products are less widely available and are now being offered with new rate premiums added. For example, borrowers who want to refinance should now expect to see an additional premium of .10% to .15% added to their base rate, and single-unit rental property investors will now typically pay an additional rate premium of 0.25%.

- Do these changes affect all borrowers?

No. If you are purchasing a house of $1 million or less and have the income to qualify using the Mortgage Qualifying Rate (MQR), which today stands at 4.64%, then your available rates are unaffected by the latest changes.

Put more generally, up until last week the mortgage-rate world was divided into two main groups: high-ratio borrowers, who were putting down less than 20% of the purchase price, and low-ratio borrowers, who will have equity of 20% or more in their home. Going forward, Canadian mortgage borrowers will still be divided into two mortgage-rate groups, but now they will be segmented as insured borrowers, who qualify for mortgages that are eligible for some form of mortgage-default insurance that is paid by either the borrower or the lender, and as uninsured borrowers, who require mortgages that are not eligible for mortgage-default insurance.

- Are some lenders affected more than others?

Yes. Smaller lenders who securitize all of their mortgages, and must therefore default insure every one of them, have now had to restrict their product offerings. But lenders who can use their balance sheets to fund their mortgages (like banks, credit unions and insurance companies), as well as larger monoline lenders who have access to more diverse funding sources, are all still offering a full suite of mortgage products, albeit at higher rates for certain products.

- How much will these additional rate premiums cost me?

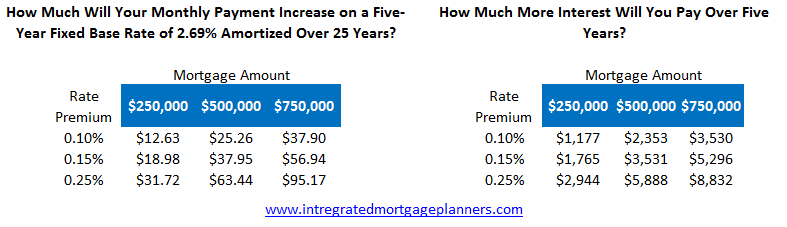

Probably less than you might think on a monthly basis, but the added interest cost will add up over time.

Here are two charts to illustrate the impact of these new rate premiums on both monthly payments and overall borrowing costs. For the purposes of illustration, in the chart below we have assumed a base rate of 2.69% on a five-year fixed-rate mortgage that is amortized over 25 years.

- Is There a Silver Lining in All of This?

Yes. While these latest mortgage-rule changes raise borrowing costs and may reduce or altogether restrict the ability of some borrowers to purchase property, they should also reduce the rate of household debt accumulation and help curtail the undeniable rise in speculative investment that we have seen in hot regional markets, specifically in British Columbia and Ontario. If you already own a home in these areas, these latest changes should help preserve the existing value of your home (and reduce the risk of a housing crash along with all of the broader, longer-lasting economic consequences that would accompany it).

Also, by reducing the percentage of residential mortgages that qualify for default insurance, our policy makers have created conditions that should lead to a rise in risk-based pricing, where mortgage rates vary according to a borrower’s relative strength, as a replacement to the one-size-fits-all default-insured pricing that until now has dominated the market.

Put simply, the prevalence of default insurance starved out private-market mortgage investment, but if demand for uninsured mortgage solutions rises and potential lending spreads increase accordingly, private investment will move in to fill the gaps. So while the latest rule changes mean that mortgage rates will rise for some borrowers over the short term, it should also lead to the creation of a deeper and more resilient pool of private capital that is available for mortgage investment. If that happens, it should increase the availability of credit for borrowers who fall just outside of the “A” lending box, and over time, the evolution of the uninsured market that these latest changes have set in motion should lead to lower borrowing rates for the strongest non-prime borrowers.

Five-year Government of Canada bond yields rose by three basis points last week, closing at 1.02% on Friday. Five-year fixed-rate mortgages are now available in the 2.49% to 2.69% range, with additional premiums now being added for refinances (+0.10%), rental properties (+0.25%) and extended amortizations (+0.10%). Five-year fixed-rate pre-approvals are now offered at around 2.79%.

Five-year variable-rate mortgages are still available in the prime minus 0.30% to prime minus 0.40% range, which translates into rates of 2.30% to 2.40% using today’s prime rate of 2.70%.

The Bottom Line: Despite the most recent mortgage rule changes, Canadian mortgage borrowers still have a variety of options available and those who invest a little extra time to shop around will continue to source both better rates and/or contracts with superior terms and conditions. As with all of the other rounds of mortgage rule changes, this is a case of borrowers (and mortgage professionals) having to endure some short-term pain today in order to preserve longer-term gains in the future.