Why CMHC Shouldn’t Raise Its Minimum Down Payment from 5% to 10%

May 25, 2020How CMHC’s Surprise Announcement May Help in the End

June 8, 2020Last week Bank of Canada (BoC) Governor Poloz delivered his final speech and press conference before passing the baton to incoming Governor Tiff Macklem. I have always appreciated his ability to explain complex issues in plain-spoken terms and will miss hearing him at the podium.

His speech offered details of how the Bank grapples with monetary policy decisions in “unknowable times.” He walked listeners through examples of how the BoC has triangulated upside and downside risks during both the oil-price crash in 2015 and during the current COVID-19 crisis, using imperfect information and a wide range of forecasts. But it was his view of our prospects for recovery that seized the media’s interest.

Specifically, he said, “Because the [current] situation is more like a natural disaster than a recession, there is reason to expect confidence to be buttressed by fiscal income supports and a reasonably swift return to growth for significant segments of the economy.”

During his accompanying press conference, he added, “I do think that, on balance, the flow [of pessimism] that I’m hearing is a little too dire. It’s a little overblown.” Poloz believes that we are currently “tracking to our best-case scenario” and not to the worst-case scenario that many fear.

While I certainly hope that his forecast proves correct, I don’t think it is the most likely outcome.

Governor Poloz draws hope from the fact that the current sharp downturn was caused by a forced shutdown and not by “behavioural adjustment[s]” in consumer behaviour that would cause a more prolonged slump.

Behavioural adjustments did not cause the current downturn, but I think they will become a by-product of it.

The current situation in Wuhan, China provides an instructive look at how our future might unfold. When the quarantine was lifted, the factories started humming again, but consumer spending in the region has barely budged. I expect we will see the same happen here.

Increased caution is understandable for myriad reasons:

- Consumers will be reluctant to expose themselves to increased infection risk by returning to restaurants, shops and public venues. I don’t think that will change until a vaccine is widely available (and then only maybe).

- Consumers will increase their saving buffers to ensure that they are better prepared if and when the next lockdown occurs. In Canada, our saving rate has already increased from 3% in the Q4 2019 to 6.1% in Q1 2020, but it is still below our long-term average of 7.5%. (While increased saving is a wise move for individuals, it will reduce spending and sap our economic momentum.)

- Consumer debt was elevated before the crisis and many consumers have since fallen deeper in the hole. The cost to service this debt will divert funds that might otherwise go toward spending for a long time to come.

When our economy turns back on, behavioural adjustments like the ones listed above will mean that increases in supply won’t be matched with a pickup in demand. That will cause the downturn to drag out.

While Governor Poloz conceded that “any structural damage such as business failures and labour market scaring will of course take longer to repair”, I believe the confidence levels of businesses that make it through will also be impacted for longer than he expects.

Our businesses were stubbornly reluctant to invest in productivity enhancements and capacity expansion before the current crisis hit, in large part because of trade uncertainty. That uncertainty hasn’t gone away, and now businesses must grapple with a wide range of COVID-related challenges as well. With that in mind, I don’t see a rebound in business spending anytime soon.

Readers of this blog might at first be relieved to learn Governor Poloz assessed that “we are in an era where interest rates are probably going to stay low, for demographic reasons and economic growth reasons.” Low rates would typically be expected to provide solace to borrowers if the recovery does drag out, but that assumes that we don’t fall into a deflationary spiral.

Deflation refers to a general decline in the prices for goods and services. An extended period of deflation could trigger a self-reinforcing spiral of lower prices, decreased production, lower wages and decreased demand that central bankers will struggle to counteract.

Deflation increases the cost of debt. In a deflationary environment, even ultra-low interest rates can prove expensive. For example, if deflation is -2% and you have a nominal interest rate of 1%, your real interest rate is 3%. (Our year-over-year inflation rate of 0.9% in March just swung to a deflation rate of -0.2% in April.)

Governor Poloz referred to the current crisis as a “giant deflationary crater in the middle of the economy.” He explained that the Bank worries most about deflation because it “interacts horribly with existing debt” and added that debt and deflation are “the two main ingredients of depressions.”

We may not be in a deflationary spiral now, but if the recovery takes longer than Governor Poloz believes it will, the risk will rise.

He concedes that we are living in a time of “unprecedented uncertainty both in terms of magnitude and origin.” Against that backdrop, I commend him for his optimism, even if I don’t share it.

The Bottom Line: In his final speech before stepping down, BoC Governor Poloz assessed our economic momentum as currently tracking the Bank’s best-case scenario, and that most economists’ forecasts are erring to the downside.

While I hope that he is right, for the reasons listed above, I believe significant behavioural changes and fragile confidence will combine to delay our recovery. If that fuels a deflationary spiral, even ultra-low interest rates will be expensive in real terms.

Forewarned is forearmed.

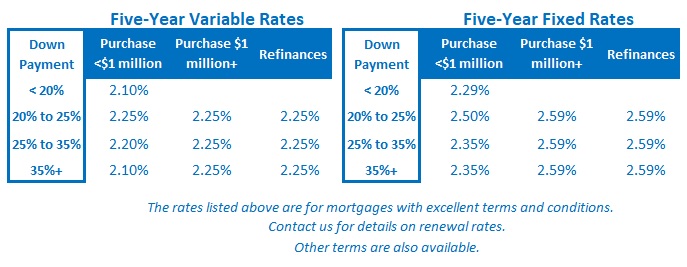

Five-year fixed rates held steady last week, while five-year variable-rate discounts widened a little.

2 Comments

Hi Dave, Interesting article. We have seen real estate values pullback in April but they have rebounded and recent values in the downtown core are still strong. As long as active listing don’t skyrocket and home owners don’t sell their home out of free– “let’s get out now before the market tanks” then hopefully the market will be stable.

I’ve been watching specific houses @ $600k in the Hamilton area since September.

During the pandemic I saw a steady decrease of approximately 10 houses I was interested in drop 10-12.5%.