The Latest Inflation Data Are Not as Bad as You Might Think

January 24, 2022Why CDN Bond Yields Surged Despite Big Job Losses

February 7, 2022The Bank of Canada (BoC) held its policy rate steady last week, and that will keep our variable mortgage rates at their current levels for a little longer.

There was widespread speculation that today’s elevated inflationary pressures would compel the Bank to start hiking, but doing so would have come at a cost (which I wrote about in this post).

Simply put, in its recent forward guidance the BoC said that it expected to raise “in the middle quarters of 2022”. Given that, hiking earlier would have cast doubt on the reliability of its future forward guidance, undermining the Bank’s most valuable asset – its credibility.

To be clear, if the BoC felt that inflation expectations were becoming unanchored it would have hiked anyway, because fear of higher inflation can cause it to intensify. Anyone scanning the mainstream media headlines might easily become convinced that we have now reached that stage. But in its final analysis, the Bank assessed that hype aside, while “near-term inflation expectations have moved up … longer-run expectations remain anchored on the 2% target”. That reassurance gave the BoC the leeway it needed to stay the course.

Notwithstanding its decision to stand pat last week, the BoC’s latest communications made it clear that its policy rate, and our variable mortgage rates, will move higher in the near future.

To wit:

- It removed its policy of offering forward guidance, which opens the door for rate hikes at future meetings.

- It assessed that “the overall slack in our economy has now been absorbed”.

- It expects that “interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving the 2% inflation target.”

BoC Governor Macklem added the following in his accompanying press conference:

- “We are removing our commitment to hold our policy rate at its floor of 0.25%.”

- “Interest rates will need to increase to control inflation. Canadians should expect a rising path for interest rates.”

- “Higher interest rates will be needed to bring inflation back to the 2% target.”

- “The time for emergency policy settings is over.”

Variable-rate borrowers have known for some time that their rates were due to rise. The most important questions now are: How fast and by how much?

The Bank is no longer offering forward guidance, so the best way to try to estimate its rate-hike pace and path going forward will be to evaluate how the key assumptions in its latest forecast compare to the actual data as they unfold.

Here are some examples of some of the assumptions that I will be monitoring:

- “Robust growth should resume in the second quarter.” (The BoC projects that our GDP will grow by 4% in 2022 and 3.5% in 2023.)

- “Consumer spending is anticipated to rebound, and exports and business investment are projected to grow solidly.”

- The economic impact of the Omicron variant is expected “to be less severe than previous waves”.

- “Inflation should decline relatively quickly to around 3% by year end” and then “decline to around 2¼% by the second half of 2023 and remain close to the target in 2024.”

- “Economic slack is now essentially absorbed” (meaning that our economy has little or no additional capacity for non-inflationary growth).

The BoC was strident with its assurances that it will control inflation, but it also repeatedly acknowledged that the complexity of the pandemic recovery has added to the uncertainty in its forecasts.

For my part, and with a healthy dose of humility due to the inherent uncertainty in my own forecasts, I believe that circumstances will continue to favour today’s variable mortgage rates for borrowers who are comfortable with the inherent risk that their rate might rise more than initially expected.

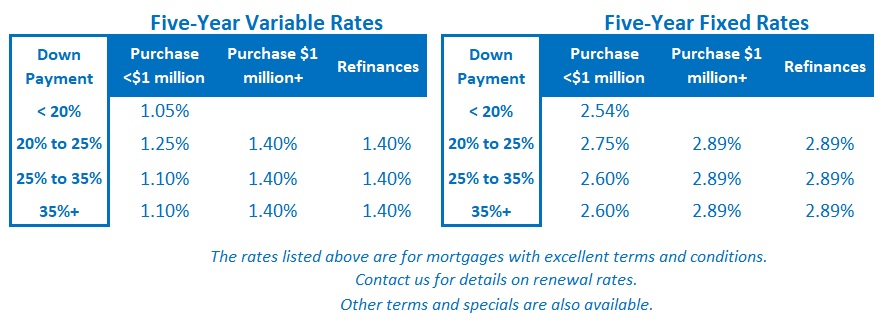

Today’s five-year variable rates are priced about 1.50% below their fixed-rate equivalents, and that means that they will continue to produce a saving until (and if) the BoC raises its policy rate by a full 1.75% from its current level. That is a significant gap to work with, and even though it will soon start to narrow, some portion of that saving will likely be sustained for quite some time yet.

Consider that the BoC is also about to start raising rates against a backdrop of record-high debt levels. That debt that will magnify the impact of each hike, to a degree that isn’t entirely clear yet, and that, combined with the fact that rate-rise impacts occur with a lag, makes it more likely that the Bank will proceed with caution.

Even if that doesn’t turn out to be the case and the Bank tightens more rapidly, our elevated debt levels increase the risk that any over-tightening will trigger a recession. If that happens, rate cuts will follow.

The BoC’s expectation of a robust rebound in the second quarter appears to be based largely on the fact that our economy rebounded strongly after previous lockdowns. But in my view, it hasn’t sufficiently accounted for the fact that this time around our recovery will by buttressed by much less fiscal and monetary-policy support.

Lastly, while there is risk that rising labour costs will cause longer-lasting inflation after supply bottlenecks are resolved, there are two important factors that will weigh against that tendency in this case.

One is that despite our having regained all of the jobs lost to the pandemic months ago, our GDP has yet to recover its lost ground. We now have more workers producing less output (lower productivity) and that should provide more room for non-inflationary growth in our economy than our current data imply.

The second factor is that record levels of planned-for immigration will also increase the supply of labour and help to counteract the pressure for wage increases.

Some food for thought from this avowed contrarian. The Bottom Line: The BoC’s latest communications had only a minor impact on the five-year Government of Canada bond yield, and as such, the five-year fixed mortgage rates that are priced on that yield appear to be range bound over the short term.

The Bottom Line: The BoC’s latest communications had only a minor impact on the five-year Government of Canada bond yield, and as such, the five-year fixed mortgage rates that are priced on that yield appear to be range bound over the short term.

Five-year variable rates were unchanged last week, but as the BoC made clear in its latest communications, its first rate hike could come as soon as its next meeting on March 2.