Why the Bank of Canada Should Cut Its Policy Rate Again This Week

April 14, 2025 The Bank of Canada (BoC) held its policy rate at 2.75% last week, which it considers to be the mid-point of its neutral range (the level where it is neither stimulating demand nor restricting it).

The Bank of Canada (BoC) held its policy rate at 2.75% last week, which it considers to be the mid-point of its neutral range (the level where it is neither stimulating demand nor restricting it).

The Bank decided that it was best to stand pat while waiting to see how US President Trump’s on again/off again tariff threats play out.

I thought there was enough justification to cut again last week, but it’s hard to fault the BoC for pausing in the face of so much “uncertainty”. That word was used forty-nine times in the Bank’s accompanying Monetary Policy Report (MPR), which must be some kind of record.

Instead of publishing its usual baseline forecast in its MPR, the BoC offered two “illustrative scenarios” of how events may unfold. Interestingly, the last time it adopted this approach was at the start of the pandemic (which gives us a little more perspective on its current level of uncertainty).

The first scenario assumes the new tariffs soon “get negotiated away”. Near-term growth slows, and inflation drops below the BoC’s 2% target “for the rest of 2025 and into 2026”. Below-target inflation gives the Bank leeway to enact further rate cuts to help our economic recovery.

In the second scenario, the global trade war is longer lasting and “the economic consequences are severe”. Our economy enters recession for a year, and while it resumes growth in 2027, it “remains soft … as US tariffs permanently reduce Canada’s potential output and lower our standard of living”. Inflation rises “above 3% in mid-2026 as tariffs, countermeasures and shifts in supply chains raise costs, pushing up many prices”.

This is the BoC’s nightmare stagflation scenario where persistent inflation pressures require it to keep monetary policy tight at a time when it would otherwise loosen policy to stimulate demand.

It will take time for our actual economic trajectory to become clearer, but I think some version of the first scenario is more likely.

To explain why, let’s examine the two main upside inflation risks cited by the BoC in its forecasts.

The first is that businesses “pass on a greater share of the cost of tariffs to consumers” and that “businesses not directly impacted by tariffs may try to take advantage of the reduced competition and raise their prices”.

We did see businesses enact opportunistic price increases during COVID, but back then there was strong pent-up demand, consumers had excess savings to absorb higher costs, and our labour market was drum tight.

Canadian consumers have lower savings now, they are already reducing their spending, and many are increasingly concerned about their job prospects.

Weakening labour-market conditions will significantly reduce the risk that inflation pressures will increase or even be sustained.

Against that very different backdrop, businesses should also be much less confident that demand for their products and services will be sustained if they raise prices. This time around, if their costs increase, they are much more likely to feel compelled to shrink their profit margins to absorb at least a portion of those increases.

The BoC’s second main upside inflation risk is an “upward drift in longer-term inflation expectations” as one-time tariff-related price increases cause consumers to expect that prices will continue to rise thereafter.

The Bank is concerned that “these expectations of higher future inflation could become self-fulfilling if they feed through to wage demands and if businesses change how they set prices”.

But as discussed above, weakening labour market conditions reduce the likelihood that demands for higher wages will be successful, and businesses will be reluctant to increase prices for fear of reduced sales.

Other near-term factors are also exerting downward pressure on inflation:

- Overall inflation is highly correlated with oil prices, and these have recently plunged to their lowest levels in more than four years.

- Our federal government just announced the cancellation of its carbon tax, effective April 1, and the BoC estimates that this one factor “will reduce CPI inflation by about 0.7 percentage points for one year”.

- Mortgage interest costs had been the main driver of inflation pressure for more than a year, but that impact has been waning because mortgage rates have fallen steadily.

- The Loonie has been strengthening against the Greenback of late, and that will reduce the cost of everything we import from US markets.

- Rising bond yields have led to increased borrowing costs and falling stock-market prices have further tightened financial conditions by reducing the “wealth effect”. (These factors produce effects like those that occur when the BoC hikes its policy rate).

When the BoC is so uncertain about where our economy is headed, I readily admit that I should not be too confident in my own analysis. But for the reasons outlined above, I do think it is unlikely that persistently higher inflation pressures will prevent the BoC from continuing to reduce its policy rate to help our economy if it weakens further (as I expect it will).

Furthermore, if history repeats itself, a pause now doesn’t rule out more cuts to follow.

This week, economist David Rosenberg noted that “the Bank almost always pauses in an easing cycle … [and] has done so on three occasions since 2008”.

Mortgage Advice for Now

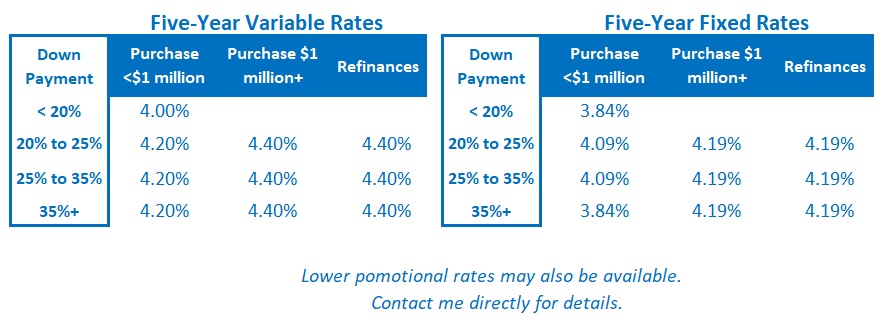

I think variable mortgage rates will likely prove cheaper than today’s fixed-rate options. But these are volatile times. Anyone choosing a variable rate should do so only if they can live with heightened uncertainty and have the capacity to withstand higher payments if my forecast proves incorrect.

If you are interested in a much more detailed breakdown of the pros and cons of fixed and variable mortgage rates during this trade-war era, here is a link to my recent post on that topic. The Bottom Line: Bond yields moved a little lower last week. That has helped ease some of the upward pressure on our fixed mortgage rates, and they should remain range bound over the near term.

The Bottom Line: Bond yields moved a little lower last week. That has helped ease some of the upward pressure on our fixed mortgage rates, and they should remain range bound over the near term.

The BoC ended its streak of consecutive meetings with a rate cut at the seventh, but I expect this pause to be brief for the reasons outlined above.

The BoC also noted last week that, while it will be “less forward-looking than usual until the situation is clearer”, it will also be “prepared to act decisively if incoming information points clearly in one direction”.

In other words, the Bank is leaving the door open for a cut of more than 0.25% if needed.