Thoughts on the Bank of Canada’s Meeting This Week

July 9, 2018Canadian Inflation Hits a Six-Year High

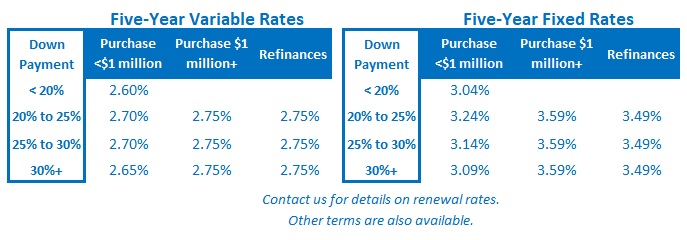

July 23, 2018 The Bank of Canada (BoC) raised its overnight rate by 0.25% last Wednesday and it now stands at 1.5%. The move was widely expected, and Canadian lenders quickly increased their variable mortgage rates in response.

The Bank of Canada (BoC) raised its overnight rate by 0.25% last Wednesday and it now stands at 1.5%. The move was widely expected, and Canadian lenders quickly increased their variable mortgage rates in response.

This marked the fourth BoC rate hike over the past twelve months, matching the U.S. Federal Reserve’s policy-rate increases over the same period. That is somewhat surprising given the significant differences in our current economic trajectories and the fact that our federal government has raised taxes at the same time that the U.S. federal government has cut theirs substantially.

Yet here we are.

The BoC’s recent guidance left little doubt about its immediate plans, so the only real question was whether additional near-term rate hikes were also likely. To that end, the Bank’s accompanying statement was deemed to be a little more hawkish than the consensus had expected, and that put upward pressure on the Government of Canada (GoC) five-year bond yield, which our five-year fixed-rate mortgage rates are priced on. But that run-up was short lived and the five-year GoC bond yield actually ended the week slightly lower.

In today’s post, I’ll offer my take on the highlights from both the BoC’s latest policy statement and the release of its latest Monetary Policy Report (MPR), which provides us with the Bank’s assessment of current economic conditions at home and abroad and includes forecasts for key economic data. Now that the Bank has decided to offer less guidance going forward, its MPR forecasts have increased importance as benchmarks that will confirm whether our economy Is evolving as expected, and if not, whether additional policy-rate moves may be required. I’ll summarize the Bank’s key forecasts and observations and offer my related comments in italics.

On U.S. economic growth …

- The BoC assessed that U.S. economic growth had been “stronger than expected” and it increased its U.S. GDP growth forecast for 2018 from 2.7% to 3.1%. Interestingly, it downgraded its U.S. GDP growth forecasts for 2019 and 2020 by 0.2% each, bringing them down to 2.5% and 1.8% respectively. This change in forecast recognizes the short-term sugar-high impacts of the U.S. tax cuts and fiscal spending stimulus, both of which are effectively borrowing growth from the future.

On economic growth elsewhere …

- The BoC calls the escalating U.S.- led trade war “the most important threat to global prospects.” Accordingly, the Bank downgraded almost all GDP growth projections for China, Japan and the Euro area over the next three years, largely in response to the “considerable risks” that are posed by “escalating trade tensions” and more broadly, “a more pronounced shift away from a multi-lateral rules-based trading system”. Simply put, the deglobalisation of trade will mean less growth for everybody.

On Canadian economic growth …

- The BoC is forecasting Canadian GDP growth of 2.0% in 2018, which is the same as its previous forecast, but it raised its projections for 2019 and 2020 by 0.1%, to 2.2% and 1.9%. This is not a pace for growth that would normally correspond with aggressive monetary-policy tightening.

- The Bank observed that “the composition of growth is shifting”. Going forward, it expects that consumption and housing’s relative contributions to our GDP growth will be smaller and that the relative contribution from exports and business investment will be larger. While it makes sense to me that the combined impact of higher interest rates and the mortgage rule changes will slow consumption and housing investment, it is harder for me to see how exports and business investment will rise significantly in the face of so much trade uncertainty. That said, the BoC holds this view “even with the larger impacts from both trade policy uncertainty and tariffs.”

On Inflation …

- The BoC believes that “inflation is on target” and that “higher interest rates will be needed to keep it that way”. It expects that higher gas prices and minimum wage increases will push inflation up to 2.5% in the second half of 2018, but that these “temporary factors” will dissipate thereafter. It then forecasts inflation of 2.2% and 2.1% for 2019 and 2020. The BoC is forecasting GDP growth of around 2% over the next three years. If that happens, it’s hard to imagine that it will take many more policy-rate increases to keep inflation at about the same level, especially when the Bank acknowledges that the factors pushing inflation higher today are temporary.

On employment and wage growth …

- The BoC observed that wage growth “remains close to 2.3%” and that “growth of employment and average hours worked has slowed from last year’s strong pace”. If that’s accurate, and average wage growth continues to barely outpace inflation, what happens to consumption when higher borrowing costs eat into those meagre income gains?

- The Bank acknowledges that there is “less wage pressure than would be expected in a labour market with no slack”. It believes that “the recent uptick in the labour force participation rate indicates that additional people may be willing to work.” Since the start of 2018, our economy has actually shed about 20,000 jobs on a net basis, so the supply of labour is now increasing while the demand for it is decreasing.

On Oil …

- Oil is a big X factor in the BoC’s forecasts. Oil prices have risen steadily over the past year and are about $10/barrel higher than when the Bank released its previous MPR. The BoC always assumes that today’s prices carry forward and if that is the case, it will buoy both investment spending and our export volumes. That said, we don’t need to be reminded that oil prices are volatile.

On escalating trade tensions …

- The BoC estimates that the U.S. trade war will boost inflation “by about 0.1% until the third quarter of 2019”, and that it will subtract 2.5% from business investment and 1.2% from our overall exports by 2020. These are only minor impacts but they could just be the starting point. The BoC acknowledged this when it said: “Escalating trade tensions pose considerable risks to the outlook.” The BoC’s estimate of the impact of trade uncertainty on business investment seems curiously low to me.

- More broadly, the Bank estimates that “the dampening effects associated with trade policy uncertainty and the implemented U.S. tariffs will subtract about 2/3 per cent from the level of GDP by the end of 2020”. Here again, though, the BoC also acknowledges that “the range of possibilities is wide, and the channels through which the measures would affect the economy are complex.”

On the recent softening of our economic data …

- “A few data points over the past few weeks have seemed out of step with those projections, but when all the data are taken together, the economy seems to be on track.” We’ll see if those “out of step” data points are really out of step or whether they signal the start of a longer-term trend that won’t be as easily ignored in future.

On the closest thing we are going to get to policy-rate guidance …

- The BoC expects that “higher interest rates will be warranted to keep inflation near target”, even though it assesses that temporary factors are responsible for most of today’s upward pressure. That said, it expects to maintain “a gradual approach, guided by incoming data”, while paying special attention to “the economy’s adjustment to higher interest rates … the evolution of capacity and wage pressures … [and] the response of companies and consumers to trade actions.” Put simply, the Bank is maintaining a cautious upward bias for the time being.

In summary, the BoC is expecting a short-term spike in inflation that will be caused by temporary factors. It will be interesting to see if it will continue to raise its policy rate to offset these short-term pressures, or follow its stated cautious approach and delay further action until these pressures begin to dissipate naturally. At the same time, we’ll see if a slowdown in spending on consumption and housing is really going to be fully offset by increases in exports and business investment (a much smaller sector). Average wage growth is barely outpacing inflation and higher borrowing costs are further eroding those small gains in purchasing power. Meanwhile, there is tremendous uncertainty surrounding trade, and there is no guarantee that rising economic momentum from rebounding oil prices will offset waning momentum across a broad cross section of non-energy related sectors.

The Bottom Line: The BoC raised rates last week and cautioned that “higher rates will be needed” to keep inflation on target. That said, the Bank plans to proceed with caution and that will allow time for new data to confirm whether inflationary pressures are dissipating naturally, whether our employment and wage-growth momentum continue to slow, and whether ongoing trade uncertainty curtails export growth and investment spending. For my part, I think that the BoC should have waited before raising rates this time and that we aren’t likely to see any further increases this year. Furthermore, the Bank’s decision to raise last week increases the likelihood that our next rate cut (remember those?) will happen sooner than expected.