Why a 0.50% Rate Cut by the Bank of Canada is a No Brainer

October 21, 2024Have Canadian Fixed Mortgage Rates Bottomed?

November 4, 2024 The Bank of Canada (BoC) reduced its policy rate by 0.50% last Wednesday, from 4.25% to 3.75%.

The Bank of Canada (BoC) reduced its policy rate by 0.50% last Wednesday, from 4.25% to 3.75%.

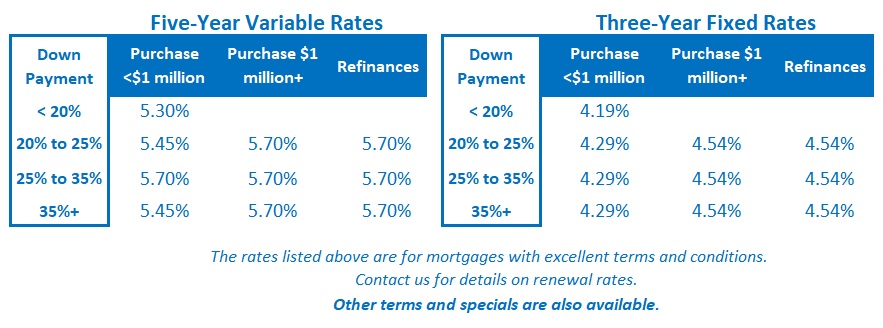

Variable mortgage rates dropped by the same amount shortly thereafter, and fixed mortgage rates were unchanged. The Government of Canada (GoC) bond yields on which they are priced had already dropped in anticipation of last week’s cut.

The cumulative decline in our mortgage rates has caused me to alter the mortgage selection advice I have been offering to borrowers currently in the market.

I explain my rationale in more detail below, but first, here are my five key takeaways from the BoC’s most recent policy statement, press conference, and Q3 Monetary Policy Report (MPR):

- Price stability has returned.

BoC Governor Macklem has previously explained that the Bank’s assessment of whether we have achieved price stability isn’t dogmatically determined by specific indicators. Rather, to borrow an old quote from US Supreme Court Justice Potter Stewart about pornography, when it comes to price stability, the Bank knows it when it sees it.

There is now plenty of evidence to support the view that price stability has returned.

Our headline CPI came in at 1.6% in October. While the BoC anticipates that it may rise a little over the near term, it now projects that it will “remain close to target” from now until the end of 2026.

The Bank’s preferred measures of core inflation, CPI‑median and CPI‑trim, have also continued to ease, and are now down to 2.3% and 2.4% respectively.

In its latest MPR, the BoC observed that while shelter prices remain elevated, they are expected to “gradually diminish”. In the meantime, “price pressures have moderated across a broad range of other goods and services.” It also noted that “business and consumer expectations of inflation have shifted down and are nearing normal”.

The Bank sees the downside and upside risks to inflation forecasts as “reasonably balanced”. That eliminates the need for a more restrictive monetary-policy stance than our economic data would otherwise warrant.

- More rate cuts are urgently needed.

There is no longer any rationale for tight monetary policy.

The BoC noted that our GDP per capita “likely declined by about 1¼% [in Q3], a somewhat larger decrease than the average over the first half of the year.”

Our overall GDP growth in Q3 is also tracking to be weaker than forecast. It is projected to come in at about 1.5% in Q3, down from 2% in the first half of 2024. That weakness was due, in part, to subdued business sentiment.

The Bank also observed that our labour market” is soft”, that household and business spending “continues to soften”, and that “the economy remains in excess supply” (relative to demand).

- We should expect further BoC rate cuts totaling between 1.00% and 1.50%.

The Bank needs to keep beating a hasty retreat until its policy rate has been lowered to a neutral level that no longer restricts demand.

Most economists believe that the policy-rate’s neutral range is currently between 2.25% and 3.25%, and that the BoC will lower to at least the midpoint of that range this cycle.

For its part, the Bank anticipates “cutting our policy rate further”, with its usual caveat that the “timing and pace of further interest rate cuts will depend on incoming information”.

While the bond market isn’t pricing this in yet, unless our economic data improves markedly from where it has been trending, I expect the BoC to cut by another 0.50% when it next meets on December 11.

- The weaker Loonie is a feature, not a bug.

The BoC’s policy rate is now 1% below the US Federal Reserve’s policy rate, and that has caused the Loonie to weaken against the Greenback. The softer Loonie adds to our inflation pressures because it increases the price of everything we buy, and depend on, from the US.

There has been much speculation that the weakening Loonie might concern the Bank enough to cause it to alter the timing and magnitude of its cuts. But it made little mention of that in its latest MPR. That leads me to infer that the Bank believes the inflationary impact of the weaker Loonie will be offset by other forces of disinflation in our economy.

The weaker Loonie provides benefits as well, because it also lowers the cost of everything we sell to the US, which make our exports more competitive.

Not surprisingly, the BoC noted a pickup in our exports in Q3. It expects that our export sales will “remain strong, supported by robust demand from the United States”.

If the BoC is forecasting strong export growth over its forecast horizon, it is reasonable to conclude that it also expects the Loonie to remain relatively soft over that period, and again, with no net deleterious impact on overall inflation.

If our lower current exchange rate is projected to help more than it hurts, then the weaker Loonie is a feature, not a bug.

- The BoC is forecasting a housing rebound.

The BoC is forecasting that our housing markets will pull out of their recent slump due to a combination of lower mortgage rates, changes made to government mortgage insurance rules, and its assessment that “growth in housing demand [will] outpace increases in supply”.

In addition, it projects that “renovations should also be supported by a projected rise in house prices”.

The Bank cited the potential that “lower interest rates could fuel a stronger rebound in housing activity” as one of the key upside risks to its inflation forecast.

Mortgage Advice for Now

My assessment of the best choice for borrowers who prefer fixed mortgage rates has changed in response to rate movements, last month’s sharp decline in inflation, and the BoC’s most recent actions and statements.

Until recently I have recommended the three-year term as the best fixed-rate option.

One and two-year rates were considerably higher, and in my opinion, not worth the additional required premium. Alternatively, five-year fixed rates were well above their long-term averages, and five years seemed like too long to be locking when we were still near the peak of the current interest-rate cycle.

But the GoC bond yields on which our fixed mortgage rates are based have now priced in additional anticipated BoC rate cuts of about 1%. That reduces the potential for bond yields and fixed mortgage rates to decline further.

Those yields also have increased upside risk now.

They are tightly correlated with US Treasury yields, and if the US economy continues to chug along, US Treasuries may rise from their current levels and take our GoC bond yields along for the ride.

The BoC could also end up cutting by less than expected and/or reduce its policy rate more slowly. Those developments would also exert additional upward pressure on our bond yields. (That’s not in my baseline forecast, but it is a risk that should be acknowledged.)

Simply put, now that fixed mortgage rates have fallen substantially from their peak, their future direction is no longer a one-way bet. And now that five-year fixed rates are nearer to their longer-term averages, there is less risk that locking in for longer will end up costing borrowers substantially more.

Notwithstanding my assessment that five-year terms should have increased appeal for more conservative fixed-rate borrowers, I continue to believe that variable mortgage rates have the best chance of producing the lowest overall borrowing cost during their typical 5-year term.

The BoC has already cut its policy rate by 1.25%, and a further reduction of between 1% to 1.5% is widely expected. If variable rates fall by another 1% from their current levels, they will be lower than any of today’s available fixed rates.

One word of related caution is needed:

Some borrowers who would typically lean toward fixed rates are considering a variable rate today with a plan to convert mid-term, on the bet that fixed rates will bottom out somewhere in the mid-3% range. While that could certainly happen, as per my points above, it isn’t my base-case scenario.

My advice is that borrowers resist the urge to try to time the market, because in the vast majority of cases, most won’t do that successfully. No one rings a bell at the perfect time to lock in, and the variable-rate conversion feature should be viewed only as a “break-glass-in-case-of-emergency” option.

If you talk yourself into a variable rate today based on the bet that fixed rates will drop further from here, and they don’t, you could find yourself stuck with an ill-fitted mortgage.

Instead, I advise you to choose an option that you are prepared to live with over its full term, and then re-evaluate at renewal time. The Bottom Line: GoC bond yields increased last week, despite the BoC’s 0.50% cut and the increasingly dovish tilt in its accompanying communications.

The Bottom Line: GoC bond yields increased last week, despite the BoC’s 0.50% cut and the increasingly dovish tilt in its accompanying communications.

They were pulled higher by their US Treasury equivalents, which rose in response to stronger-than-expected economic data and the increased probability that Donald Trump will win the US presidential election and enact policies that will fuel higher US inflation.

Our variable mortgage rates moved lower by 0.50% in direct response to the BoC’s cut. For the reasons outlined above, I think there is substantial room for their further decline over the near term.