The Latest Canada and U.S. Employment Data Raise the Same Vexing Question

May 8, 2017Canadian Mortgage Rates Explained: Why a Smaller Down Payment Comes with a Lower Mortgage Rate

May 23, 2017 It’s time to take another look at a mortgage question that is as old as the hills: Should you go with a fixed or variable mortgage rate?

It’s time to take another look at a mortgage question that is as old as the hills: Should you go with a fixed or variable mortgage rate?

In today’s post I outline the key points for and against each option and offer my take on which one is likely to save you money over the next five years.

Three Reasons to Choose Today’s Five-Year Fixed Rate

- Stability and a good night’s sleep – If you lock in a five-year fixed rate, you can basically “set it and forget it”. For the next five years, the economic headlines may garner your interest, but they won’t affect your interest rate. And while it’s true that you still face the risk that your rate might rise at renewal, at that time your mortgage will have five-years’ worth of principal paid against it, and that is a powerful mitigant. To use an example, a $300,000 five-year fixed-rate mortgage at a rate of 2.39% amortized over 25 years today comes with a monthly payment of $1,327. If a borrower makes only the minimum payments on this loan, the balance at renewal will be $253,349. If five-year fixed rates have risen to 4% by that time, in a worst-case scenario this borrower can re-extend their amortization and lock in a monthly mortgage payment of $1,332 for the following five years (and that’s if rates increase by 67% relative to where they are now).

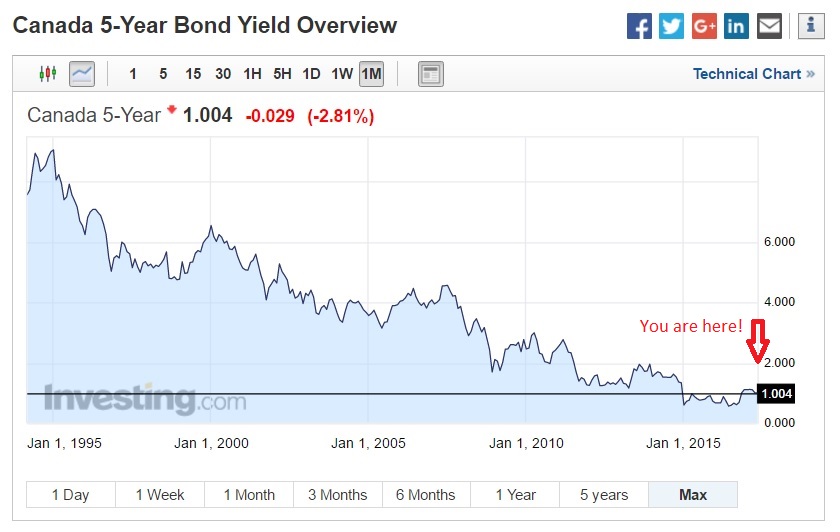

- You will be locking in one of the lowest five-year fixed rates in Canadian history – Five-year fixed mortgage rates are priced on Government of Canada (GoC) five-year bond yields, which are still bouncing along at near all-time lows. (See chart of GoC bond yields since 1995 from Investing.com below.) Even if you have the potential to save a little money going with a variable mortgage rate, why risk being wrong when you can lock in a rate that previous generations could only dream of?

- The spread between today’s five-year fixed and variable mortgage rates is narrow – Today, depending on the size of their down payment, purchasers can lock in a five-year fixed rate at around 2.40% and a five-year variable rate at around 2.00%. That 0.40% premium is effectively the cost of buying rate insurance for the next five years, and when the spread between five-year fixed and variable rates is that narrow, it is considered cheap by historical standards. (To give today’s fixed/variable spread some context, consider that it has been wider than 1.00% for extended periods over the past decade.)

Three Reasons Not to Choose Today’s Five-Year Fixed Rate

- Five-year fixed rates come with higher penalties, in some cases, much higher – If you break a variable-rate mortgage, you typically pay a penalty that is equal to three months’ interest, but if you break a fixed-rate mortgage, your penalty is calculated as the greater of three months’ interest or interest-rate differential (IRD). IRD penalties can work out to a lot more than three months’ interest, and if you take a fixed-rate mortgage from a major bank, shockingly more. (Here is a post I wrote that explains the different IRD calculations that lenders use in detail.) Higher penalties limit your future flexibility, and over a five-year time period that can really come back to bite you.

- Variable rates have proven to be cheaper about 90% of the time – There was a much-publicized study done by Dr. Moshe Milevsky, a finance professor at York University, called Floating Your Way to Prosperity, which showed that the five-year variable rate saved Canadians

money about 90% of the time between 1950 and 2000 when compared to its fixed-rate equivalent. (The average variable-rate saving over fifteen years was a little more than $20,000 for every $100,000 borrowed, so we’re not talking about small potatoes here.) It’s true that past may not necessarily be prologue, because mortgage rates generally fell over the period that Dr. Milevsky studied and variable mortgage rates will always beat fixed mortgage rates in a falling rate environment. But variable rates can also win in flat or even slowly rising rate environments, and as such, the odds say that over most longer-term time horizons the five-year fixed rate is still likely to end up costing you more money.

money about 90% of the time between 1950 and 2000 when compared to its fixed-rate equivalent. (The average variable-rate saving over fifteen years was a little more than $20,000 for every $100,000 borrowed, so we’re not talking about small potatoes here.) It’s true that past may not necessarily be prologue, because mortgage rates generally fell over the period that Dr. Milevsky studied and variable mortgage rates will always beat fixed mortgage rates in a falling rate environment. But variable rates can also win in flat or even slowly rising rate environments, and as such, the odds say that over most longer-term time horizons the five-year fixed rate is still likely to end up costing you more money. - It’s a safe fixed-rate choice, but a more expensive one – The scope of this post is limited to a comparison between the five-year fixed and variable mortgage rates, but I should mention that borrowing at shorter-term fixed rates has also often proven to be a cheaper longer-term financing strategy when compared to the five-year fixed rate. Bluntly put, if you choose the five-year fixed, you’re probably leaving some money on the table.

Three Reasons to Choose Today’s Five-Year Variable Rate

- You save money at the outset, and even if your variable-rate rises during your term, you can still end up better off – If you choose a variable rate today you are instantly saving money over its fixed-rate equivalent and that will be true for as long as today’s rates hold steady. The Bank of Canada (BoC) overnight rate is used to set variable-rate pricing and BoC Governor Poloz’s recent comments make it reasonable to assume that the Bank doesn’t plan to start raising it until at least the summer of 2018, at the earliest. Furthermore, the BoC has said that when it eventually does raise its policy rate, it will do so more slowly than in past rate-rise cycles. The longer the BoC takes to start raising rates, the more variable-rate borrowers will save in the meantime, and if the BoC then raises its policy rate slowly, some of that saving will continue past the BoC’s first rate rise. Variable-rate borrowers can add an additional prepayment to their regular mortgage payment that is equivalent to the amount they are currently saving versus the five-year fixed-rate. This will accelerate their rate of mortgage repayment and further increase their savings buffer. (I outline how to use this technique in detail in this prior fixed vs. variable post.)

- The penalty to break a variable-rate mortgage is only three months’ interest – The penalty to break a standard five-year variable-rate mortgage is often much smaller than the cost to break a five-year fixed-rate mortgage. That ensures that if you decide to either sell, renovate, or refinance mid-term, you are not restricted by the cost of your break fees. The cheaper three months’ interest penalty also gives you some leverage when negotiating with your existing lender mid-term because if their offer isn’t competitive, the cost to take your business elsewhere is manageable.

- You will only be approved for a variable-rate mortgage if you can withstand more than a doubling of your payment over the next five years – Borrowers who are considering a variable-rate mortgage are often concerned about the risk of being turned out

of house and home if their rate rises dramatically. Our regulators worry about that to, and to address that risk they instituted a rule in 2010 that requires anyone who applies for a variable-rate mortgage to qualify using the BoC’s Mortgage Qualifying Rate (MQR), also commonly referred to as the “stress-test rate”. This means that when the lender underwrites your loan application, they must calculate your mortgage payment using the MQR, which today is 4.64%, and only borrowers whose incomes can support having to make these significantly higher payments are approved. The MQR greatly reduces the risk that any mortgage borrower who gets approved for a variable-rate mortgage today will lose their home if rates rise in future, even dramatically so.

of house and home if their rate rises dramatically. Our regulators worry about that to, and to address that risk they instituted a rule in 2010 that requires anyone who applies for a variable-rate mortgage to qualify using the BoC’s Mortgage Qualifying Rate (MQR), also commonly referred to as the “stress-test rate”. This means that when the lender underwrites your loan application, they must calculate your mortgage payment using the MQR, which today is 4.64%, and only borrowers whose incomes can support having to make these significantly higher payments are approved. The MQR greatly reduces the risk that any mortgage borrower who gets approved for a variable-rate mortgage today will lose their home if rates rise in future, even dramatically so.

Three Reasons Not to Choose Today’s Five-Year Variable Rate

- If today’s five-year variable rate ends up saving you money, it probably isn’t going to be that much – With the spread between five-year fixed and variable mortgage rates this narrow (at about 0.40% today), if the variable rate proves cheaper over the next five years, the actual savings aren’t likely to be significant. Also, remember that the last two times the BoC cut its overnight rate by 0.25%, lenders only passed on 0.15% of each discount. So even in the unlikely event that the Bank drops the overnight rate further, there is no guarantee that any of that additional saving will be passed on to you. Given that, the 0.40% or so that you are saving with a variable rate on day one is probably going to be as good as it gets, and only for as long as it lasts.

- The option to convert to a fixed rate at any time is over-rated (and expensive to use) – Variable-rate borrowers take comfort in the fact that they can always convert to a fixed rate with a term that is equal to or greater than the time remaining on their current variable-rate mortgage at any time, but this option is over-rated, for two reasons. First, conversion rates are never as aggressively priced as those offered to borrowers who have yet to walk through the lender’s front door, so don’t expect to be offered best rates if you call your lender to convert mid-term. (Lenders have different policies for the rates they offer at conversion, so it’s good to ask about these upfront.) Second, fixed rates will almost always rise before variable rates, so by the time variable-rate borrowers are getting nervous enough to think about converting, today’s fixed rates will be long gone. Studies have shown that variable-rate borrowers who convert mid-term typically end up paying more than those who chose a five-year fixed rate at the outset, so I only recommend a variable rate to borrowers who are committed to sticking with their initial choice for the full five years in all but the most extreme interest-rate scenarios.

- It’s tougher to qualify for a variable-rate mortgage – As per the MQR point made above, borrowers who want a variable-rate mortgage are

qualified using a tougher standard, which limits their affordability. For example, let’s assume that a borrower earns $80,000/year, has no additional debt, and has 20% of the purchase price of a property as a down payment. If that borrower chooses a five-year fixed rate at 2.40%, they can afford to buy a house for approximately $670,000, but if they want a variable-rate mortgage, their maximum purchase price drops to about $530,000.

qualified using a tougher standard, which limits their affordability. For example, let’s assume that a borrower earns $80,000/year, has no additional debt, and has 20% of the purchase price of a property as a down payment. If that borrower chooses a five-year fixed rate at 2.40%, they can afford to buy a house for approximately $670,000, but if they want a variable-rate mortgage, their maximum purchase price drops to about $530,000.

When borrowers ponder the fixed-versus-variable question, most of them base their view on a guess about where interest rates are headed. But as you can see from the points made above, there are many other factors to consider such as penalties, conversion options, qualifying rules, and so on.

For my part, I think that the five-year variable rate is still likely to save borrowers money over the next five years. It’s true that the current spread between fixed and variable rates is narrow, but that’s because the market believes that interest rates aren’t likely to rise in the near future.

I subscribe to the macro view that long-term trends are largely responsible for the low-rate environments that exist in most of the world’s developed countries today. These include: aging populations with increased appetites for fixed-income assets, public and personal balance sheets with excessive levels of debt that are suffocating economic momentum, and economies where supply can quickly rise to meet demand and where inflation is benign as a result. (I’m also concerned that the U.S. economy is headed for a recession this year, but I’ll go into more detail on that topic in a future post.)

Notwithstanding that view, I see only a limited upside inherent in today’s variable rates, so if you’re a person who is going to lie awake at night worrying that your mortgage rate might rise, perhaps paying a little more for the stability of the fixed rate will be worth it, for peace of mind alone.

Of course, there are other people who lie awake worrying that they’re paying too much interest, and if you count yourself in that group, variable-rate options are still worth a look (especially if you partner with an experienced mortgage broker who can assist you by keeping a vigilant eye on economic developments that might impact your rate).

Five-year GoC bond yields rose two basis points this week, closing at 1.00% on Friday. Five-year fixed-rate mortgages are available at rates as low as 2.34% for high-ratio buyers, and at rates as low as 2.39% for low-ratio buyers, depending on the size of their down payment. Borrowers looking to refinance should be able to find five-year fixed rates in the 2.54% to 2.69% range.

Five-year variable-rate mortgages are available at rates as low as prime minus 0.80% (1.90% today) for high-ratio buyers, and at rates as low as prime minus 0.70% (2.00% today) for low-ratio buyers. If you are looking to refinance, you should be able to find five-year variable rates around prime minus 0.45%, which works out to 2.25% using today’s prime rate of 2.70%.

The Bottom Line: As is true of most things in life, mortgage decisions that look simple from distance become complex as you learn more about them. For an informed borrower, the fixed-versus-variable decision should come down to more than just a guess about where they think rates are headed in future, for the reasons outlined above. But since everyone loves a rate forecast, here is my current read of the tea leaves: I think the five-year variable rate still offers some upside, but probably only enough to buy a couple of nice dinners out on the town, and not enough to also pay for the cases of Pepto-Bismol you’ll need if you’re going to drive yourself crazy worrying about every new interest-rate headline that hits the wires.

guess about where they think rates are headed in future, for the reasons outlined above. But since everyone loves a rate forecast, here is my current read of the tea leaves: I think the five-year variable rate still offers some upside, but probably only enough to buy a couple of nice dinners out on the town, and not enough to also pay for the cases of Pepto-Bismol you’ll need if you’re going to drive yourself crazy worrying about every new interest-rate headline that hits the wires.