Canadian Employment Surges, But Bond Yields Don’t

July 12, 2021Mortgage-Rate Primer – Five Key Recent Posts

July 26, 2021The Bank of Canada (BoC) held its policy rate steady last week as expected.

The Bank’s latest policy statement was accompanied by BoC Governor Macklem’s press conference and the release of its latest quarterly Monetary Policy Report (MPR), which offered a detailed assessment of current economic conditions both at home and abroad.

If you’re keeping an eye on mortgage rates, this is where the rubber meets the road.

The BoC’s recent guidance continues to be hotly debated among market watchers.

Some prominent Canadian economists predict that inflationary pressures will force the BoC to start hiking sooner. For my part, I think the Bank’s next rate hike is more likely to be delayed, especially if the US Federal Reserve doesn’t move first. (As I explain in this post, if the BoC raises ahead of the Fed, that would almost certainly cause the Loonie to soar against the Greenback, thereby undermining our critically important export sector.)

In its latest communications, the Bank reiterated that it still expects to raise its policy rate, which our variable mortgage rates are priced on, “some time in the second half of 2022” and laid out its forecast to support that view.

While it doesn’t directly control the Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, the BoC’s guidance around the timing of policy-rate changes and its growth and inflation forecasts typically impact these rates as well.

(Case in point: Since last Wednesday, when the BoC reiterated its prediction that our current inflation run-up will prove transitory, the 5-year GoC bond yield has fallen from 0.97% to 0.88%.)

Here are the highlights from the BoC’s latest communications, along with my take on the implications for our mortgage rates.

The Path of the Virus …

The BoC assessed that “the downside risks associated with the pandemic have significantly diminished” since its April MPR.

It now expects “broad immunity” to be achieved in “the third quarter of 2021 in Canada”, and its base case also assumes that all our domestic lockdowns will cease (permanently) by the end of the third quarter of 2021.

The Bank noted that the US vaccine rollout is progressing “at a slower pace than anticipated”, and it now expects US herd immunity to be reached “at a slightly slower pace”. The pace of US vaccinations is an important development because the BoC is counting on a “strong US recovery” to “support robust export growth over the projection horizon”.

The BoC tempered its more optimistic assessment of pandemic progress with an acknowledgement that “the emergence of new variants … continues to add uncertainty into the outlook.”

On the Economic Recovery …

The Bank assessed that global economic momentum is now strengthening after “weakness in the first quarter” and predicted that it will remain “highly uneven” until vaccination rates are significantly increased in emerging market economies.

It noted “particularly strong” growth in the US due to “substantial fiscal stimulus” and its “more advanced … reopening phase”.

Whether that strength will continue is an open question. US fiscal stimulus programs are due to wind down in the fall, US vaccination rates are plateauing, and infection rates from new variants, particularly the Delta variant, are rising in many US states.

Interestingly, the BoC is now decidedly more optimistic about US economic growth than is the Fed. The Bank is now forecasting US GDP growth of 5.1% in 2022, whereas the Fed’s latest 2022 forecast, once adjusted using the same methodology, is only 3.3%. (Hat tip to David Rosenberg for that observation.)

On the home front, the BoC noted that the reintroduction of lockdowns during the third wave led to “weaker than estimated” growth in Q2, but it expects growth to “pick up strongly in the third quarter as the economy reopens”.

The Bank is “increasingly confident that growth will rebound strongly” and that “this time growth will be more durable”. It expects consumption to “lead the rebound” and estimates that about 20 percent of the cash that has built up on household balance sheets will be deployed over its projected horizon.

Thereafter, the BoC predicts that our economic momentum will become more “broad-based and self-sustaining” as rising export demand fuels a “robust” pick-up in business investment.

On that note, the best question at BoC Governor Macklem’s press conference came from Greg Bonnell at BNN Bloomberg.

He pointed out that the BoC has long predicted that rising export demand and increased business investment will take the baton from consumer spending and become the primary drivers of our economic momentum, but to no avail.

He then asked Governor Macklem to explain where this unrequited hope comes from, and Governor Macklem responded that the Bank’s belief is underpinned by its business surveys, which indicate increasing confidence and “broad-based strength in investment intentions”.

Those same surveys have been leading the BoC down the same garden path dating back to the days when Mark Carney was the BoC Governor (for reference, check out my comments in this 2013 post). At this point, the Bank’s pattern of continuing to overvalue that feedback looks a lot like willful blindness.

The Bank did temper its increased optimism with acknowledgements that our recovery process is likely to be “lengthy”, “uneven”, and “bumpy”, and that our economy “continues to require extraordinary monetary policy support”.

On Inflation …

Now on to the hot topic of the day.

The BoC once again took pains to explain why it continues to believe that our current inflation run-up will prove transitory.

It attributed our recent spike to three primary factors: 1) the normalization of gasoline prices after they plummeted at the outset of the pandemic, 2) the normalization of other prices that experienced the same phenomenon, and 3) temporary production constraints and shipping bottlenecks that have been caused by demand rebounding more quickly than supply.

The BoC is forecasting that these temporary factors will cause inflation to run above target for the remainder of 2021 before easing back to about 2 percent in 2022. After that, it projects that inflation will temporarily rise above the 2% target again in 2023 as our output closes.

The BoC is forecasting that these temporary factors will cause inflation to run above target for the remainder of 2021 before easing back to about 2 percent in 2022. After that, it projects that inflation will temporarily rise above the 2% target again in 2023 as our output closes.

(As a reminder, the output gap measures the gap between our economy’s actual output and its maximum potential output.)

That part of the forecast is noteworthy because normally the BoC would begin to tighten its monetary policy in anticipation of the output gap closing. That’s because it takes time for policy-rate changes to work their way through the economy, and the Bank would normally focus on preventing inflation from overshooting. But this time around it has committed to hold its policy-rate steady until the output gap fully closes.

That is a contentious detail.

The BoC is now telling financial markets that it intends to let the economy run hot and temporarily overshoot its 2% target both now and again in 2023. BoC Governor Macklem emphasized that the Bank’s broader inflation target range of 1% to 3% gives it the flexibility to do this, and that while this step is unusual, both the Bank and the Fed deem it appropriate given the severity of the economic shock caused by the pandemic.

Some market watchers are warning that the Bank will be playing a dangerous game by doing this and that it may not be able to put the inflation Genie back in its bottle. (For my part, I find that argument unconvincing because record-high debt levels will magnify the impact of each BoC rate increase and thereby enhance its ability to bring inflation to heal.)

On Tapering …

The BoC announced that it will continue to taper its quantitative easing (QE) purchases, this time from $3 billion to $2 billion per week.

It attributed the rationale for this move to “continued progress towards recovery” and “increased confidence in the strength of the Canadian outlook”.

I guess that’s one way to spin it.

The other obvious reason for the BoC’s continued tapering, as I have written before, is that the Bank now owns about 40% of all the outstanding GoC bonds and is fast approaching the point where there won’t be enough other bonds left in circulation to ensure a liquid market.

On Jobs …

BoC Governor Macklem observed that our economy is about 500,000 jobs short of where it needs to be for our employment rate to recover to its pre-pandemic level.

He also highlighted concerns about a spike in the number of long-term unemployed workers who have been out of the labour market for more than a year and noted the mismatch between worker skills and employer requirements, which will “take time to reconcile”.

Most significantly, and in direct contradiction to anecdotal feedback about employers having to hike wages to entice people back to work, the Bank noted in its MPR that “wage inflation remains subdued”. (You can read my full write-up on our most recent employment data here.)

On the Loonie …

BoC Governor Macklem offered some interesting commentary on the Canada/US exchange rate, which he acknowledged “is always a tricky topic” because the Bank is careful not to be seen as trying to influence the Loonie’s value.

He said that if the Loonie appreciates against the Greenback because exports are strong and the economy is doing well, “that’s good news”. But if the Loonie moves higher because the US dollar is broadly depreciating “as we have seen over the past year … that would be bad”.

If the BoC doesn’t believe the Loonie’s recent rise is a positive signal, that should heighten its concern that maintaining a distinctly more aggressive monetary policy stance than the Fed, which is still holding out for “substantial further progress”, will almost certainly cause it to appreciate further.

On the BoC’s Confidence in Its Rate-Hike Timetable …

Financial markets put a lot of stock in the BoC’s forward guidance, but lest we assign too much certainty to the Bank’s guidance, a sampling of the various qualifiers included with its latest communications are worth reviewing:

- “Many sources of uncertainty surround the medium-term outlook”

- “Estimates of when the output gap will close are particularly uncertain”

- “The uncertainty around the output gap and inflation remains high” and “because of this, the estimated timing for when slack is absorbed is highly imprecise”

- “Uncertainty around the projection remains unusually high”

The Bank may be increasingly confident about the recovery, but it sounds much less sure about the timing of its next rate hike.

Now let’s conclude this post with my take on the implications for our mortgage rates.

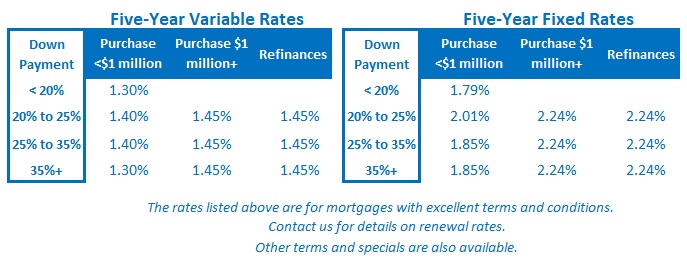

I continue to believe that today’s variable rates are likely to save money when compared to their current fixed-rate equivalents over the next five years.

I am concerned that the economic recovery on both sides of the border will be impacted by virus variants, especially in the US, where vaccine hesitancy is more prevalent.

I’m also not buying the BoC’s bet on a robust and sustainable US rebound, or relatedly, the export and business investment-led recovery that it expects us to enjoy as a result.

Lastly, while I agree with the Bank’s assessment that today’s inflationary pressures will likely dissipate as our economy works through its reopening phase, I am less confident that we will then build enough sustainable momentum to close our output gap along the BoC’s expected timeline.

Simply put, we live in volatile and uncertain times, and that reality makes muddle-through scenarios seem much more likely than the more robust outcomes the BoC is hoping for (and forecasting). The Bottom Line: Fixed and variable rates were unchanged last week and remain range bound. That trend should continue over the near term, especially given the BoC’s reassurance last week that it will look through our current inflation run-up even if it lasts longer than originally expected.

The Bottom Line: Fixed and variable rates were unchanged last week and remain range bound. That trend should continue over the near term, especially given the BoC’s reassurance last week that it will look through our current inflation run-up even if it lasts longer than originally expected.