Canadian Mortgage Rate Update: A Busy Week for New Economic Data

July 4, 2023The Bank of Canada Tightens Again

July 17, 2023Fixed mortgage rates rose again last week, and the Bank of Canada (BoC) is expected to hike its policy rate by another 0.25% when it meets this Wednesday.

Sound familiar?

Mortgage rates have reached their highest levels in more than twenty years.

I know. Ouch.

If you’re in the market for a mortgage today, I am writing this post to help you navigate through today’s difficult environment.

First, a disclaimer.

If I knew with certainty where interest rates were going, you wouldn’t be reading this post because I would already be retired and sipping Mai Tais in the South Pacific. But here we are, and with my fallibility conceded, this is my hand-on-heart best guess on the optimal way forward for anyone who needs a mortgage today.

The recent spike in mortgage rates has been epic, but I maintain my belief that the faster they rise, the faster they will fall.

We now have record high levels of household and government debt, and the size of that debt will ultimately magnify the impact of sharply increased borrowing costs, even if we’re not seeing it yet. For now, it feels as though we have arrived at that moment in the old Road Runner cartoons where Wile E. Coyote has run over the edge of a cliff but is temporarily suspended in mid-air with his legs still spinning.

We now have record high levels of household and government debt, and the size of that debt will ultimately magnify the impact of sharply increased borrowing costs, even if we’re not seeing it yet. For now, it feels as though we have arrived at that moment in the old Road Runner cartoons where Wile E. Coyote has run over the edge of a cliff but is temporarily suspended in mid-air with his legs still spinning.

Our economy and our headline economic data are being temporarily held aloft by three primary factors:

- Pandemic savings which have enabled Canadian consumers to absorb higher costs without having to reduce their spending.

- Record levels of immigration which are boosting our national headline results.

- Variable-rate mortgages which extend mortgage amortization periods rather than increase monthly payments.

Just as in the cartoon, the timing of our inevitable drop has been delayed, but the outcome cannot be in doubt. Our pandemic savings are diminishing, immigration can’t paper over our falling productivity forever, and our variable-rate mortgages must renew every five years.

Until recently I have recommended three-year fixed rates as the safe, middle-of-the-fairway pick.

Three-year fixed rates were about 0.25% higher than five-year fixed rates, but I think that small premium was worth paying to reduce the risk of paying above-market rates in the latter stages of your term.

Two-year fixed-rate premiums had much higher premiums, which were about another 0.75% above three-year fixed rates. The shorter the term, the greater the risk that you would need to renew before rates have dropped significantly.

But our backdrop has shifted now, and that changes my assessment in two ways.

For starters, the gap between three-year fixed rates and shorter-term options has narrowed. For example, many lenders now offer two-year fixed rates that are only 0.40% above their three-year fixed-rate offerings. Therefore going shorter now costs significantly less than it did not long ago.

At the same time, if I’m right that the higher rates go now the faster they will fall on the other side, each rate rise hastens the arrival of that eventual reversal.

Important sidenote: I assume, as most observers do, that higher rates will push our economy into recession, and that our rates will fall when that happens, just as they have in every other modern recession. But if our economy slows and inflation stays high (a scenario called stagflation), rate cuts would be far less likely.

Now that I have bestowed some newfound love on two-year fixed rates, let me close with my take on what the BoC will do when it meets this Wednesday.

I’m betting on a 0.25% hike.

That belief is underpinned by a quick look back at the four key factors the Bank said at its June meeting that it would be monitoring to determine whether additional hikes will be needed.

- Excess demand – Our annualized Consumer Price Index (CPI) has dropped from 5.1% to 4.3% since the BoC’s last meeting. But note that this has only happened on an annualized basis. The CPI rose sharply on a month-over-month basis in both May and June, and the core inflation measures that the BoC watches closely have either ticked up or barely moved lower. Meanwhile, our latest retail spending data came in higher than expected, as did our most recent GDP estimate for May.

- Inflation Expectations – Consumer and business inflation expectations have come down a little, but they are still well above the BoC’s target rate of 2% when looking one, two and five years ahead.

- Wage Growth – Average year-over-year wage growth dropped from 5.1% in May to 4.2% in June, but that number was likely skewed by the fact that most of last month’s hires were younger workers who tend towards lower-paying jobs. Wage growth is probably still way too high for the BoC’s liking.

- Corporate Pricing Behaviour – In the Q2 2023 Business Outlook Survey, released on June 30, the BoC noted that “some firms are planning to make larger and more frequent price increases than usual in the coming year … because they have not yet finished passing through the cost increases they experienced during the pandemic.”

Investors now expect another rate hike over the near term, so the door is open for the BoC to hike without unduly upsetting financial markets.

Our recent string of economic data will likely compel them to do it. The Bottom Line: Government of Canada (GoC) bond yields surged higher again last week, and the five-year GoC bond yield has now broken above 4%.

The Bottom Line: Government of Canada (GoC) bond yields surged higher again last week, and the five-year GoC bond yield has now broken above 4%.

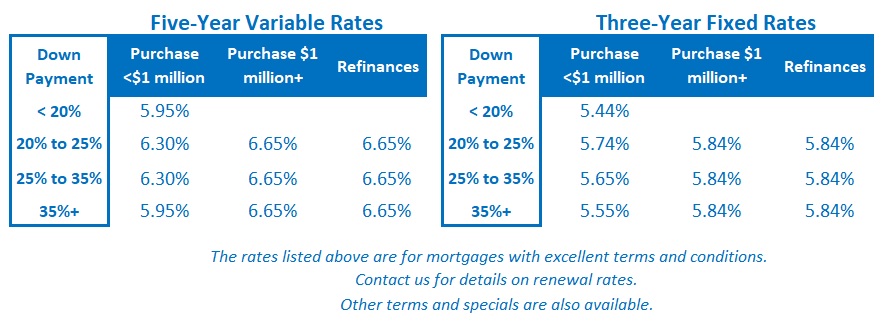

Lenders raised their fixed rates again last week. Over the near term, borrowers should expect them to continue to play catch up with the bond yields they are priced on.

Five-year variable-rate discounts were unchanged last week. I think variable-rate borrowers should expect the BoC to hike by another 0.25% this Wednesday and the bond market is now close to pricing in one additional quarter-point increase before the year is out.

Speaking of Mai Tais, I could use one about now.

2 Comments

Thank you, Dave. A very informative article as always.

In wake of the most recent rise in interest rates last week, and considering your other article dated 17 July on BoC’s perception of future, can you please share your updated recommendation to choose between two-year fixed and three-year fixed mortgages as the “safe, middle-of-the-fairway pick”?

Hi Bahman,

My advice to individual borrowers will always be specific to their individual profile and risk tolerance, but generally speaking, I still view the three-year fixed as a safe “middle-of-the-fairway” pick and the two-year fixed rate as a more aggressive bet.

Best regards,

Dave