What Disappointing GDP Growth Means for Canadian Mortgage Rates

December 2, 2024The Bank of Canada Cuts Again (and More Should Still Be on the Way)

December 16, 2024

Last Friday brought some surprising holiday cheer for anyone keeping an eye on Canadian mortgage rates.

We learned that overall job growth in both Canada and the US came in above their consensus forecasts in November.

Normally, bond-market investors would respond to upside surprises by bidding up yields, based on the belief that increased hiring would fuel rising labour costs and stoke inflation pressure. But that didn’t happen this time.

Instead, investors looked beyond the impressive headline results to the far less impressive details and pushed bond yields sharply lower in response.

In Canada, we added 51,000 new jobs in November, about double the consensus forecast. But we also added 138,000 new workers to our labour force last month, causing our unemployment rate to increase to 6.8% in November. According to Statistics Canada, that’s the highest it has been since January 2017.

Average wage growth fell sharply from 4.9% to 4.1% (annualized), average hours worked declined by 0.2%, and the unemployment rate for prime-aged workers (ages 25 to 54) increased to 5.8%, the highest it has been since December 2016.

The key takeaway from this most recent round of employment data is that our supply of labour is increasing more quickly than the demand for it.

That trending imbalance should cause wage growth to cool further so, at the very least, the Bank of Canada (BoC) can be less concerned about a tight labour market stoking inflation.

Bond-futures buyers are now pricing in an 80% chance of a 0.50% rate cut by the BoC this Wednesday.

The US economy added 227,000 new jobs in November, a little above the consensus forecast. But here again, the underlying data did not live up to the banner headline (although the disparity between the headline and the details was not as marked as it was in Canada.)

Much of last month’s US employment growth was merely the recovery of jobs temporarily lost to hurricanes and strikes in October. CIBC Chief economist Avery Shenfeld noted that when November’s headline gain is combined with the 36,000 jobs created in October, the resulting average run rate falls below the twelve-month trend.

In other words, US job-growth momentum is slowing.

The US unemployment rate increased from 4.1% to 4.2% last month, and it would have been higher still if the US labour participation rate hadn’t fallen for the third straight month. (The US participation rate measures the percentage of American workers who are either working or actively seeking employment.)

The details of the US employment data aren’t as concerning as the latest Canadian results, but US bond market investors have also concluded that labour costs are unlikely to be a meaningful source of near-term inflationary pressure.

US bond traders responded to their latest employment data by increasing the odds of a 0.25% rate cut by the Fed on December 18 to 86%.

The Bottom Line: Government of Canada bond yields fell sharply on Friday, and just like that, they have now completely reversed all the earlier run up associated with Donald Trump’s election win.

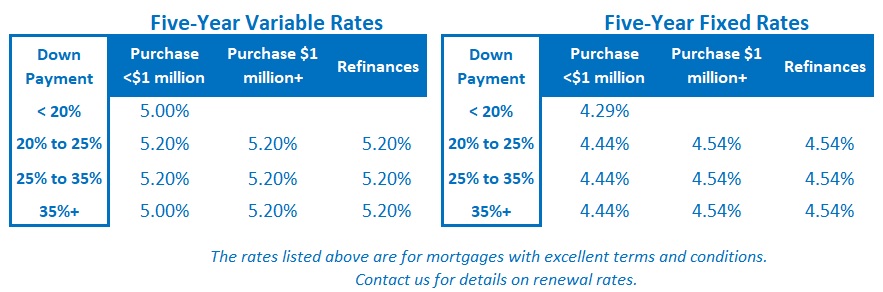

As a result, lenders should start cutting their fixed mortgage rates in short order.

There is also broad consensus that the BoC will cut by 0.50% this Wednesday.

The Bank’s policy rate now stands at 3.75%. At that level it is still restricting demand at a time when our economy looks increasingly like it could use some help stimulating it instead.

A more accommodative policy rate is overdue. Put me down for a 0.50% rate cut this week.