How the US Fed’s Latest Decision Will Impact Canadian Mortgage Rates

June 17, 2024Will Last Month’s Inflation Uptick Alter the Bank of Canada’s Plans?

July 2, 2024

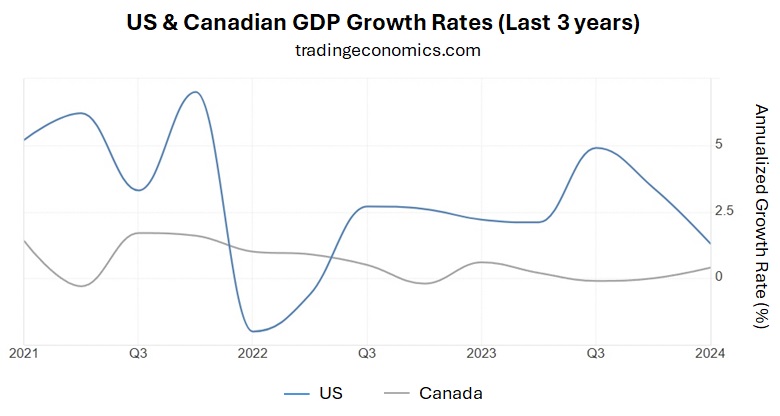

It doesn’t take long for anyone keeping an eye on Canadian mortgage rates to see the impact on them from US economic developments.

Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, closely follow their US Treasury equivalents. US Treasury yields have risen this year because the US economy has been stronger than expected. That has pulled GoC bond yields higher at a time when a weaker Canadian economy would otherwise be pulling them lower.

The Bank of Canada’s (BoC) policy rate, which our variable mortgage rates are priced on, is directly tied to Canadian economic momentum. But the Bank’s policy rate can’t be much lower than the US Federal Reserve’s policy rate without causing the Loonie to weaken against the Greenback. As such, US economic momentum exerts some gravitational pull on our variable mortgage rates as well (although less than with fixed rates).

The US economy has consistently outperformed the Canadian economy since the end of the pandemic. That is now changing (see chart).

The US economy is slowing, in part, because some of the forces that had been giving it a short-term boost are either waning or are likely to wane soon.

The US federal government is spending far more than it is taking in. According to economist David Rosenberg, the US deficit-to-GDP ratio now stands at 6.5%. That deficit level has only been exceeded twice: at the depths of the US housing crash in 2008 and at the start of the pandemic in 2020. The US federal government can’t maintain that level of spending for much longer. (For reference, Canada’s current deficit-to-GDP level is 1.5%.)

US consumers, who account for about two-thirds of the US GDP, have now spent most of their pandemic savings. The US saving rate currently stands at 3.6%, well below its long-term average of 8.5%. (By comparison, Canada’s saving rate is currently 6.2%, slightly above its long-term average of 6.0%.)

Edward Jones investment strategist Angelo Kourkafas recently observed that “U.S. personal income, which includes government benefits, interest and dividends in addition to wages and salaries, has grown faster than inflation (up 28% since 2020) thanks to government support and stimulus measures in the early days of the COVID-19 pandemic. But as excess savings deplete, the impact of inflation is becoming more intense”.

In other words, US consumers used their pandemic savings to maintain spending despite higher prices. Since that savings cushion has now mostly dissipated, the bite on demand from higher prices is intensifying.

In addition, higher mortgage rates have had a more lagged impact in the US than in Canada. US mortgage borrowers typically lock in their fixed-rate mortgages for thirty-year terms, whereas Canadian fixed-rate mortgages tend to be locked in for five years or less.

David Rosenberg recently observed that US debt-servicing costs currently absorb about 10% of after-tax incomes as compared to 15% in Canada. That’s not surprising when you consider that about 50% of Canadian mortgagors have renewed at higher rates thus far, compared to far fewer US renewers. Americans have been avoiding buying or selling houses to avoid higher mortgage rates but cannot do this forever. (Importantly, US mortgages aren’t portable.)

Longer lags have helped prolong the current run of US economic expansion, but they didn’t repeal the laws of the business cycle.

I expect the US economy to slow more sharply over the months ahead as the boosts from aggressive deficit spending and a sharp savings drawdown continue to wane. If that happens, concerns about the divergence between the US and Canadian economic trajectories will abate, and so will much of the current US-based pressure on GoC bond yields.

Mortgage Selection Advice for Now

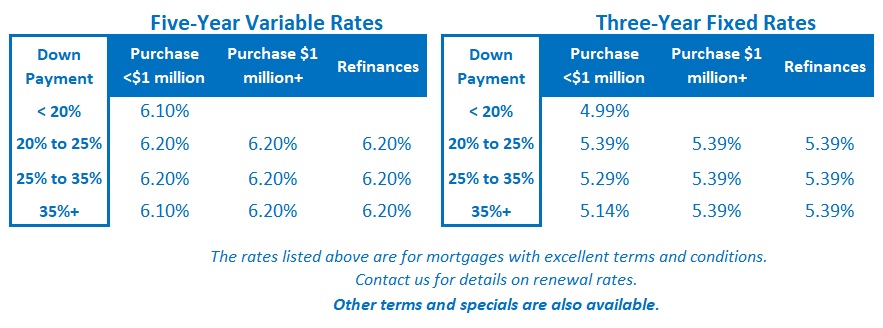

The BoC’s policy rate has started to fall from what appears to have been its peak for the current interest-rate cycle. If that continues, today’s five-year variable-rate mortgages should prove cheaper than any of today’s fixed-rate options over their five-year term.

That said, anyone choosing a variable rate today must be willing to accept a higher initial rate and comfortable with the inherent risk that it will fluctuate.

Alternatively, I think more conservative borrowers are well advised to consider three-year fixed-rate terms. The premiums required for one- and two-year fixed rates remain substantial, and while five-year fixed-rate terms are offered at lower rates, I still worry that five years may be too long to be locking in when rates are near their cycle peaks. The Bottom Line: GoC bond yields were rangebound last week. Lenders have been slow to cut fixed rates in response to the earlier drop in bond yields, but there is room for them to drop. That will likely happen soon.

The Bottom Line: GoC bond yields were rangebound last week. Lenders have been slow to cut fixed rates in response to the earlier drop in bond yields, but there is room for them to drop. That will likely happen soon.

Variable-rate discounts were unchanged last week. I expect that the BoC will continue to lower its policy rate over the short term, with the next cut probably coming at the Bank’s meeting on July 24.