Are Higher Fixed Mortgage Rates Here to Stay?

March 28, 2022How the 2022 Federal Budget Will Impact Our Real-Estate Markets

April 11, 2022 Surging Government of Canada (GoC) bond yields have recently pushed our fixed mortgage rates significantly higher. They have risen by an average of about 1% across different loan-to-values and product types, marking the fastest run-up that I can remember in my two decades in the mortgage industry.

Surging Government of Canada (GoC) bond yields have recently pushed our fixed mortgage rates significantly higher. They have risen by an average of about 1% across different loan-to-values and product types, marking the fastest run-up that I can remember in my two decades in the mortgage industry.

The Bank of Canada (BoC) has hiked its policy rate by only 0.25% thus far over that same period, and right now five-year variable rates are available at discounts of 1.50%, or more, over their fixed-rate equivalents. But that is about to change.

The Bank is now widely expected to accelerate its tightening pace. Our bond futures market is pricing in about 70% odds that it will hike by 0.50% at its next meeting on April 13, something it hasn’t done since May 2020.

The BoC has bolstered that view in its recent communications. For example, in a speech given on March 25, Deputy Governor Sharon Kozicki reiterated the Bank’s “unwavering commitment” to bring inflation back to its 2% target and said that they “are prepared to act forcefully” to achieve that end.

There is certainly a reasonable argument to be made for a 0.50% hike.

Most market watchers expect the Bank to raise by a total of anywhere from 1% to 2% over the remainder of this year, so the timing of the individual increases is the only missing detail.

Hitting the brakes harder in the early stages could also create even more impact by producing a kind of shock-and-awe effect. If it worked, that approach might mean that less overall tightening will be required. A rare 0.50% hike would also bolster the BoC’s inflation-fighting credentials and help anchor medium and longer-term inflation expectations at a time when the Bank has faced criticism for being behind the curve on inflation.

All that said, the magnitude of the BoC’s next rate hike won’t impact my continued belief that variable rates are still a good bet to save money over their fixed-rate equivalents over the next five years (as I outlined in this recent post).

For starters, financial markets have a well-established track record of overreacting during volatile periods, and especially when one-time events are causing the significant but temporary effects that we are currently witnessing with both the pandemic and the war in Ukraine.

Also, if the BoC is determined to cool inflation by reducing demand until it meets supply at its currently impaired levels, there are factors beyond policy-rate hikes that are already helping in that regard.

For example, the significant run-up in our fixed mortgage rates is impacting our economy in many of the same ways that BoC rate hikes will do, and today’s surging food and energy prices are pulling money away from other forms of discretionary spending.

Most importantly, our elevated government and household-debt levels will magnify the impact of rate hikes, and it stands to reason that, against that backdrop, fewer hikes will ultimately be required.

Anyone starting a five-year variable-rate term today is no doubt focusing on how much higher their rate will go over the near term. That is understandable. But they should also remember that the bond market continues to price in BoC rate cuts in 2024 under the assumption that the Bank will end up overtightening and will have to reverse course when the economy slows by more than expected. (If that ends up happening, anyone starting a variable-rate mortgage today will be only about halfway through their term at that point.)

As we head toward the choppier variable-rate waters ahead, this seems like a good time to remind everyone that not all variable-mortgage payments respond to rate increases in the same way.

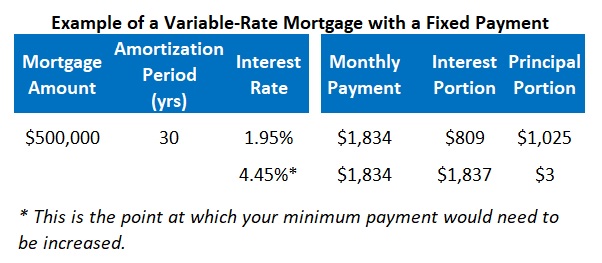

Some variable-rate mortgages come with payments that move up or down each time their underlying rate changes. These are referred to as adjustable-rate mortgages (ARMs). But other variable-rate mortgages come with fixed payments that don’t change until you reach the point where they are no longer covering the interest cost. (That would take an increase of about 2.5% today – and the chart below provides an example.) When variable rates rise, fixed payment mortgages defer the extra interest cost by reducing the amount of principal repayment. That said, you still have the option to voluntarily increase your payment each time your rate rises, but those increases don’t happen automatically, as they would if you opted for the ARM product instead.

When variable rates rise, fixed payment mortgages defer the extra interest cost by reducing the amount of principal repayment. That said, you still have the option to voluntarily increase your payment each time your rate rises, but those increases don’t happen automatically, as they would if you opted for the ARM product instead.

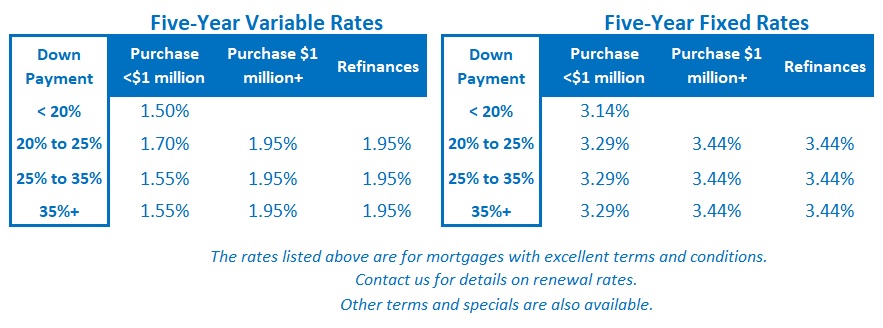

While no one wants to be passing their mortgage debt on to their grandkids, which you might end up doing if your fixed-payment variable rate moved materially higher and remained there for an extended period, the flexibility offered by that option might provide a useful cash-flow buffer during periods of shorter-term rate volatility. The Bottom Line: Five-year fixed rates continued their seemingly inexorable climb higher last week, and the offerings of several large lenders are now 4%+. I don’t see any signs that this upward trend will reverse in the near future.

The Bottom Line: Five-year fixed rates continued their seemingly inexorable climb higher last week, and the offerings of several large lenders are now 4%+. I don’t see any signs that this upward trend will reverse in the near future.

Five-year variable mortgage rates will almost certainly rise again when the BoC next meets on April 13, and perhaps by 0.50% instead of the standard 0.25%. But for the reasons outlined above, I continue to believe that there is a good chance that variable rate mortgages will still save money when compared with their fixed-rate equivalents over their full five-year terms.