Employment Surges Higher. Will Mortgage Rates Follow

January 13, 2025Why the Bank of Canada Will Cut Again This Week

January 27, 2025

Last week contained noteworthy developments for anyone keeping an eye on mortgage rates.

On Wednesday, we received the latest US Consumer Price Index (CPI) data for December. It showed that overall US inflation increased for the fourth consecutive month. But bond-market investors were obviously happy with the report because they pushed US Treasury yields lower in response.

On Thursday, the Bank of Canada (BoC) announced that it would end its current quantitative tightening (QT) program in the first half of 2025. Government of Canada (GoC) bond yields fell sharply after the announcement. Of note, that drop occurred while US Treasury yields were moving higher.

Today’s post will offer my take on how these developments will impact Canadian mortgage rates – although with the start of the Trump presidency 2.0 today, the only certainty is increased financial-market volatility.

The Latest US CPI Data

The US CPI increased to 2.9% (year-over-year) in December in line with consensus expectations. This marks its fourth consecutive monthly increase after bottoming at 2.4% in September.

US core CPI, which strips out food and energy prices, fell to 3.2%, a little better than the consensus forecast of 3.3%.

Bond-market investors liked the cooling of shelter-price inflation to 4.6% in December, which marked its lowest increase since January 2022. Shelter prices comprise approximately one-third of the total CPI and have been a primary driver of US inflation since the pandemic.

The latest US inflation report didn’t seem worthy of too much celebration, but it did assuage fears that rising inflation pressure might force the US Federal Reserve to start raising its policy rate instead of cutting it further. (The latest US employment data, released two weeks ago, was much stronger than expected. That fueled speculation that the Fed might be compelled to reverse course.)

The BoC Announces That It Will End Its Quantitative Tightening Program

Last Thursday, BOC Deputy Governor Toni Gravelle announced in a speech that the Bank will end its QT program “in the first half of this year”.

To explain why this is noteworthy, let’s start with a quick recap.

When COVID hit, the BoC announced that it would start to buy billions of dollars’ worth of bonds (and other debt instruments) as part of its pandemic stimulus package. This process was referred to as quantitative easing (QE).

QE created artificial demand. This helped keep GoC bond yields at ultra-low levels at a time when our federal government was issuing huge quantities of new bonds to fund its massive deficit spending.

To put that in perspective. At peak QE the BoC was buying more than half of all newly issued GoC bonds and leaving regular market participants with unfilled orders (which raised liquidity concerns).

The BoC’s balance sheet ballooned to an unprecedented level during QE. When the pandemic ended, the Bank set about reducing it by allowing bonds it had purchased to roll back into the secondary market as they matured. That process is referred to as quantitative tightening (QT).

Whereas QE created excess demand for bonds and put downward pressure on their yields, QT creates excess supply that puts upward pressure on our bond yields.

The BoC’s plan to stop QT in the first half of 2025 will eliminate a small but steady source of upward pressure on our fixed mortgage rates. It has been impacting them for more than three years.

While the elimination of QT will likely have only a minor impact on bond yields over the long run, the announcement was enough to knock 0.20% off the five-year GoC bond yield last Thursday.

Trump 2.0

When Donald Trump is sworn in today, he will begin his new term with a bond market that hasn’t been behaving as expected lately.

Normally when the Fed starts to cut its policy rate, longer-term US Treasury yields will decrease in sympathy, but the opposite has happened this time. The benchmark 10-yr US Treasury yield has spiked about 1% higher since the Fed’s initial 0.50% rate cut in September.

That has led to speculation that bond-market investors aren’t confident the Fed will do enough to contain inflation pressures and/or that the federal government will sufficiently rein in its profligate deficit spending.

The upward momentum in US Treasury yields is a likely sign that bond-market investors are building in a Trump-related risk premium. That premium will likely remain until there is more clarity around Trump’s inflationary tariff and mass deportation threats.

The small US bond-yield rally that started after the release of the latest US CPI data on Wednesday had already dissipated by the close of business on Friday.c

Note: If you are in the market for a mortgage today and want my take on the best options currently available, check out the section labelled Mortgage Selection Advice For Early 2025 in this link.

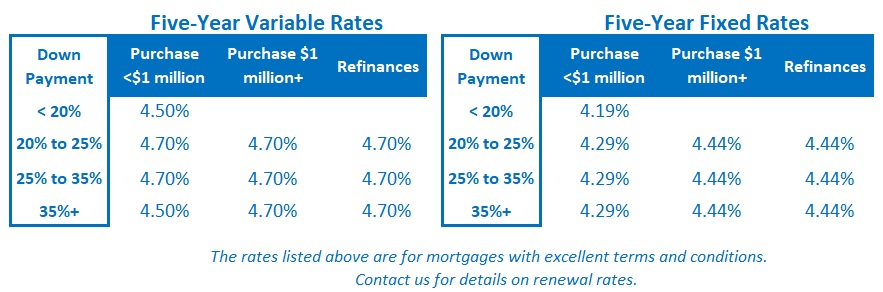

The Bottom Line: GoC bond yields fell sharply last week and have now fully retraced their recent run-up. The upward pressure on our fixed mortgage rates has therefore dissipated. The recent round of increases to our fixed mortgage rates is now being unwound.

Five-year variable-rate discounts were unchanged last week.

We will receive the BoC’s latest business and consumer surveys today, and Statistics Canada will release our CPI data, for December, on Wednesday. Both reports could serve as catalysts for the next move in GoC bond yields – but so too could the Trump tariff announcements that have been handing over our heads like the sword of Damocles.

We are living in increasingly uncertain times. Stay tuned.