What Our Inverted Yield Curve Means for Canadian Mortgage Rates

June 10, 2019Will the Bank of Canada Lag the U.S. Federal Reserve on Rate Cuts?

June 24, 2019 The U.S. Federal Reserve has sounded decidedly more dovish of late, and for good reason.

The U.S. Federal Reserve has sounded decidedly more dovish of late, and for good reason.

Recent U.S. economic data have shown slowing momentum in many key areas, such as employment growth, consumer spending, manufacturing output, export sales and home sales. Not surprisingly, the consensus now forecasts that U.S. GDP will slow sharply from 3.1% in the first quarter to around 1.8% in the second quarter on an annualized basis.

This loss of momentum comes after nine quarter-point interest rate increases by the U.S. Fed that began in December 2015. As with Bank of Canada (BoC) moves, the Fed’s rate hikes take time to assert their full impact. If we use the common assumption that this process takes an average of two years, consider that thus far, five of the Fed’s nine hikes have been on the books for less time than that.

The current U.S. economic expansion is about to become the longest in U.S. history, but the Fed’s aggressive monetary-policy tightening isn’t the only cause for concern.

The deficit-financed Trump tax cuts that were enacted in December 2017 gave the U.S. economy a powerful short-term boost that I have often likened to a “sugar high”, but those effects appear to have all but worn off. Those same tax cuts widened the U.S. federal government’s budget deficit to levels that have historically been associated with severe recessions, not record expansions, and that huge budget gap will limit its ability to provide stimulus to counteract slowing economic momentum in future.

At the same time, the U.S. trade war with China has hurt business confidence and raised consumer prices – and that’s before the impact from President Trump’s decision to increase tariffs (on $200 billion worth of Chinese goods from 10% to 25% in May) has worked its way into business sentiment surveys and the inflation data.

Speaking of U.S. inflation, it dropped from 1.9% to 1.8% in May on a year-over-year basis despite the upward pressure on prices from tariffs. Over that same period, U.S. core inflation, which strips out the most volatile components in the overall inflation measure, also fell from 2.1% to 2.0%. The Fed assessed that last month’s inflation drop was caused by “transitory factors”, but regardless, U.S. inflationary pressures appear to be well contained and should not limit the Fed’s options over the near term.

Against that backdrop, the U.S. futures market is now betting that the Fed will cut its policy rate three times over the remainder of this year, pricing in 85% odds of a 0.25% rate cut in July, 65% odds of another 0.25% cut in September, and 55% odds of a third 0.25% cut in December. For his part, Fed Chair Jerome Powell reassured financial markets in early June that the Fed “will act as appropriate to sustain the expansion”.

The Fed meets this week, and despite its dovish shift and the market’s expectation that rate cuts are on the horizon, the consensus does not think it will cut its policy rate just yet. This view is based on three main factors: 1) There is hope that the G-20 at the end of the month may lead to a breakthrough in the U.S./China trade war, 2) The Fed doesn’t want to appear to be kowtowing to President Trump’s hectoring for lower rates, and 3) The sooner the Fed cuts, the more its last rate hike last December will look like a mistake. Instead, the consensus expects that the Fed will use more dovish language at this week’s meeting to set the stage for a cut at its next meeting on July 31.

So, what are the implications for Canadian mortgage rates?

The Fed’s dovish shift should put downward pressure on the Greenback, and if it follows through with expected rate cuts in the ensuing months, that pressure will intensify.

The BoC insists that its monetary policy decisions are not influenced by what the Fed does, but experienced market watchers know better. The earth cannot ignore the sun. If the Fed cuts its policy rate and the BoC doesn’t follow suit, the Loonie will soar against the Greenback, and that will heap more suffering on our already beleaguered exporters.

Recall that the BoC is forecasting (read: hoping) that economic momentum lost from the policy-induced slowdown in Canadian consumer spending will be replaced by a rise in export sales that will then fuel increased business investment. Bluntly put, when it comes to the BoC’s projections, aspirations for increased export sales are the straw that stirs the drink.

While the BoC has made it clear that maintaining stable inflation is its primary mandate and that it will maintain price stability even if doing so creates negative side effects for our broader economy, our current inflation data give the Bank leeway to follow the Fed’s lead.

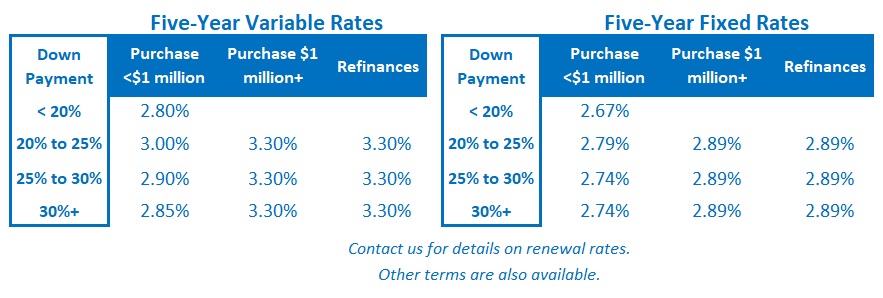

If all of this unfolds as expected, Government of Canada (GoC) bond yields could start to move lower after the Fed’s meeting this week, and that will put downward pressures on our fixed mortgage rates, which are priced on those bond yields. Variable-rate mortgage borrowers will have to wait for the BoC to actually pull the trigger on a rate cut, but in the meantime, they can at least be reassured by the increased likelihood that its next move will be a cut.

The Bottom Line: Although the Fed is not expected to drop its policy rate when it meets this week, it is expected to signal that rate cuts are a distinct possibility in the near future. If that happens, GoC bond yields should fall in concert with their U.S. equivalents, and that will put further downward pressure on our fixed mortgage rates. Variable-rate mortgage borrowers will likely have to wait a little longer before BoC rate cuts materialize, but these developments further increase the odds that their rates will move lower at some point this year.