Are Canadian Bond Yields About to Push Our Fixed Mortgage Rates Higher?

April 15, 2019Bank of Canada Update: Rates to Stay Low for Longer

April 29, 2019 The Bank of Canada (BoC) is not expected to move its policy rate when it meets this Wednesday. The real question in the lead up to this meeting is whether the Bank will continue its shift to a more dovish outlook.

The Bank of Canada (BoC) is not expected to move its policy rate when it meets this Wednesday. The real question in the lead up to this meeting is whether the Bank will continue its shift to a more dovish outlook.

Against a steadily weakening economic backdrop, thus far the BoC has conceded only that its next rate hike will likely be delayed by what it views as a temporary “soft patch”. But if the Bank is now more concerned about slowing momentum, its accompanying Monetary Policy Report (MPR), which offers valuable insights into the BoC’s evolving economic view, should make that clear.

There is an especially interesting subtext this time around.

When it comes to our recent high-level economic data, beauty has been in the eye of the beholder. For example, our fourth-quarter annualized GDP growth disappointed (0.4%), but then our GDP grew faster than expected on an annualized basis in January (0.3%). Our employment growth was weak to finish off 2018, but then it bounced back in the first quarter of 2019. Our overall inflation had been hovering well under the BoC’s 2% target (in the 1.5% range) until last month, when it surged higher to 1.9%.

Through all of this, the Business Outlook Survey (BOS), which summarizes how Canadian businesses perceive their current economic environment, has proven resilient. When predicting that economic momentum will pick up in the second half of this year, BoC Governor Poloz has repeatedly cited the underlying confidence evident in the BOS data.

But that changed last week.

The latest BOS indicator, which is a summary measure that boils down all the results from the main survey questions into a single number, turned negative for the first time in three years. And the detail in the latest BOS revealed that, whereas businesses were previously worried about being able to meet demand and fill vacant positions, they are now much less concerned about capacity pressures. And they are now cutting prices instead of raising them.

If the BoC does offer a more dovish outlook on Wednesday, we may see the Government of Canada (GoC) bond yield move lower. As noted in last week’s post, the five-year GoC bond yield has been on a surge of late, rising by 0.22% basis points thus far in April. If that trend continues for much longer, five-year fixed mortgage rates are likely headed higher (at least temporarily).

Stay tuned.

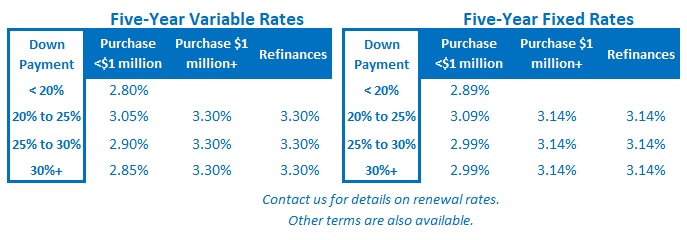

The Bottom Line: The BoC is not expected to raise its policy rate when it meets this week, which means that our variable mortgage rates will likely remain at their current levels. The real question is whether the Bank will continue to shift to a more dovish outlook, and the negative turn in the latest BOS data support that view. If the Bank does turn more dovish, we should see five-year GoC bond yields move lower, and that would reduce the likelihood of near-term fixed mortgage rate increases.