Should Canadians Choose a Fixed or Variable Mortgage Rate During a Trade War?

March 31, 2025Why the Bank of Canada Should Cut Its Policy Rate Again This Week

April 14, 2025 Last Wednesday US President Trump announced new tariffs on imports from nearly every country on the planet. Even Heard Island, located off the coast of Australia and occupied primarily by penguins, made the list.

Last Wednesday US President Trump announced new tariffs on imports from nearly every country on the planet. Even Heard Island, located off the coast of Australia and occupied primarily by penguins, made the list.

Analysts struggled to reverse-engineer how the supposedly “reciprocal” tariff rates were calculated, and many offered scathing assessments of the proceedings.

The Economist called all of Trump’s economic assertions “flat-out nonsense”, his every word “utterly deluded”, and his reading of history “upside down”. It summed up his method for calculating the tariffs as “almost as random as taxing you on the number of vowels in your name” and asked the president if he “really thinks Americans would be better off if only they sewed their own running shoes?”

In my post last week, I offered my best guess at how the announcement would go: “The initial levies will be dramatic [check], the US stock market will immediately sell off [check], and Trump will respond by reducing most of them (while declaring victory with each reduction).”

Further to that last prediction, when asked if he would consider reducing some tariff rates, Trump said he would be open to “phenomenal” offers.

The most vulnerable countries will queue up to make deals, but those countries won’t move the needle much.

In addition to the evolving responses from Canada and Mexico, the other key tests will be the responses of the world’s largest economies: China, Europe and India. (And they may be happy to let Trump sweat out his new reality for a while.)

While we wait for those chips to fall, stock markets will sell off, economic momentum will slow, and inflation pressures will rise.

Investors hoping for relief from Fed rate cuts are likely to be disappointed, at least initially, as the new tariffs increase US prices.

US Federal Reserve Chair Jerome Powell has already said that the announced tariffs were “significantly larger than expected” and that “the same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

Renowned US financial expert John Mauldin noted that “[Fed] rate cuts have a limited impact on this kind of shock”. Thus far, US bond-market investors have responded by only increasing their bets on the number of quarter-percent rate cuts by the Fed this year from two to three (with the first now expected in June).

All told, last week wasn’t too bad for already hard-hit Canadians:

- There were no new tariffs announced against Canada, and about 40% of our total US exports are protected under the CUSMA agreement. That means Canadian goods have, on average, lower tariffs than those that are now being applied to most other countries.

- Until last week, only Canada, Mexico and China had been singled out by Trump, but now his punitive trade policies have global reach. That will increase their cost to the US economy, through higher prices and counter-tariffs, and should shorten the time it will take to settle on more reasonable outcomes.

- While they are making purely symbolic gestures, some Americans are rallying to support their northern neighbours. The US Senate voted in favour of blocking Trump’s tariffs on Canadian products (although the bill isn’t expected to secure enough votes in the House). The Alaska State Senate passed a bi-partisan resolution supporting Canadian sovereignty.

- The US trade war has inspired a serious discussion about the removal of our inter-provincial trade barriers, which National Bank Chief Economist Stéfane Marion estimates are equivalent to a 25% tariff rate between provinces.

- If you want to be reminded of Canada’s economic strengths (and there are many), here is a recent Globe and Mail article that describes them well: How to awaken Canada’s sleeping economic giant.

- Against all odds, our Loonie has increased in value against the US dollar of late.

Mortgage Advice for Now

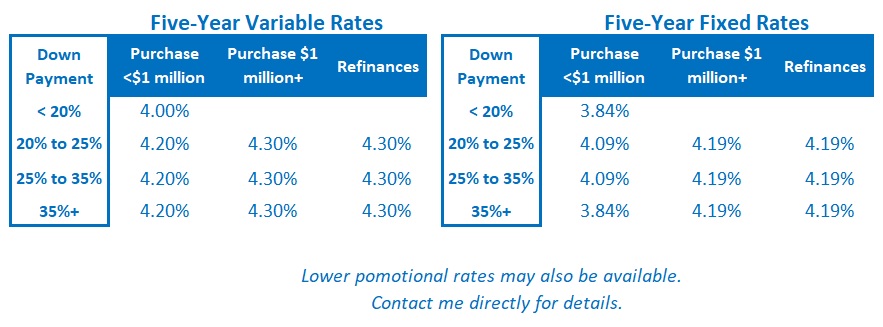

Last week’s post provided a detailed take on the pros and cons of fixed and variable mortgage rates during this trade-war era. It has had more than 10,000 views (which might be a record for this blogger), and I commend it to you here. The Bottom Line: Government of Canada (GoC) bond yields fell sharply last week.

The Bottom Line: Government of Canada (GoC) bond yields fell sharply last week.

A portion of that drop was offset by widening credit spreads tied to rising risk premiums, but that still leaves enough room for fixed mortgage rates to fall further from here.

(If you’re new to the mortgage rate-watch game, let me reiterate the old refrain that lenders tend to take the elevator when they raise rates and the stairs when they lower them.)

Variable-mortgage rate discounts have shrunk of late, also due to higher credit spreads, but they were unchanged last week.

I continue to expect the Bank of Canada (BoC) to cut by another 0.25% at its next meeting on April 16, and I don’t think that cut will be their last.

Last week we learned that our economy lost 33,000 jobs in March, marking our first monthly decrease in more than three years. The TSX also took a hammering alongside every other stock market.

While inflation has perked up of late, I think the Bank will likely err on the side of cutting too much, rather than not enough. I am reminded that the last time our country faced a severe economic shock, BoC Governor Poloz justified his actions by saying that “a firefighter has never been criticized for using too much water”.

Bond-market investors increased their odds of a BoC rate cut on April 16 from 33% last Thursday to 50% on Friday. They also now expect the Bank policy rate to drop by another 0.75% this year, up from 0.50% previously.