How Last Week’s Mortgage Stress-Test Change Will Impact Borrowers

February 24, 2020The Bank of Canada Finally Cuts and Mortgage Rates Plummet

March 9, 2020 There is a growing consensus that the Bank of Canada (BoC) will finally cut its policy rate when it meets this Wednesday. This would be welcome news to variable-rate mortgage borrowers, whose rates are priced on the BoC’s policy rate.

There is a growing consensus that the Bank of Canada (BoC) will finally cut its policy rate when it meets this Wednesday. This would be welcome news to variable-rate mortgage borrowers, whose rates are priced on the BoC’s policy rate.

A BoC rate cut might push our fixed mortgage rates lower as well. (Fixed mortgage rates are priced on Government of Canada bond yields which, although not directly linked to BoC’s policy rate, often move in sympathy with BoC rate changes.)

Let’s start with a look at the factors that may finally push the BoC into rate-cut mode:

Coronavirus – The negative economic shocks from the coronavirus disease continue to grow. Manufacturing supply chains are being disrupted, oil volumes and prices are down, travel bans and lockdowns are widening, and the psychological impact of the virus is roiling financial markets and spreading panic across the globe.

Trade wars – Notwithstanding recent progress on Phase One of the U.S./China trade agreement and on the USMCA (which will replace NAFTA), trade-war tensions still abound. Uncertainty over access to foreign markets and the sustainability of global supply chains continues to weigh on business spending.

Rail Blockades – On February 6, rail blockades brought rail traffic across the country to a near standstill. (The blockades were set up in solidarity with the Wet’suwet’en hereditary chiefs who are opposing the proposed Coastal GasLink pipeline route through their lands in northern B.C.) The magnitude of the disruption has surprised policy makers. It has crippled the flow of goods across the country and led to spoilage, cancelled orders and layoffs, to cite a few examples.

Slowing Growth – Last week we learned that our GDP grew by a tepid 0.3% in the fourth quarter of 2019, bringing our final tally for last year to only 1.6%. Our economic data pointed to further slowing as we entered 2020, and that was before the Coronavirus spread and rail blockades began to bite.

If at this point you think a BoC rate cut this Wednesday should be an easy call, consider these countervailing factors, which the BoC must also take into account:

Our Recent Inflation Spike – Our overall inflation, as measured by our Consumer Price Index (CPI), spiked up to 2.4% in January, which is well above the BoC’s 2% target. While that spike was largely caused by the previously depressed gasoline prices that rolled out of the CPI calculation, two of the Bank’s three key measures of core inflation are also now above 2%. The BoC has repeatedly emphasized that maintaining stable inflation is its sole mandate and that it will meet this objective even if doing so creates negative side effects in other parts of our economy.

Real-Estate Froth – Our real estate markets were already heating up when our regulators announced that, on April 6, they would change the way the stress-test rate, which is used to qualify insured mortgage borrowers, is calculated. While this change (which I outline in this post) will only lower the stress-test rate from 5.19% to 4.89%, there is concern that its psychological impact, combined with fixed mortgage rates moving lower in response to plunging bond yields, will add more froth to our already hot housing markets. The Bank has long worried about the twin risks of excessive debt levels and regional housing bubbles, and a rate cut now would would risk fuelling both.

A Rate Cut Won’t Alleviate Coronavirus Impacts – John Mauldin summed this up well in a recent article when he said: “Rate cuts are not vaccines.” Mauldin explains that rates cuts will not bring factories back online or get people travelling again any faster, and with rates already at ultra-low levels and debt levels so high, rate cuts have lost much of their stimulative impact. Mauldin adds that even if rate cuts do stimulate more demand, “virus containment measures will make any such [increase in] demand hard to fill.”

So, what will the BoC do?

The consensus now appears to be leaning toward a cut at this meeting, but I’m not convinced. The BoC proved to be stubbornly patient when the Fed cut last year and when it looked as though our economic momentum was clearly slowing. I don’t see our Bank changing course this Wednesday.

The market’s reaction to the coronavirus seems extreme over the short term, the blockades appear to be coming down, and CN is now recalling laid-off workers. Also, trade war uncertainty hasn’t been enough to push the Bank off the sidelines yet, and recent trade developments have been positive, so I don’t see that worry tipping the BoC’s hand.

Over the short term, I think the Bank’s most immediate worry is the impact that the stress-test change and plunging bond yields will have on our real-estate markets, and against that backdrop I just don’t see it cutting.

We’ll find out if I’m right on Wednesday, and I’ll report back next Monday on the BoC’s tough call.

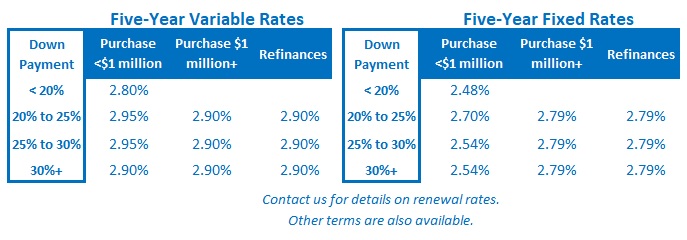

The Bottom Line: Variable mortgage rates were unchanged last week while fixed mortgage rates continued their steady downward march. (Lenders don’t all move at the same time, so bond-yield-fuelled rate drops can be spaced out over multiple weeks.) I don’t expect the BoC to cut its policy rate when it meets this week, but for the reasons outlined above, it will be a tough call. Stay tuned.