What Is Happening with Inflation and Mortgage Rates?

May 30, 2022Inflation, Jobs, and Mortgage Rates

June 13, 2022 The Bank of Canada (BoC) hiked its policy rate by another 0.50% last week, as expected.

The Bank of Canada (BoC) hiked its policy rate by another 0.50% last week, as expected.

That means lender prime rates, and, by association, our variable mortgage rates, will increase by the same amount in short order.

Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, have also risen in response to the Bank’s accompanying policy statement, which was more hawkish than expected. (One major lender has already increased its fixed rates, and others are expected to soon follow.)

The BoC’s brief but pointed statement warned that inflation will “move higher in the near term” and that price pressures are broadening. It noted that 70% of the items that make up its headline Consumer Price Index (CPI) are “now showing inflation above 3%”.

The Bank attributed today’s elevated inflation readings primarily to higher food and energy prices. It pointed to Russia’s invasion of Ukraine, China’s COVID lockdowns, and ongoing supply disruptions as the main causes (I think droughts impacting agricultural yields should also have made its list). The Bank knows that its policy-rate hikes will do very little to mitigate these primary price pressures, but it also assessed that our economy is “clearly operating in excess demand” and warned that “interest rates will need to rise further”, and, more ominously, that it is “prepared to act more forcefully if needed”.

The bond futures market interpreted the BoC’s statement to mean that it may increase by 0.75%, instead of 0.50%, at its next meeting, and it is now pricing in another 1.50% in rate hikes over the remainder of this year (up from 1.00% before last Wednesday’s meeting).

The Bank’s tough talk is a reasonable response to current conditions.

Recent consumer surveys have confirmed that the public now expects inflation to remain elevated for an extended period. If those concerns cause consumers to accelerate their buying plans to avoid future price increases, that increased demand will fuel additional inflation. At the same time, if employees believe that price rises will continue, they will demand increased compensation to preserve their purchasing power. Rising labour costs will also lead to more price rises.

The BoC is determined to prevent these self-reinforcing cycles from taking root.

That said, while mortgage borrowers are well advised to heed the Bank’s warning to expect higher rates, it is also worth remembering that the circumstances underpinning its forecasts and commentary can, and often do, change.

For example, in July of 2020 BoC Governor Tiff Macklem told Canadians that “interest rates are very low and they’re going to be there for a long time”. Back then the Bank wasn’t forecasting its first rate rise until 2023. (Oops!)

When it comes to rate-hike forecasts, Desjardins economist Royce Mendes noted that in 2017 “the central bank told a similar story about getting rates up towards the 3 per cent range, but was only able to push the policy rate up to 1.75 per cent. At that point, the housing market and consumer spending began to weaken so dramatically that rate cuts were on the table even before the pandemic”.

History might not necessarily repeat this time around, but to borrow a phrase from Mark Twain, it may at least rhyme.

The BoC noted that “Canadian economic activity is strong” and cited our 3.1% (annualized) GDP growth in Q1 as evidence. That result was better than our pre-pandemic average of about 2%, but it also came in well below the consensus estimate of 5%+, and it included a near 20% surge in residential investment, which isn’t expected to continue at anywhere near that pace as rate hikes continue to pile up (more on that in a minute).

In Q1, our productivity also fell by 0.5%, while our labour costs grew by 2.7%. That means it cost our economy more to produce less, and in a slowing economy that combination is a recipe for reduced labour demand, layoffs, and rising unemployment.

Our momentum is now clearly slowing, and record high debt levels will magnify the impact of rate rises. It can take up to two years for each rate hike to exert its full impact, but the BoC doesn’t have the luxury of time at this point. Runaway inflation has forced them to hit the brakes hard and hope it all works out (which they have basically admitted, albeit with a more eloquent choice of words about “walking a fine line”).

CIBC Chief economist Avery Shenfeld recently noted that the cyclical components of our economy, which will be most impacted by rate hikes, account for only about 20% of our current inflation. Based on that, he concludes that “even if the Bank had hiked earlier and managed to get cyclical inflation down to zero today, total inflation would still be around 5.5%.”

If the BoC hopes to restore its inflation credentials by bringing cyclical inflation to zero, it’s going to have to crush housing demand. The Bank has said that it is closely watching how our housing markets respond to its repeated rounds of outsized rate hikes and has implied that it can maintain a delicate policy-rate balance that will both preserve housing-market momentum and forcefully bring inflation under control.

That is pure fantasy.

It’s one or the other at this point – and pretending otherwise is disingenuous.

To be clear, rates are going to continue to go up over the near term, and the BoC is going to keep talking tough because they must justify their decision to enact a series of oversized rate hikes. But the question anyone considering a five-year term today should be asking is: “What happens when this current surge is over?”

I continue to believe that the BoC will overtighten and cause a recession that will lead to rate cuts thereafter. (If that happens, variable mortgage rates will fall from their peak, and will likely prove cheaper than today’s fixed-rate equivalents over the next five years.)

Others share this view.

Back to Avery Shenfeld, who recently predicted that by October “a deep retreat in housing activity, sluggish global growth, and inflation’s squeeze on consumer spending power will, in our view, have growth indicators pointing to a significant second half slowdown, one much sharper than the BoC’s last projection.”

Of course, it’s possible that the BoC will continue hiking rates even if a material slowdown materializes. After all, it has a mandate to maintain price stability by keeping inflation low, predictable, and stable.

But after a series of oversized rate hikes have crushed demand in the cyclical, interest-rate sensitive parts of our economy, the Bank will have little ability to do anything about the price pressures that remain. At that point, the cure (more rate hikes) would likely become more harmful than the disease (inflation caused by external factors). The Bottom Line: The five-year GoC bond yield rose again last week, driven higher by the BoC’s more hawkish than expected policy statement. One major lender has already raised its rates, and borrowers should expect to see others move their five-year fixed rates higher in short order.

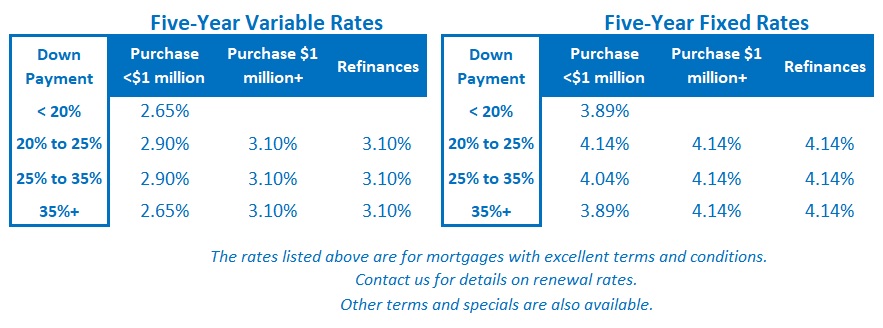

The Bottom Line: The five-year GoC bond yield rose again last week, driven higher by the BoC’s more hawkish than expected policy statement. One major lender has already raised its rates, and borrowers should expect to see others move their five-year fixed rates higher in short order.

Five-year variable-rate discounts appear to have stabilized for the time being, but the lender prime rates will rise by 0.50% over the coming days in response to the BoC’s rate hike last week. Bond market investors are pricing in another 1.50% in additional rate hikes over the balance of 2022. But for the reasons outlined above, I think there is a good chance that a sharper than expected slowdown in the second half of this year will leave the BoC short of that mark.

2 Comments

Hi

I’ve been reading your Monday interest rate update for a number of months now; thank you for your analyses.

Just like you mention, BoC’s response to inflation is pure fantasy. I have a bad feeling that an additional 2 or 3 0.5 calibre rate hikes is all it’ll take to trigger a nasty recession. At that point, the housing market might experience a brutal contraction and they’ll have achieved next to nothing in terms of inflation control.

Hi Frank,

We’ll how many more rate hikes materialize. The BoC’s actions don’t always match its words (often for good reason) and if our economy

slows more than anticipated (likely) they may adopt of more cautious approach.

We live in interesting times (whether we like it or not).