The Bank of Canada Beats a Hasty Retreat

October 28, 2024A Busy Week for Mortgage-Related News

November 11, 2024

Canadian mortgage borrowers have benefitted from some helpful tailwinds of late.

The Bank of Canada (BoC) aggressively cut its policy rate, lowering it from 5.00% to 3.75% over its last four policy-rate meetings, and our variable mortgage rates fell in lockstep.

The Government of Canada (GoC) bond yields, which our fixed mortgage rates are based on, aren’t directly impacted by BoC policy-rate changes. But investors price yields on a forward-looking basis, and that pricing is influenced by the Bank’s expected policy-rate path.

On that note, GoC bond yields dropped substantially over the summer as bond-market investors priced in more BoC rate cuts than we have seen thus far. At their current levels, GoC bond yields have priced in the assumption that the BoC’s policy rate will hit a low of between 2.50% and 2.75% late next year.

Markets rarely move in a straight line in any direction. Now that seemingly everyone expects our fixed mortgage rates to keep steadily declining, the contrarian in me is reminded of one of Bob Farrell’s prescient ten rules of investing: “When all the experts and forecasts agree – something else is going to happen”.

I provide my contrarian take in the Mortgage Selection Advice for Now section below. But before we get to that, here is a quick look at developments south of the 49th parallel that will determine the near-term direction of US Treasuries. Given their gravitational pull, they will also influence where GoC bond yields are headed.

The Fed’s Next Rate Cut

The US Federal Reserve meets this week, and bond-market investors have set the odds of a 0.25% cut at 99%. When there is near-universal consensus, the cut itself typically won’t have much impact on bond yields. It has already been fully priced in.

The Fed is also expected to hint at a slower pace for rate cuts after a string of stronger-than-expected US economic data (notwithstanding the weak US jobs print for October, which I detail below).

If the Fed tilts in a more hawkish direction, and I think it will, I expect US Treasury yields to move higher.

US Employment Disappoints

Last week we learned that the US economy is estimated to have added a meagre 12,000 new jobs in October, well below the consensus forecast of 100,000. Estimates for US job creation in August and September were also revised down by 112,000 (although that still left about 300,000 newly created jobs over those months, which is right around the long-term average run rate for the US economy).

The disappointing October headline was chalked up to hurricane-related distortions and a Boeing strike. With those factors accounted for, the adjusted headline result would have come in closer to the consensus forecast.

Nevertheless, investors typically shoot first and sort through the details later.

The normal bond-market reaction to a big downside miss would be to push yields lower in expectation of more monetary-policy accommodation from the Fed. This time however, they swung higher. That atypical response bolsters my belief that US Treasury yields have an upward bias right now.

US Election Turbulence

US voters will elect their next president on Tuesday, and if the results are as close as the polls predict, we may not know the winner until well after election night.

If turbulence around the US election results ensues, will it push yields higher as investors add a risk premium to US Treasuries? Or will it trigger a flight to safety that pushes yields lower?

It’s not clear to me how election uncertainty will impact bond yields at this point, but it could have a material impact either way. The answer will be clearer by next Monday’s post.

Mortgage Selection Advice for Now

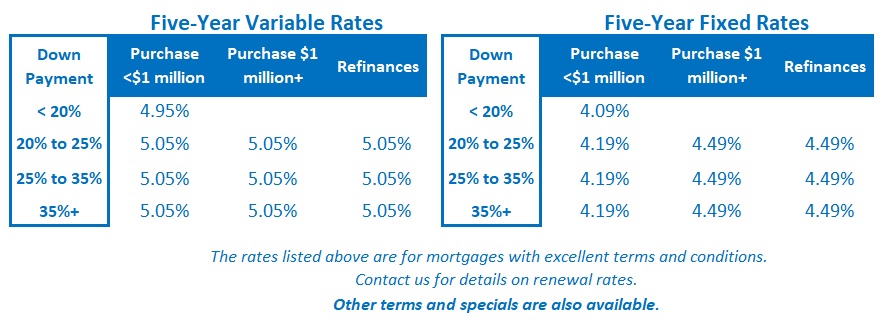

I continue to believe that variable mortgage rates will likely render borrowers their lowest overall borrowing cost over the next five years.

Further BoC rate cuts of between 1% to 1.5% are widely expected. If variable rates fall by even 1% from their current levels, they will end up lower than any of today’s fixed-rate options.

But that’s if everything plays out as expected. Anyone choosing a variable rate should have a clear-eyed understanding of what could happen if unforeseen factors force the Bank to change its plans.

For example, when the worst of the pandemic was behind us in early 2022, it looked as though inflation pressures would ease. But then Russia invaded Ukraine, causing the prices of oil and wheat to spike higher. The war that followed forced central bankers to recalibrate their monetary-policy plans. That unforeseen event significantly impacted the path of our variable mortgage rates.

If you are a conservative borrower who is more comfortable with a fixed rate, it’s time for a fresh look at the available options.

I think our fixed mortgage rates may now be at or near their lows for the time being, based on a growing list of factors:

- US Treasury yields are moving higher as bond-market investors price in stronger-than-expected economic data and anticipate increased deficit spending by the federal government, regardless of who wins the US election. If US Treasury yields rise, they will take their GoC equivalents along for the ride.

- Canadian inflation has fallen back to within the BoC’s 2% target range and our economy’s return to price stability is now fully priced into GoC bond yields. That tailwind has run its course.

- Geopolitical risks, this time in the Middle East, could cause a spike in commodity prices, reigniting inflation pressures (just as we saw happen when Russia invaded Ukraine).

- GoC bond yields have priced in another 1.00% (or so) in cuts by the BoC. If those expectations change and investors believe that the Bank will enact fewer cuts and/or adopt a slower rate-cut pace for policy-rate reductions, those yields will move higher.

- Our yield curve has started to flatten. The next stage will be for the curve to regain its normal upward slope. When that happens, the premium that borrowers must typically pay to lock into a longer term will be restored.

There is nothing wrong with hoping for rates to go lower, but context is always needed.

Our three- and five-year fixed rates are below their long-term averages right now, they have already fallen markedly from their peaks, and there is a lot of “good news” already in the price of the GoC bond yields they are based on. Those factors will limit their potential to decline much further from here.

I think the opportunity to lock in a five-year fixed term at a rate that is the same or lower than those offered on shorter fixed terms won’t be around much longer. Conservative borrowers should consider taking advantage of that pricing anomaly while they still can. The Bottom Line: GoC bond yields remained range bound last week.

The Bottom Line: GoC bond yields remained range bound last week.

As per my reasoning above, I think there is near-term upside risk for GoC bond yields, and the fixed mortgage rates that are priced on them.

I also believe that fixed rates may be nearer to the bottom of their range for our current cycle than is generally perceived. For that reason, five-year fixed rates now have increased appeal.

Variable mortgage-rate discounts were unchanged last week.

I expect the BoC to continue cutting its policy rate. Unlike GoC bond yields, which are heavily influenced by their US Treasury equivalents, the BoC’s policy-rate path will reflect much more closely the state of our domestic economy.

For that reason, I expect today’s variable mortgage rates to outperform today’s fixed mortgage rates over their full terms (with the usual reminder about the uncertainty that accompanies any prediction).